Automic Trader uses grid and martingale strategies for trading the markets. The robot comes with different settings that are there to tweak the risk and hence the system’s output. It can trade on multiple currency pairs. To see if the claims made on the website about the robot are true, we have decided to conduct a detailed analysis of the system and its performance.

Features

The robot has the following features:

- It can trade on multiple currency pairs.

- There is a detailed setup guide for installing the product.

- It comes with lifetime updates are free with the robot

- A 30-day money-back guarantee is also included.

Strategy

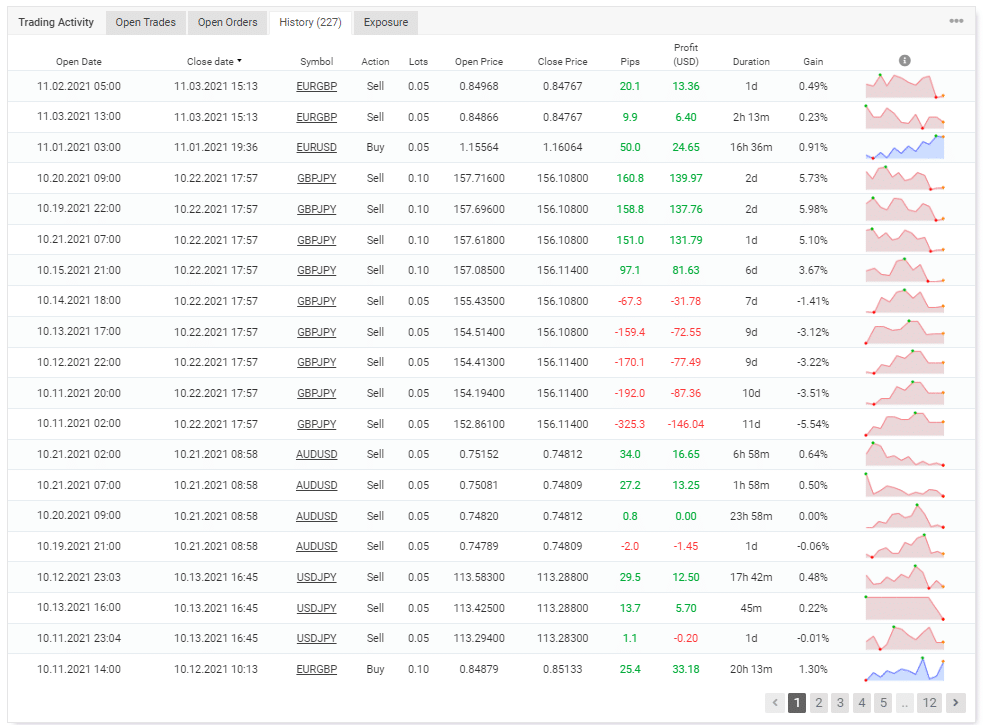

As mentioned before, the EA works on multiple currency pairs. It aims to provide 20-30% profit each month. There is no solid information on the game plan, so we had to use the live records on Myfxbook to verify the true story. From there, we could see the implementation of grid and martingale strategies. The robot holds trades for an average duration of 2 days which shows an intermediate approach between day and swing trading.

How to start trading with Automic Trader?

The robot can be downloaded directly from your email id after you make the payment to the developers. Afterward, traders have to place it in their MT4 experts directory and attach it to the charts to start trading.

There is no statement on the amount of leverage, or minimum deposit traders should use.

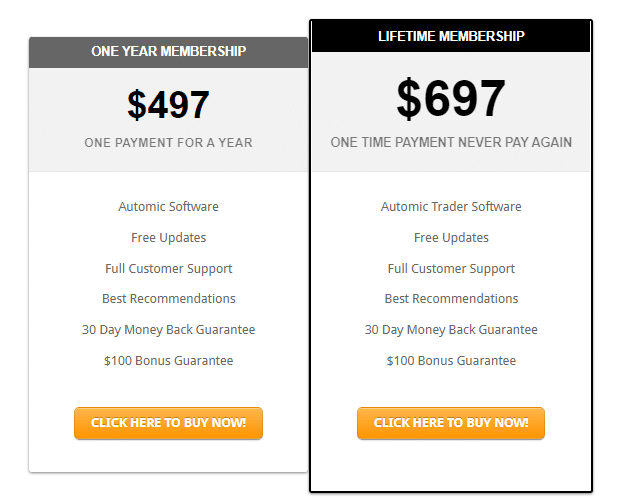

The asking price is $497, and there is a 30 money-back guarantee. Traders can also get it with a one-time payment of $697.

Backtests

Backtesting results are not available for the product, which is quite a strange approach. This may mean that the algorithm fails while being put on historical data. Failure to provide customers with necessary information raises many concerns about the product and lowers our trust in the expert advisor.

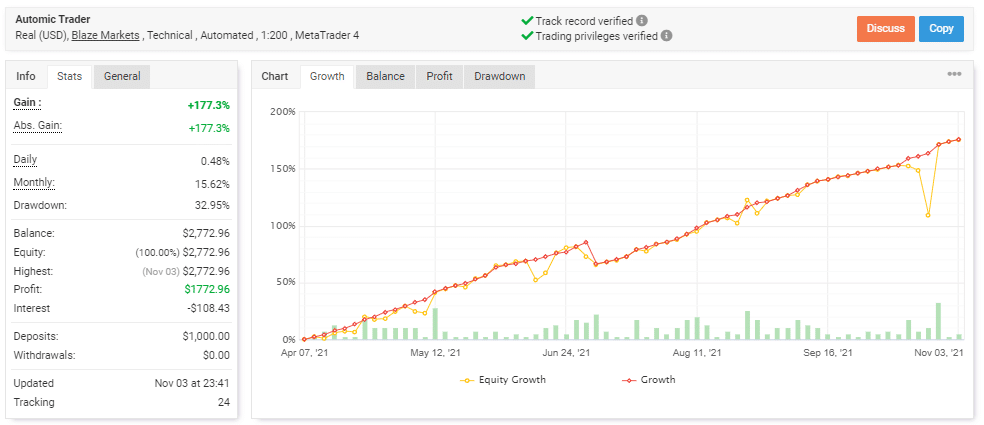

Verified trading results of Automic Trader

The system has made an average monthly gain of 15.62% for 8 months of trading activity, with a drawdown of 32.95%. The stated drawdown is high, giving us a risk-reward of 2:1 for the system. This means that for every dollar we make, we have to risk $2 on the line.

The winning rate stood at 79%, with a profit factor of 2.09. The best trade was $8.78, while the worst was -$16.05 in a total of 535 trades. The developer made $1000 in deposits and $0 in withdrawals. The current balance of the system hangs at 2772.96 with the interest of -$108.43.

Vendor transparency

Leap FX is the author of the product. The company has many robots published in the financial markets but does not share any information on their portfolio or trading experience. Now we have a lack of transparency in both backtesting and author bio, raising more suspicions on the genuineness of the product.

Is Automic Trader a viable option?

Automic trader does not come with backtesting records and is not transparent on developers’ portfolios, making it a risky investment. We can not trust the algorithm as of now.

Advantages

- It comes with live records

Disadvantage

- Not much transparency on strategy

- No backtesting records

- It has a high asking price

Conclusion

Automic trader is not transparent on the backtesting records as it might have reached a margin call due to the implementation of martingale and grid. The algorithm can not be implemented on a live account due to this reason. The developers should openly declare the risky methodology but fail to put any comments on this. We can say that investing in such a product is not worth it.