Crypto cards and how they work

By using cryptocurrency credit cards, everyday expenditure turns into a way to earn digital currencies. Similar to a cash back card, you get a certain percentage on purchases with this card, such as 2%. The cardholders can then use the cashback to buy crypto tokens, which gives it a distinction from other cards. We’ve compiled a list of the top cryptocurrency crypto cards available in the market below.

Nexo Card: The best for no-fee services

When you use your Nexo card to make a purchase, you’ll get 2% cash back right away. Before completing a transaction, you have the option of receiving your rewards in either NEXO tokens or Bitcoin. All of your redeemed rewards will be credited to your Nexo account automatically.

There are no monthly fees, annual fees, or foreign exchange costs with the Nexo Card. Notably, this is the only credit card that allows you to spend the value of your crypto without selling them.

Features

- APR of up to 12% on your Nexo Token.

- More Nexo Tokens in your portfolio means bigger returns on various cryptocurrencies.

- More Nexo Tokens in your account means lower interest rates on your borrowing.

- Additional monthly withdrawals are completely free!

BlockFi: The Best Bitcoin Reward System

When looking for an easy-to-use credit card that rewards cryptocurrency users, BlockFi offers a great option. Although BlockFi is most well-known for its crypto lending services, it also offers a customized Visa card that provides an unrestricted 1.5% reward on every transaction. Also, BlockFi is one of the most cost-effective cards because it has no yearly or foreign exchange fees.

At the end of the month, BlockFi transfers your points into the cryptocurrency of your choosing at the market rate. However, the value of your points can change substantially if the price of cryptocurrencies falls or rises. Additionally, Bitcoin holders can earn interest on their balances using the BlockFi Rewards Visa Signature card. Your BlockFi card comes with a basic reward structure based on crypto by default. In addition to a 1.5% rebate on every purchase, your BlockFi account earns with Bitcoin. Asan introductory offer, users get back 3.5% of their expenditure for the first 90 days.

Features

- No annual fees.

- Users earn 1% cashback on purchases and 3.5% cashback on the first 90 days’ expenditure.

- It does not charge fees on foreign transactions.

Crypto.com card: The most flexible and high-return credit card

If you want to get the most value for money, check out the Visa cards offered by Crypto.com. In order to get the free Midnight Blue visa card, you do not need to stake any CRO (Crypto.com’s native token) at all. Additionally, you will earn 1% of the transaction value in CRO for purchases you make using the Midnight Blue card.

Crypto.com cardholders can trade over 250 digital currencies using the app that comes with the card. An astounding 8% cashback is available at the highest level, Obsidian. Crypto.com users, on the other hand, can only reach this tier if they invest £300,000 ($391,530) in CRO.

Features

- Users get back up to 8% cashback.

- It does not charge annual fees.

- Rewards in CRO token.

- Users can spend their crypto.

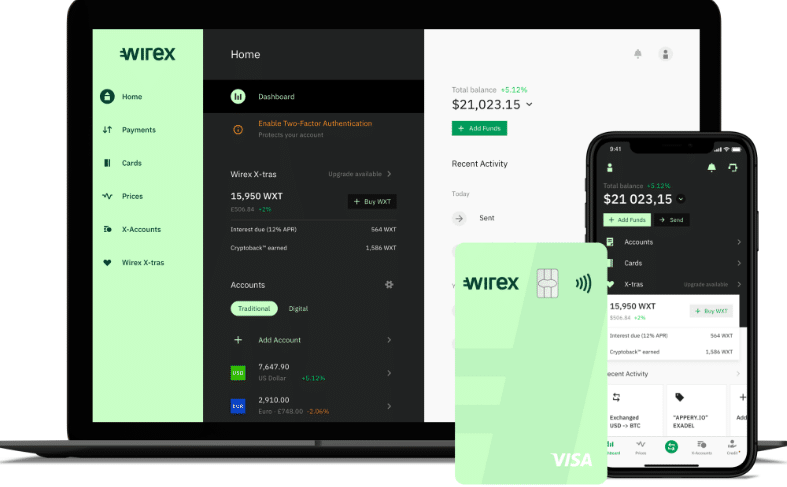

The Wirex Visa Card: Best for crypto-fiat earnings

Using the Wirex Visa Card, customers can transact directly in fiat currency or a cryptocurrency and vice versa. Using the card entitles users to cashbacks on their purchases.

Wirex funds your account with WXT tokens, which you can stake for rewards. Also, staking gives you access to additional features and services on the platform. If you make an eligible in-store purchase, you’ll receive 2% back in WXT through the Cryptoback incentives. In addition, it provides customers with a regular 1.5% rebate on in-store purchases that are eligible.

Features

- The card offers a 2% refund on all purchases made with it. WXT is the native token of the platform, and holders may convert it to any other cryptocurrency.

- In-app notifications: The software keeps track of all transactions.

The Gemini Credit Card: The best for fast cashouts

To be considered for early access to this card, you must first sign up for a waitlist. However, when Gemini’s credit card launches, it has the potential to be one of the top crypto cards on the market. It doesn’t charge an annual fee and allows you to earn in more than 40 cryptocurrencies.

Features

- There aren’t any fees associated with foreign transactions.

- You’ll get 3% back on your eating expenses (up to $6,000 in annual spending, then 1%).

- Get back 2% of what you spend on groceries and 1% rebate on all other purchases.

- Your Gemini account will be credited promptly with your crypto rewards (with the exception of purchases, which may take some time to clear).

In summary

It’s a risk-free method to get your feet wet in the cryptocurrency world if you use a rewards credit card of this type. Furthermore, if you’re currently investing, you can utilize one to add funds to your cryptocurrency account. There are a variety of cryptocurrencies you can earn as a reward on each crypto credit card. There are usually a few options available on most cards, but the number might vary widely.

You can use any crypto card you want if you’re open-minded about how you want to get your money. You can, however, use a certain credit card to earn a specific cryptocurrency. When it comes to bitcoin credit cards, you can choose your own incentive currency and transfer your earnings to a cryptocurrency wallet. Ultimately these cards should act as auxiliary support for one’s engagement with digital assets. They can help you derive substantial benefits whenever you spend, in addition to facilitating smooth trading. The underlying factor is that they ought to be secure and be able to meet your specific needs as an individual or the needs of your institution.