If you’re just getting started in crypto or have been around for a while, you’ll have to pay taxes. Therefore, it’s imperative that you compute crypto taxes correctly as rules begin to take effect. Using data from your exchanges, wallets, and other cryptocurrency platforms, crypto tax calculators are able to calculate your taxes. They use this information to calculate your investment gains, losses, and income.

IRS and crypto taxes

The IRS does not consider cryptocurrencies to be a kind of fiat currency but rather an asset similar to a stock. This means that you are required to record any capital gains or losses to the IRS if you sell or exchange these assets.

To calculate capital gains, subtract your crypto’s original market value from its market value when you sold it. This means that when calculating your capital gains, you should subtract the cost basis from the total value of all of your cryptos sold or bought during the year.

Keep in mind that if you hold your cryptocurrency for less than a year, you’ll be taxed more heavily than if you held it for longer (long-term capital gains tax). All US citizens with tax filing obligations must report the results of their crypto activities to the IRS.

Additionally, anyone who earns money from within the United States may be required to pay taxes in the United States. Tax responsibilities may also be imposed on foreign nationals who conduct business with US-based companies.

The following are the top six cryptocurrency tax calculators.

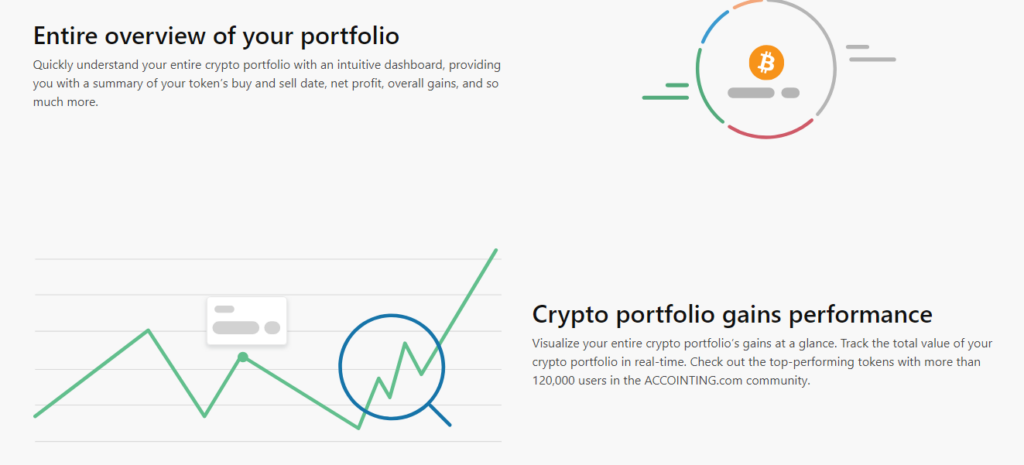

Accointing

Accointing is a great option for newcomers to the crypto world who don’t want to use multiple applications to maintain their crypto portfolio. It’s all about the user and is a great source of knowledge. In addition, it comes with crypto tracker software and a cryptocurrency tax calculator for nations where FIFO or LIFO is used for tax purposes.

Also, Accounting has excellent customer service and is one of the most cost-effective platforms available today.

Koinly

If you’re looking for the greatest free crypto tax software, go no further than Koinly. You can use it for free, with unlimited transactions and a plethora of useful options. When it comes to keeping track of your investments, Koinly has a dashboard that’s easy to use.

At the same time, you’ll be able to keep track of your earnings from mining, staking, and other related activities. A profit/loss and unrealized capital gains dashboard is also available. It can automatically sync transactions with over 6,000 other blockchains and has seamless integration. If you’re a cryptocurrency trader, Koinly’s most intriguing feature is that it accepts nearly every cryptocurrency.

With Koinly’s auto-import verification, you don’t have to worry about importing data anymore. A built-in duplicate-handling function ensures that no data disputes result in the creation of multiple records. When you’re in the negative, it’ll let you know. To help you avoid overpaying your crypto taxes, Koinly will identify transactions between your own wallets.

