AVIA is a money-management service that is owned by LEFTURN. This firm trades with the help of a trading tool and manually looks for positions with aggressive drawdown. It has a simple presentation. In this article, you will get to know if this trading system will fit your expectations or not with its main features, pros and cons, strategies used, and much more.

Features

We could not find any information about the traders and programmers involved with AVIA on its official website. This means there is no info about their qualifications and experience. As per the seller, they employ a semi-automated trading technique, wherein a major part of the trading is done by robots and a minor part is done manually when the expert advisor attains a high drawdown. There is no other information about the trading strategy used.

However, when we looked at their trading history for a moderate account on FX Blue, we ascertained that this trading tool uses martingale and grid strategies. The developer does not inform traders that they use such risky trading techniques. This Forex robot has many programs with different drawdowns and average monthly returns.

Some of the features of AVIA include:

- The creator provides MAM account management.

- This trading system deals in all major currency pairs.

- It has a detailed trading plan.

- This Forex robot does not trade with major risks.

- It focuses on macro fundamentals.

- There are four different risk levels.

How to start trading with AVIA

AVIA works automatically but sometimes it requires to be managed by the trader. It allows you to choose your own broker. Plus, it trades micro lots and opens and closes orders every day. When it comes to risk, there are four levels of risk tolerance, which are as follows:

- Conservative risks require a minimum investment of $3000. They let you earn 12% per month with 7% to 10% drawdowns.

- Moderate risks require a minimum investment of $3000. They let you earn 18% per month with 9% to 12% drawdowns.

- Aggressive risks require a minimum investment of $3000. They let you earn 25% per month with 13% to 17% drawdowns.

- Very aggressive risks require a minimum investment of $3000. They let you earn 34% per month with 15% to 20% drawdowns.

In order to trade using AVIA, you first have to open your trading account using your preferred broker or a broker suggested by the company. Then, you have to provide your login details. The trading system will begin copying trades as per your chosen risk plan. Its recommended leverage is 1:500 in an account less than $40,000. Unlimited positions and hedging are allowed.

Backtests

AVIA has no backtest reports. These records can tell us about an expert advisor’s historical output. This makes us doubt its performance. The expert advisor might have failed in its backtests since it employs grid and martingale techniques that are unsuccessful when the market moves in one direction.

