100% Monthly EA promises huge returns with verified backtest results that beginners can easily buy into. Using proper analysis of the system, we can pinpoint the risky strategies that the system operates and understand that big profits come at the expense of receiving margin calls. There is no information on the website about the developers of the algorithm which is quite shady as most of the scams in the financial industry take place from the secret corners.

Features

The robot promises monthly gains of 100% with no requirements of any previous trading knowledge. It follows a multi-pattern approach and trades on major and stable crosses. The EA has compatibility for both MetaTrader 4 and 5 platforms and uses automated trading to trade in all sessions 24/5.

Strategy

With the average trade duration of 25.9 hours, according to the statistics on FXblue, we can say 100% Monthly EA uses an intermediary approach between day and swing trading. It uses the martingale strategy, which involves significant risk to your account. The trader limits the maximum lot size in certain instances to reduce the ultimate loss. There are major chances of a substantial drawdown, evident while looking at trading results on the Forex Peace Army.

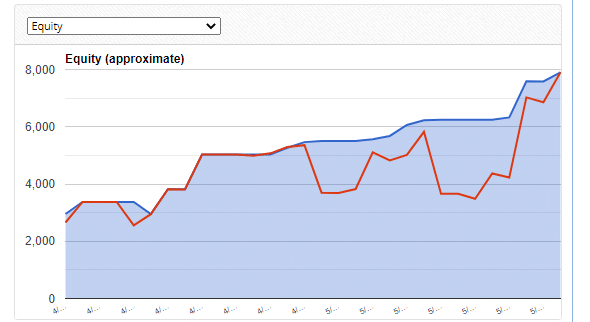

You can see the dips in the chart and observe the maximal drawdown, which is nearly 90%. From the separation between the balance and equity curve, we can confirm that there are leftover trades in place experiencing a drawdown.

How to start trading with 100% Monthly EA?

There are three options at hand for testing out the service, i.e., get monthly signals, rent the expert advisor for a month and buy it for a lifetime.

Payment can only be made via PayPal. The user does not recommend any minimum balance on the website, but from the trading results, we can observe that he uses 0.1 lots for equity of $1000. As the EA works with MT4 and 5, the installation procedures are expected to be the same as any other trading robot. After receiving the copy from the owner, you will have to place the ex4 file within your platform’s experts’ directory.