ZenLedger

ZenLedger is an easy-to-use tool for calculating your crypto taxes. They are connected to the most popular exchanges and support all of the most popular crypto and fiat currencies. Their software instantly imports your transaction history from exchanges and immediately generates tax paperwork for you. Included in these documents are capital gains and income reports, as well as contribution and closing statements. In addition, you and your CPA or tax accountant will receive a set of profit and loss statements from them.

To put it another way, all of the documents generated by ZenLedger are IRS-friendly, which means they may be used directly in your tax returns. ZenLedger’s platform is designed to ensure that you never overpay taxes, regardless of whether you’re a miner or an occasional trader. From $99 to $299 per year, you can get ZenLedger for yourself or for your CPA with three different annual subscription plans that include everything from exchange support to tax reporting.

TokenTax

Even though TokenTax is among the more expensive options, individuals who can afford it will get certain special benefits from using it. Starting at $65, you may hire a CPA to help you with your cryptocurrency taxes. Not only can the tax professionals at TokenTax file your tax returns for you as part of their “white glove” service, but they can also help you piece together your past gains and losses from collapsed exchanges. This is just one of the many benefits of using this service.

There are two main areas of expertise for TokenTax, which are tax reduction and tax loss harvesting. Using TokenTax, taxpayers can recoup tax losses and lower their tax burden.

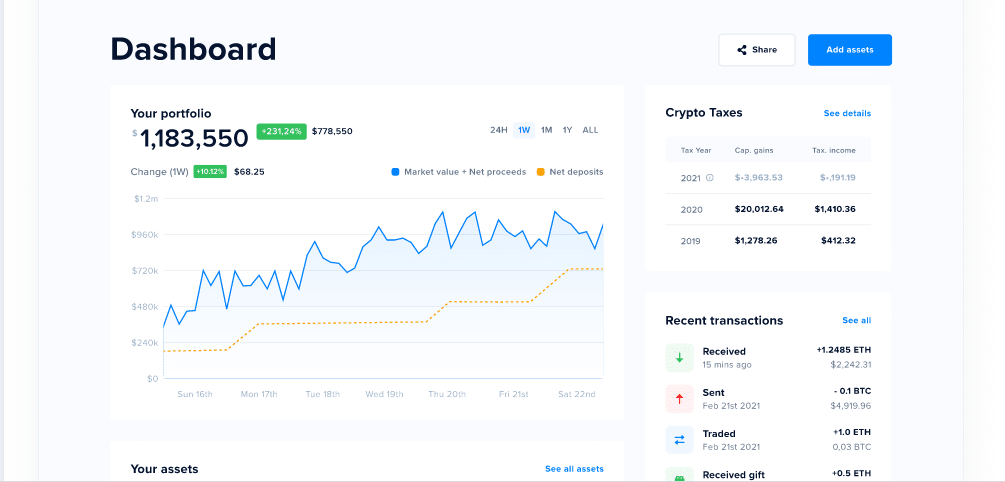

CoinTracker

Using CoinTracker, you can keep track of your crypto assets as well as file your tax returns. All of your transactions and balances are immediately synced to their platform, so you always have the most up-to-date information available. Their user interface shows a visual representation of all of your digital assets, as well as a history of your trades.

Depending on how many transactions you need, CoinTracker offers four different pricing packages ranging from $49 to $999. Every one of their plans comes with a cost basis report.

TaxBit

TaxBit stands out because it is the first tax software built from the ground up by CPAs, tax attorneys, and software engineers. To ensure that your digital asset taxes are accurate, it preserves a detailed audit record of all computations.

In order to import your trade data, they have direct interfaces with each and every trading platform out there. You can just upload a file containing your trading data to the exchanges that do not require imports, and their platform will automatically import your data. TokenTax will, once you have uploaded all of your information, generate all of the forms you need to complete your taxes. For example, you may use the 8949 form or another file from TurboTax, FBAR, or FATCA.

In summary

One of the most difficult aspects of being a crypto trader is figuring out your taxes. Using a crypto tax calculator is an excellent strategy for meeting your tax requirements. They’re simply data aggregators that gather transaction data from numerous sources, much like the best fiat money tax software. To help you narrow down your options, we’ve included a list of the six best calculators available right now. However, you should go for the one that best fits your needs.