Verified trading results of AVIA

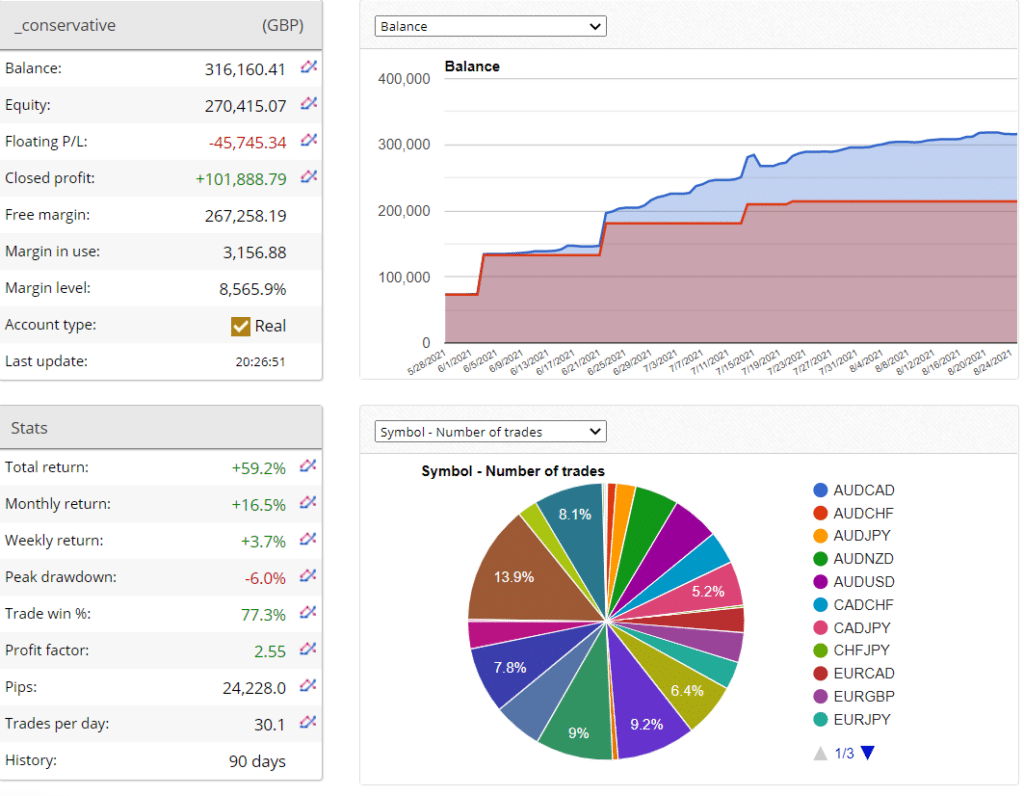

AVIA has live trading results on FX Blue. This account began trading in May 2021 with an initial deposit of £73,000. It has a balance of £316,160.41 at present, which is huge, with a floating loss of -£45,745.34 and a margin level of 8565.9%. Its win rate is -77.3% and it has been active for 90 days now.

The Forex robot shows a total profit of 59.2% with weekly returns at 3.7% and monthly returns at 16.5%. Its profit factor is 2.55 with a maximum drawdown is -6.0%. The risk/reward ratio is 9.11, which is quite high for an account with conservative risk. Moreover, the profit factor is low, which indicates that the EA’s trading approach is ineffective with high risk.

Update 2021

Now if you decide to trade with Avia, you will see no sign of this forex managed account service on the dev’s website. The system failed and they decided to rebrand it. They deceive traders by offering the same service under another name – Alphi. It’s unprofessional and should not be ignored.

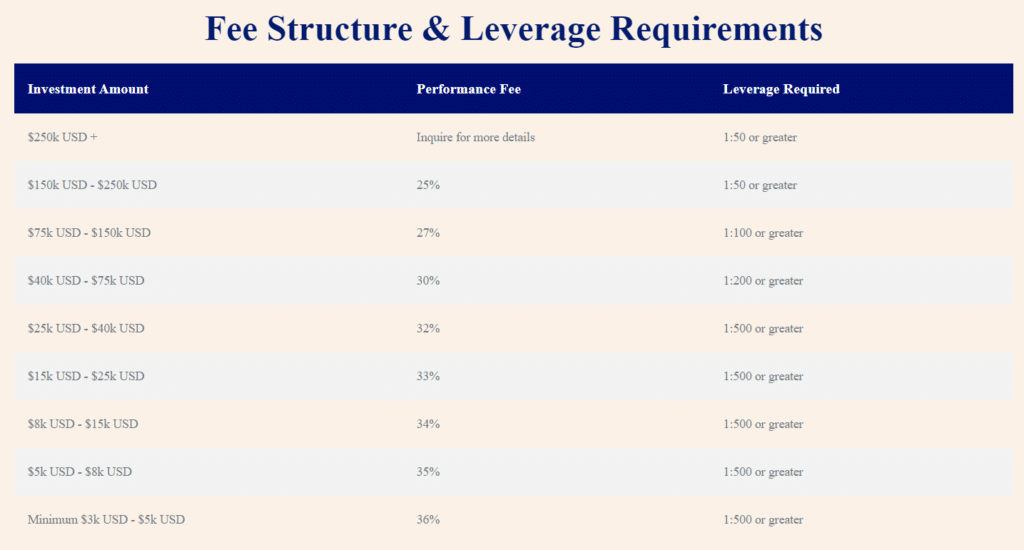

Pricing and refund

When it comes to the price of AVIA, it charges performance fees on monthly profits. This fee diminishes as the equity of the account amplifies in size. There is also a trial period of 30 days with no risk. You get a demo account for the trial with your preferred Forex broker. This lets you test the service and decide if its trading style suits you before you purchase its live account.

Is AVIA a viable option?

AVIA is not a viable trading tool. Some of its pros and cons are written below:

Advantages

- Both automated and manual trading strategies used

- Four different risk levels

- Verified trading results

- Free trial for testing

Disadvantages

- Lack of transparency about the developer information

- The strategy used is not disclosed

- Trading results show that the trading approach has high risk

- No backtesting results

- Expensive price

Conclusion

AVIA is not transparent about its traders and strategy used, which makes us question its reliability and authenticity. It claims that it boosts profits and minimizes risk exposure, but its performance shows that these are false claims. Even though there are several live trading results of AVIA that tell us about its performance, it has high risk, resulting in huge losses. Thus, AVIA is not worth investing in.