Broadly, there are three types of currency pairs in the forex market. There are majors (like the EUR/USD and USD/JPY), minors (like the EUR/GBP and AUD/NZD), and exotics (like the USD/TRY and USD/ZAR).

Minors are those pairs that combine two currencies of developed world currencies like the euro, New Zealand dollar, and Swiss franc. Minors exclude the US dollar.

In this article, we will look at some of the best currency minors to trade.

Why trade currency minors

Most day traders focus on forex majors like the USD/CHF and EUR/USD. This is understandable since these are some of the most liquid currency pairs. They are also cheap to day trade because of their thin spreads.

Still, minor pairs present some opportunities for day traders because of their substantial volatility and the regular amount of data that is released by these countries. Further, many developed countries like Australia and New Zealand and the European Union and Switzerland trade with each other a lot. Such trading flows often lead to substantial volatility among the pairs.

EUR/CHF

The euro and Swiss franc are popular minor currencies among day traders. The pair is mostly known for what happened in January 2015 when the Swiss National Bank (SNB) decided to remove the peg it had put in place a few years earlier.

As a result, the EUR/CHF pair declined by more than 20% within a single day, leading to substantial damage in the financial market. Some brokers, like FXCM, almost filed for bankruptcy. Since that period, the pair has remained between the support and resistance at 1.0480 and 1.2000.

The EUR/CHF is a good pair to trade because of the substantial volatility it has and the fact that Switzerland and the European Union have a large trade volume.

EUR/CHF monthly chart

Also, the European Central Bank (ECB) and the Swiss National Bank (SNB) are some of the closely followed Central Banks. As such, their statements tend to lead to substantial movements. Most importantly, the pair has a close correlation with the USD/CHF pair.

EUR/GBP

The euro and the British pound have a close relationship. While the United Kingdom was part of the European Union, it managed to have its own currency because it determined that the euro did not meet its key economic tests.

For example, the country wanted to remain in control of its own interest rate, environment. It also felt that using the euro would make it difficult for the country to react to its problems.

Still, the EUR/GBP is one of the most important currency minors to day trade because of the relationship between the two sides. For one, the UK and the European Union do a lot of business together every year. The UK sells goods worth more than £294 billion to the EU, while the EU sells goods worth over £374 billion.

Before 2021, the pair became volatile as the two sides dealt with the Brexit agreement. While they both wanted a deal, the path to an agreement was often rocky. This ended in December 2020 as the two reached an agreement.

The EUR/GBP is a good pair to trade because of the significance of the Bank of England (BOE) and European Central Bank (ECB).

AUD/NZD

Australia and New Zealand have a close relationship. The two countries are neighbors that are well-known for their stability. They are also export-driven countries, with Australia being a leading seller of iron ore and coal. New Zealand, on the other hand, is endowed with vast agricultural resources. The two countries also do a lot of business together.

The AUD/NZD is a good minor to day trade for several reasons. First, like the two pairs mentioned above, it is offered widely by most forex brokers. Second, because of its liquidity, the pair has thin spreads, making it affordable. Third, the pair is mostly uncorrelated with other pairs like the AUD/USD and NZD/USD.

Fourth, the two countries release troves of data every month. Australia starts most months with a decision by the Reserve Bank of Australia (RBA) on the interest rate. This usually leads to some heightened volatility. Other data that move the AUD/NZD pair are the retail sales, inflation, and employment.

Further, since they are also related to China, the Aussie is often seen as a proxy for the country. As such, the pair sees some volatility when China publishes key economic data. The chart above shows the trends of the AUD/NZD pair.

EUR/JPY

The European Union and Japan are the second and fourth economies globally, with a GDP of more than $18 trillion and $5 trillion, respectively. The two sides also conduct a lot of trade that is worth trillions of dollars every year. This makes the euro and the Japanese yen two of the most active currencies in the world.

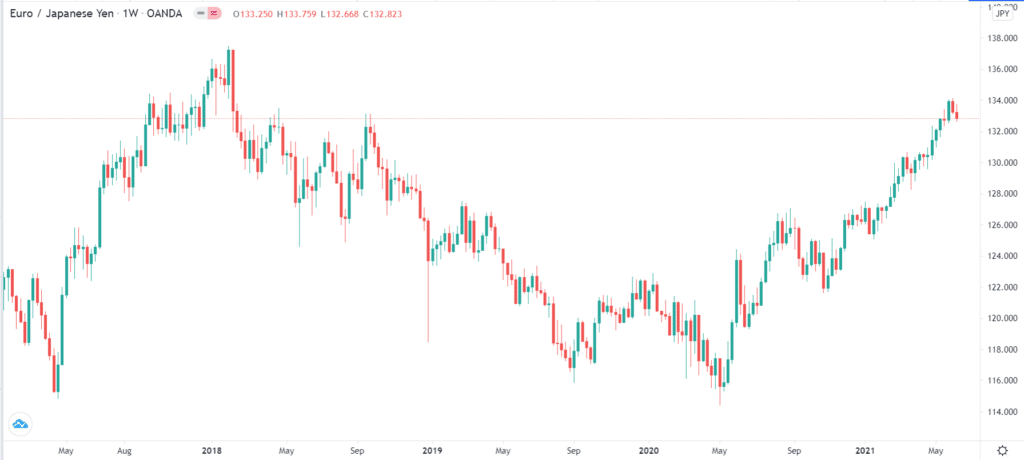

The EUR/JPY pair began its upward trend in May 2020 as the Bank of Japan accelerated its asset purchase program. That pushed the bank’s assets to more than $7 trillion. This means that the BOJ owns more assets than the country’s total GDP. The ECB also has a sizable balance sheet of more than $7 trillion.

EUR/JPY pair

The EUR/JPY is a good minor currency pair to trade for several reasons. First, it is widely offered by most brokers. Second, for traders using the euro as the base currency, there is usually no need for currency conversions. Third, the ECB and Bank of Japan are some of the most followed central banks in the world. The chart below shows the price action of the EUR/JPY pair.

Final thoughts

Currency minors provide traders with an excellent way to trade the financial market. At times, currency pairs like the AUD/NZD and EUR/JPY give them an easy way to achieve uncorrelated returns in the market. In this article, we have looked at some of the best minor currencies and some of the reasons to trade them. Other notable mentions are the GBP/JPY, EUR/SEK, and GBP/NOK.