In comparison to other financial markets, the crypto market is known for being extremely volatile. Thus, there appears to be greater hype about the possibility of arbitrage opportunities. Another reason is that they are traded globally across hundreds of exchanges 24/7. These trades, however, must be done promptly in order to make any type of profit; otherwise, the market may move, and you may lose money. The benefit of this method is that it does not require you to be a professional trader with a large investment portfolio.

Definition

Arbitrage trading is a method in which a person buys a crypto pair on one exchange and sells it on another in order to profit from a price difference between the two. The reasons why prices differ in different exchanges include fees, trading volume, and liquidity. For example, exchanges with minimal fees and increased trading volume and liquidity will have cheaper pricing.

What do you consider before you start arbitrage trading?

Fees – Fees should be factored into your trading calculations because they can erase any possible earnings. Look for exchanges with low or no trading fees.

Volume – The higher a cryptocurrency’s trading volume, the higher its liquidity, which increases the chances of your trades being executed.

Avoiding slippage – When you enter or exit a trade, you can obtain a different price than you expected. This is known as price slippage. As a result, thorough market research and excellent market timing are critical components of arbitrage trading.

Types

Cross-exchange arbitrage

This is the simplest type, in which a trader tries to profit by buying cryptocurrency on one exchange and selling it on another.

Spatial arbitrage

The cross-exchange stands out in that the exchanges are dispersed over many locations. For example, you can profit from the disparity in cryptocurrency demand and supply between two countries.

Triangular arbitrage

It takes advantage of price differences between different crypto pairs traded on the same exchange. This strategy allows an investor to purchase one crypto and then trade it for another crypto on the same exchange that is undervalued in comparison to the first.

The investor would then trade the second cryptocurrency for the third crypto, which is expensive compared to the first. Finally, the investor would exchange the third cryptocurrency for the first, completing the circuit with a small profit.

Statistical arbitrage

This technique integrates econometric, statistical, and computational tools to perform large-scale trades. Traders who adopt this approach use statistical models and trading bots to perform high-frequency arbitrage trades and maximize profit.

Decentralized arbitrage

This is common on exchanges that use smart contracts, which are automated and decentralized systems that determine the price of crypto trading pairs. If the prices of crypto trading pairs are significantly different from their spot prices on centralized exchanges, traders can swoop in and execute cross-exchange operations between the decentralized exchange and the centralized exchange.

Crypto arbitrage bots

Crypto arbitrage can be automated with trading software. Using a trading bot to do crypto arbitrage reduces the time it takes to complete each trade and raises the total number of trades (bots can run 24 hours a day, but humans need sleep to survive).

Using bots for arbitrage trading allows you to profit from opportunities that last only a few seconds or even microseconds. Tiny, regular earnings are sometimes preferred by traders because, of course, numerous small gains might add up to considerable long-term profits. Using a trading bot can operate as a form of passive income between a trader’s active trading sessions, as long as it trades positively.

How to create and customize a crypto arbitrage bot

Choose a bot type

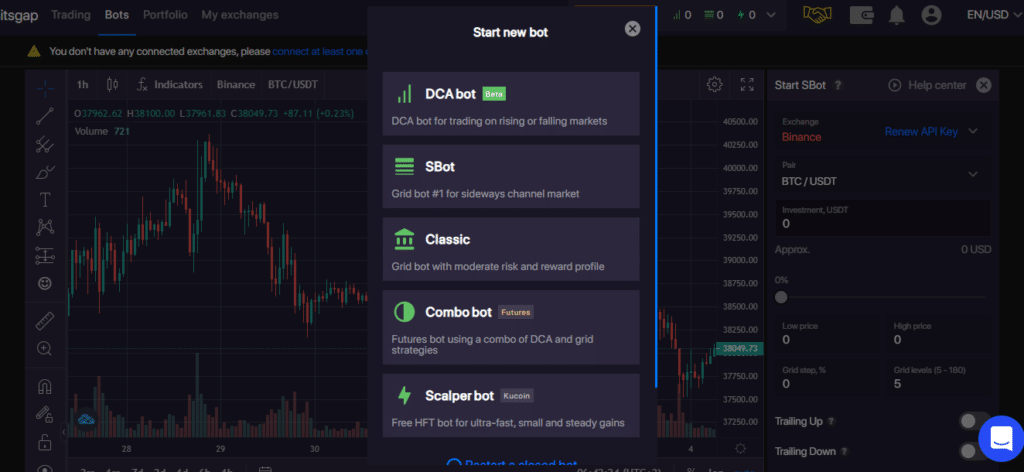

Bitsgap will send you to their landing page after you join up and log in, which has a bots option in the top right corner.