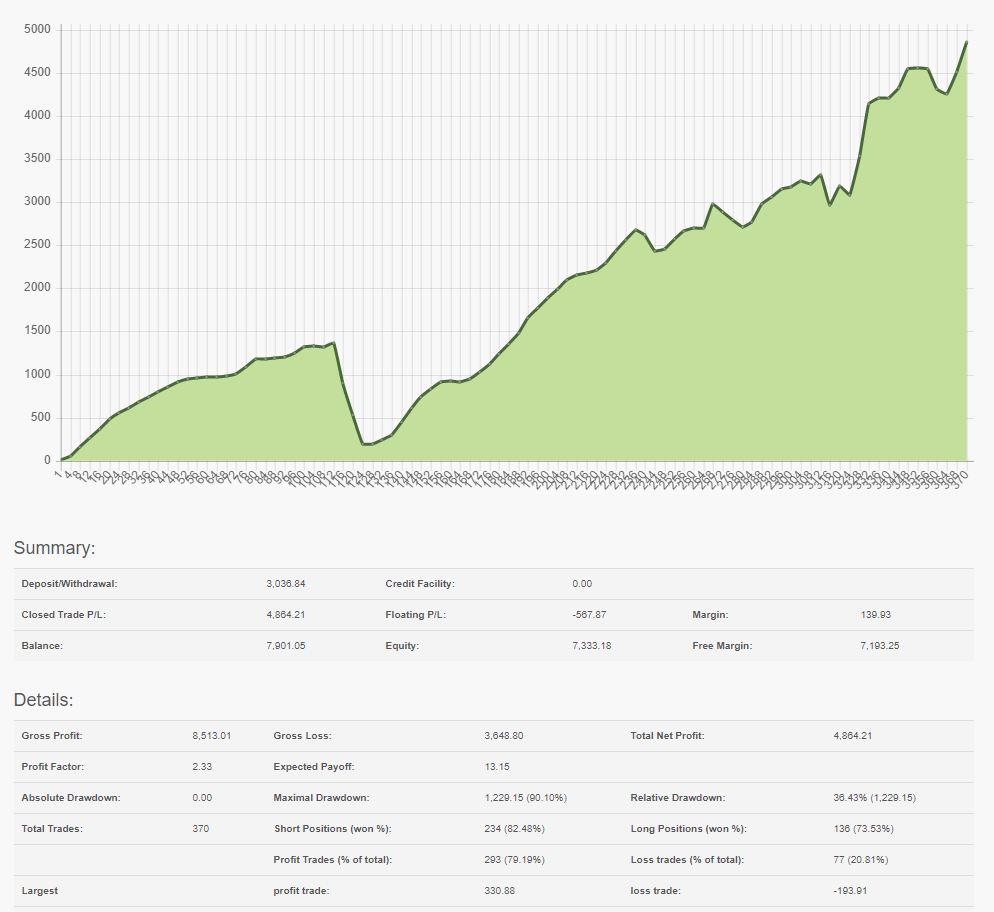

Backtests

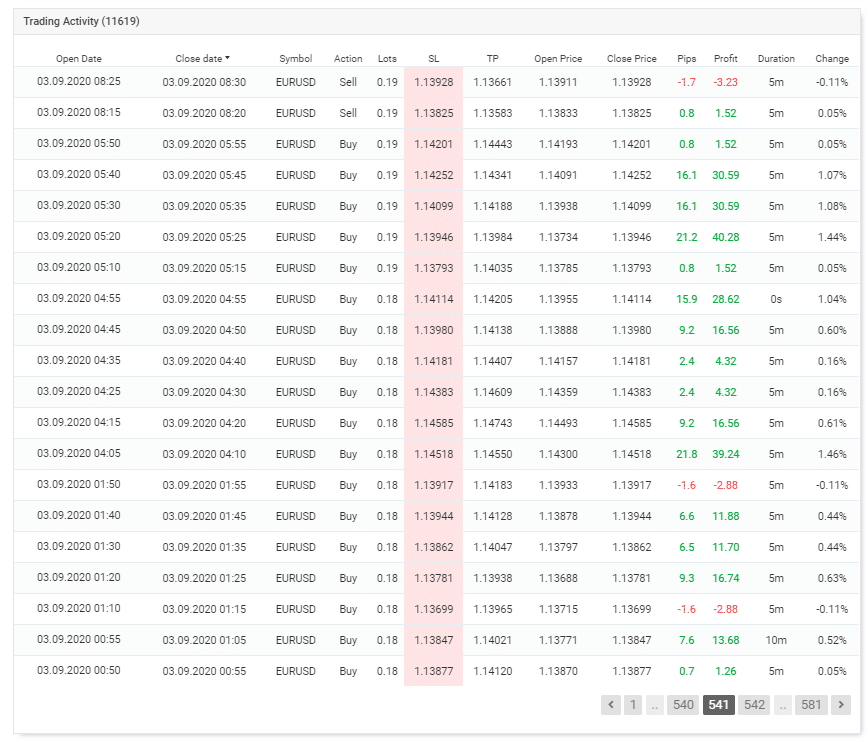

Backtesting results are available on the Myfxbook platform for the symbols of EUR/USD only and have a modeling quality of 90%. The account made up a whopping 6.34% million gain from January 2020 to April 2021. There is no involvement of martingale strategy as observed, but the EA does open trades in a similar direction in case of a drawdown. The average trade duration was around 10 minutes. The trading performance in March 2020 was more than exceptional as the robot made 5.6K% in this month alone. Overall with 11619 trades, the automated algorithm won 7275 and lost 4344.

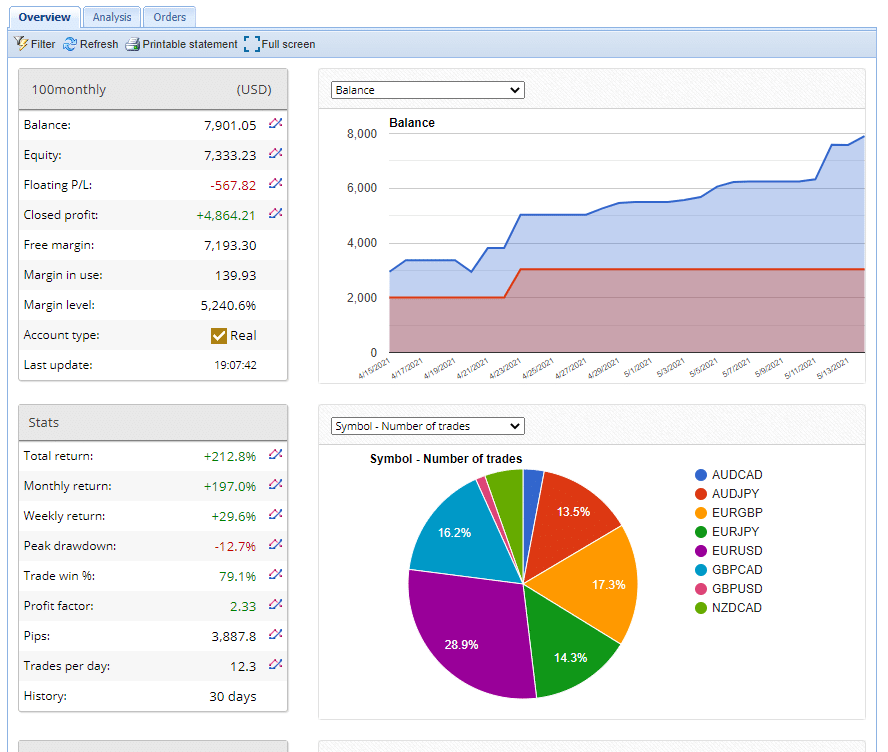

Verified Trading Results of 100% Monthly EA

The story on the verified account is different from that of the demo. From the backtest, we can see that the EA places a strict stop loss for every trade; however, the results on the real portfolio contradict this. There are no fixed exit points, and as mentioned before, the algorithm uses a martingale strategy with an increase in lot size. The EA also used multiple pairs other than EUR/USD. History is available for 30 days only where the profit factor hangs at 2.33. FXBlue does not indicate the maximal drawdown present in the live results at the Forex Peace Army. There is a difference between the average trade length as well with the value of 25.9 hours for the live account.

Is 100% Monthly EA a viable option?

The current results of the system show a considerable amount of risk and real results for a short duration which is not satisfactory for anyone to invest—the benefit of making quick bucks come at a downside of receiving margin calls. To be profitable with such a system, a trader must make frequent withdrawals to keep his hard-earned money on the safe side. It is better to wait and see how the robot performs in the future.

Conclusion

There is no such system in the world that will quickly make you rich. Such websites usually wipe off their results on Myfxbook when the account reaches margin calls and starts tracking a new one. Manual trading does come at the cost of emotional burden, but at the end of the day, your cash is not in the hands of a twisted algorithm.