Adaptive EA has multiple parameters within its code that traders can tweak to adapt to various currency pairs. It has a built-in neural network and comes with live records that are available on the MQL 5 marketplace. Our review will go through the performance statistics and analyze the product by scanning its various pros and cons.

Features

The robot has the following features:

- It can trade on multiple currency pairs.

- Traders can adjust the stop loss and take profit.

- The robot can avoid trading during periods of high spread.

- It learns as it trades using a neural network.

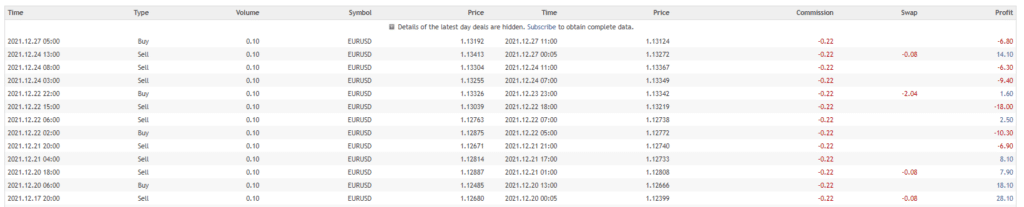

The robot trades multiple currency pairs, but traders must adjust the settings. The developer does not explain how it can be done. It shows different records when traders pass it through numerous backtests, which highlights the neural nature of the system. From the trading history, we can observe that it trades on EURUSD and will only open and close orders with the 4-hour candle. The average holding time for trades stands at 12 hours, conforming to a day trading approach.

How to start trading with Adaptive EA

To get the service up and running, you the following steps:

- Purchase the system from the developer on the MQL 5 marketplace

- Download it on your MT 5 platform

- Place it on your charts by dragging it

- Enable the auto trading button

Price

The EA is available for an asking price of $111. There is no money-back guarantee or renting options. The cost is average if we contrast it with other systems in the market. Traders can download the demo and backtest it as per the rules of the MQL 5 marketplace.

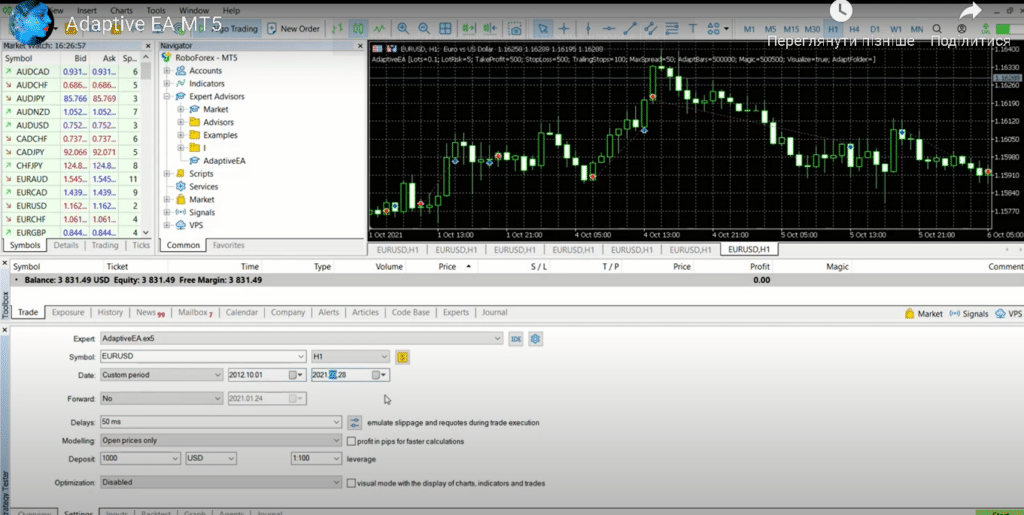

Backtests

There are no backtesting records available for the robot. The developer backtests it on one of the videos present on the website but does not show the statistics. The curve becomes upward when the EA is tested twice on the H1 chart from 2012.10.21 to 2021.09.28.

Verified trading results of Adaptive EA

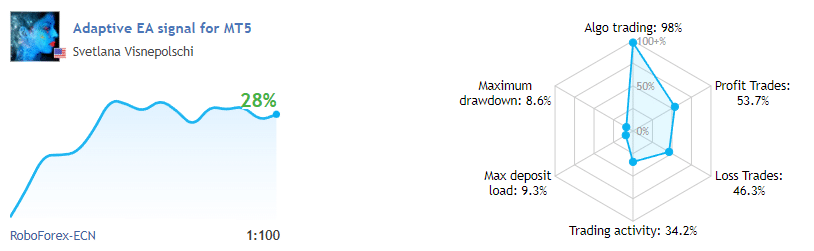

Verified trading records are available on MQL 5 . We have a performance from November 10, 2021, till the current date. The system made an average monthly gain of around 7%, with a drawdown of 8.6%. The drawdown value, when contrasted with the gains, gives us an average risk-reward ratio of 1:1.

The winning rate stood at 53.68%, with a profit factor of 1.59. The best trade was $57.28, while the worst was -$37.71 in a total of 95 trades.

The algorithm makes a total of 98% of trades. This shows that the developer does some manual intervention in executions.

The current drawdown of the system is nominal but may increase in the future. Currently, the records are live for a short duration which is not enough to predict its profitability.

Vendor transparency

Svetlana Visnepolschi is the author of the product. She resides in the United States and has a 5 rating for three feedbacks. There are a total of 2 algorithms published by her in the marketplace. According to MQL 5, he has a total experience of 1 year. Unfortunately, no statements or certificates are present on the website that could verify the developer’s background.

Is Adaptive EA a viable option?

The robot has the following benefits and demerits.

Advantages

- It uses a neural network

Disadvantage

- No backtesting records

- Live records are for a short duration

- Low information on the strategy

Conclusion

Adaptive EA is not transparent on the strategy it uses. The developer has recently started to track the live records and is using some manual intervention which makes the EA semi-automated. Traders will require some experience to use the robot.