After selecting this option, go to the top of the website and click the orange ‘Start new bot’ button. This will bring up a drop-down menu with all of the bots that can be created.

Choosing an exchange and a trading pair

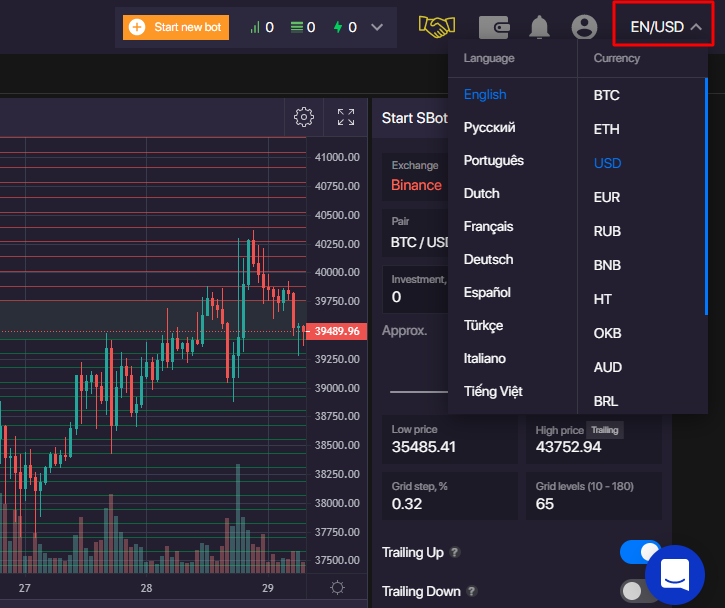

When you choose a bot, a widget appears that allows you to change the bot’s settings. To begin, select an exchange from the large list of platforms that are supported. For arbitrage trading, you choose two or more exchanges. You’ll also need to pick a cryptocurrency pair to trade.

Choose the amount you want to invest

After choosing the exchange and the trading pair, next, you choose the amount you want to invest.

This value is shown in the system currency, which can be modified by using the drop-down button at the top right corner of the page.

Choosing the frequency of your trades

We choose how frequently the bot will enter trades in this step. Slow, average, and fast are the three alternatives. The slow option places fewer trades, with a 3% step, but promises bigger returns. The average option places orders with a 1% step, with a moderate profit per trade. The last option uses a 0.3% step, which makes for plenty of orders, but typically offers less profit from each trade.

Check your forecast

You may even choose to backtest once you’ve explored the bot options and discovered a configuration that works for you and your budget. This uses historical data from the last 30 days to anticipate how the trading pair will perform with the settings you’ve chosen.

Remember that past performance isn’t always indicative of what will happen in the future. These forecasts are based on a completely different set of indicators and price movements.

Bitsgap payment plans

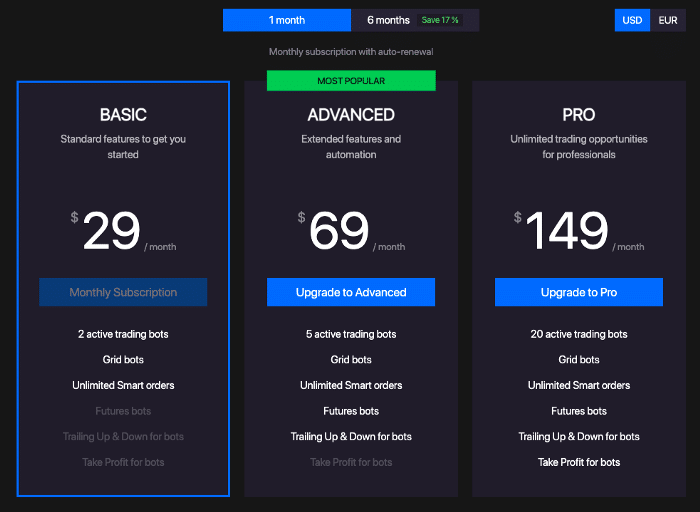

BitsGap has three membership tiers, each with a distinct fee and set of features; therefore, you will be able to choose the one that works for you.

Summary

Like any other trading strategy, arbitrage trading can be automated using trading software. Using a bot can automate and shorten the time it takes to complete each trade while increasing the total number. One of the best platforms with customizable bots is Bitsgap. It is easy to build and customize, and it has favorable payment plans.