The crypto market, thanks to its constant volatility, presents traders with numerous unique opportunities for profit. Some traders prefer the simple buy and hold technique, while others fancy actively trading these digital assets. Of the latter, day trading is one of the most lucrative and straightforward trading styles one can employ. However, though it may seem easy, it is anything but. Be that as it may, we shall demystify several ways in which you can participate in day trading crypto for profit.

About crypto day trading

This short-term trading style capitalizes on small crypto price movements for profit. It derives its name from the fact that traders who practice it close their positions within the space of a day, whether it be seconds, minutes, or hours-long positions. This technique relies heavily on the volatility and liquidity of the traded asset. Volatility helps day traders buy low and sell high, while liquidity helps them enter and exit trades as close to the current market price as possible.

To succeed as a day trader, you will need to have a suitable strategy in place. You will also need a working understanding of technical analysis, as this is how you’ll identify trading opportunities. It is also helpful to know fundamental analysis, as news and policies concerning a coin may cause significant price shifts. Let’s look at some of the popular approaches favored by day traders.

Scalping

This is a technique where traders take advantage of small price fluctuations for profit. Usually, scalp trades last for a few seconds or minutes, and they aim at very small profits per trade. For that reason, these traders often use leverage to amplify their profits. However, this could also increase their losses, which necessitates stringent risk management techniques.

The aim of scalping is not to gain a large profit from one trade but rather to accumulate these gains from several trades. Therefore, they rely heavily on a coin’s liquidity to enable them to execute trades with minimal slippage.

Due to its straightforward nature, it is easily automated, and scalpers often use bots to place their trades throughout the day.

Range trading

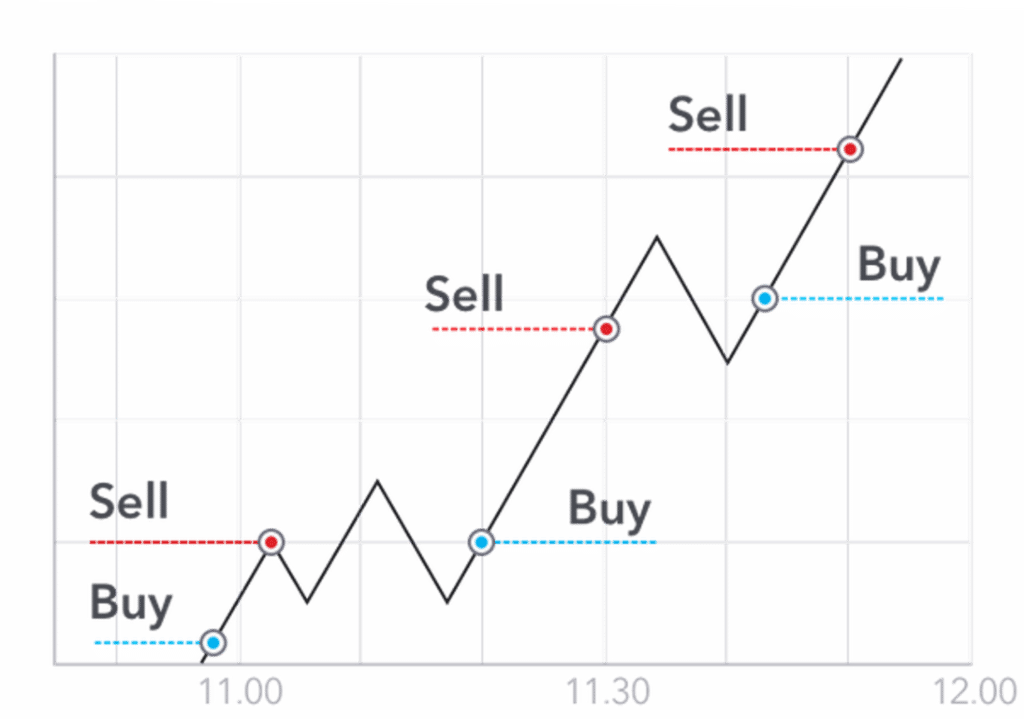

Oftentimes, a coin’s price may be stuck in a range where it could be displaying no discernible trend. In such moments, prices tend to bounce off of valid levels of support and resistance religiously. This presents day traders with a unique opportunity to buy at support and sell at resistance for as long as the consolidation period lasts. Usually, such traders will be looking for signs of a coin being overbought as it approaches the support; and oversold as it approaches resistance. Additionally, they could pay attention to volume metrics, as volume often precedes price. Therefore, if you want to open a position in any particular direction, volume must increase in the said direction.

Arbitrage

Because of the unregulated nature of the crypto market, sometimes similar assets may be priced differently on different exchanges. Arbitrage traders take advantage of this price discrepancy by buying on the cheaper exchange and instantly selling to the exchange bearing the higher price for the asset. This difference between prices is called the spread.

For example, Crypto.com could list the price of BTC as $30,000, while Kraken may list it at $30,200. On seeing this, an arbitrage trader could purchase 2 BTC from Crypto.com and sell them on Kraken, making a $400 profit from that trade. However, humans are not very good at spotting these discrepancies, which is why most arbitrage traders tend to use bots.

Technical analysis

This is an analytical method that involves studying recognizable price patterns in the past and using them to predict future price moves. It works under the assumption that history repeats itself. It also entails analyzing market data, such as a coin’s demand and supply dynamics, as well as its volume metrics. It may involve using mathematical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and others, or it could involve the trader visually identifying patterns such as the cup and handle pattern or the head and shoulders pattern.

Fundamental analysis

This is an analytical method that closely resembles the aforementioned technical analysis, as it involves predicting a coin’s future price. However, it stands out in that it is based on news, as well as human actions and reactions, collectively referred to as investor sentiment. Fundamental analysts attempt to predict prices by gauging the social consensus around a coin and anticipating how investors will act.

This method derives its data from news sources and social media posts. Some indicators, such as the fear and greed index, track such things as Twitter chatter to establish investor sentiment around a cryptocurrency.

High-frequency trading

This is a trading technique that involves developing algorithms to help quickly enter and exit positions on a crypto asset. High-frequency traders utilize bots running complex algorithms to trade price changes that occur in seconds or even fractions of a second. These bots monitor tokens across different exchanges in order to identify trends and other trading signals. However, they are not totally autonomous as they require input from the trader on the strategy to follow while trading.

This strategy is best suited for expert traders with coding experience, as these bots need constant tweaking of the algorithms to keep up with the ever-changing market conditions.

Conclusion

Due to the significant volatility of the crypto market, day trading has become a popular trading method among crypto aficionados. A trader can make numerous tiny profits by making multiple trades in a day and taking advantage of these quick surges and troughs. These gains add up over time to a significant sum. Day trading may be done in a variety of methods, including arbitrage, scalping, range trading, and high-frequency trading. As a day trader, you should make sure that the coin you’re dealing with has a lot of liquidity so that you don’t lose money due to slippage.