Crypto day traders are in it for the money, and that’s why they do it. Because cryptocurrency values fluctuate more than any other asset class, traders well-versed in the market might profit from this. With a sound crypto trading strategy and the ability to spot trends, the crypto market has the potential to be profitable for you. Below, we look at some of the strategies you can apply successfully with digital currencies.

Dollar-cost averaging (DCA)

Dollar-cost averaging over a longer period of time is a common and well-tested trading approach that is most effective when used over a long period. The idea is straightforward. It’s better to invest in little quantities, at specific times of the day and on specific days, rather than investing all of your money in a single cryptocurrency.

Example: Dan is interested in investing $50,000 in ETH. He decides to employ the DCA technique and divide his capital into 50 $1,000 portions instead of spending it all at once. After that, he decides on a specific day and time of the week to acquire ETH, for instance, Friday at 3 p.m. local time. Every Friday at noon for the following 50 weeks, Dan buys $1,000 worth of ETH for his $50,000 investment.

In the long run, Dan will likely get more ETH for his money by spreading out his purchases over a longer period of time rather than spending it all at once. Furthermore, he will reduce the risk of losing his money on one or two failed trades.

Scalping

Squeezing a tiny profit out of many deals can result in a larger profit over the long run. Scalping is a strategy that uses huge sums of liquidity to take advantage of modest price fluctuations over a short period. Time horizons range from seconds to hours but are typically a few minutes long. Scalpers look at the cryptocurrency’s price, historical trends, and trading volumes, then decide when to buy and sell it within the day.

Scalping is all about making the largest profit possible in the smallest amount of time possible. When it comes to trading cryptocurrency, scalping has shown to be one of the most successful methods. However, to be a successful cryptocurrency scalper, you must be able to react quickly to price changes.

Arbitrage

In the financial markets, arbitrage is a popular strategy. In this case, you would acquire a coin on one platform and sell it on another, leveraging the price differential that exists between the two platforms.

For example, let’s consider a situation where the price of ETH on Coinbase is $3,450, but the currency trades on Kraken for $3,500. Therefore, on Kraken, you may make a profit of $100 if you buy 2 ETH from Coinbase and sell it in a matter of minutes.

Arbitrage, like scalping, typically yields modest profits. This means that bigger is better when it comes to order sizes.

Range Trading

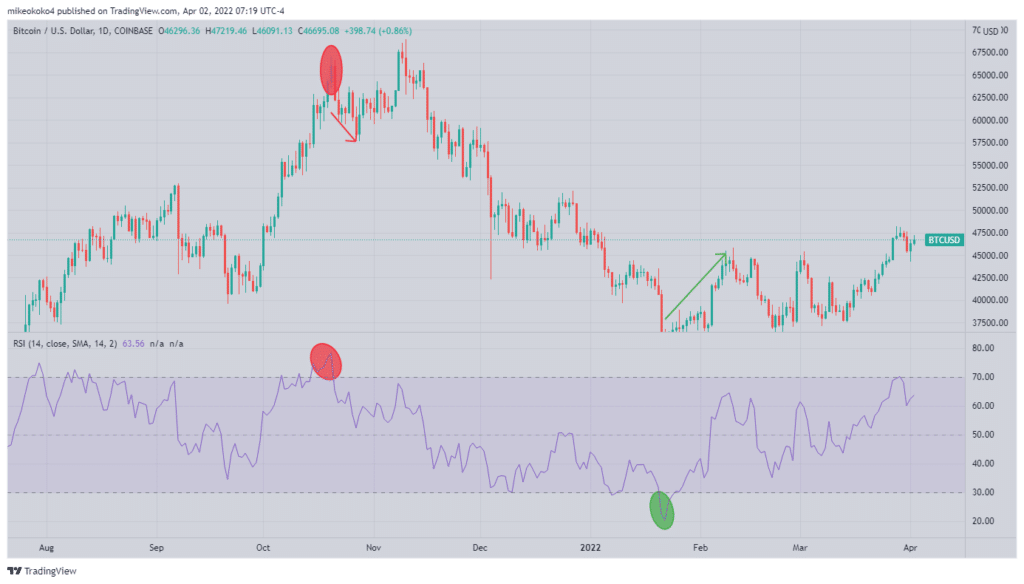

Range trading operates on the premise that cryptocurrency prices will often only vary within a specific range over time. When a price moves outside of that range, it is presumed that a price is poised to experience an abnormal shift. A price drop below the lower bound of the range, for example, could indicate that it is time to sell with the expectation that a large downward movement is just around the corner.

For instance, over the next few weeks, if Solana (SOL) is trading at $100 and you feel it will rise to $120, then trade in a range between $100 and $120. Based on this logic, you can range trade SOL by buying at $100 and then selling when the price hits $120. Therefore, for as long as you think SOLUSD will stay in this range, you’d repeat this approach.

A decent rule of thumb is to place stop orders outside the trading range. It’s possible to get even more information by employing multiple indicators simultaneously. For example, you can purchase or sell when the RSI oscillator shows an oversold or overbought position (below 30 and/or above 70, respectively).

A common technique to gauge the intensity of a trend without paying much attention to direction is using the ADX.

The index operates on a scale of 1 to 100, with a reading below 20 indicating a market in a range, as seen on the ADAUSD chart above.

Death cross/golden cross

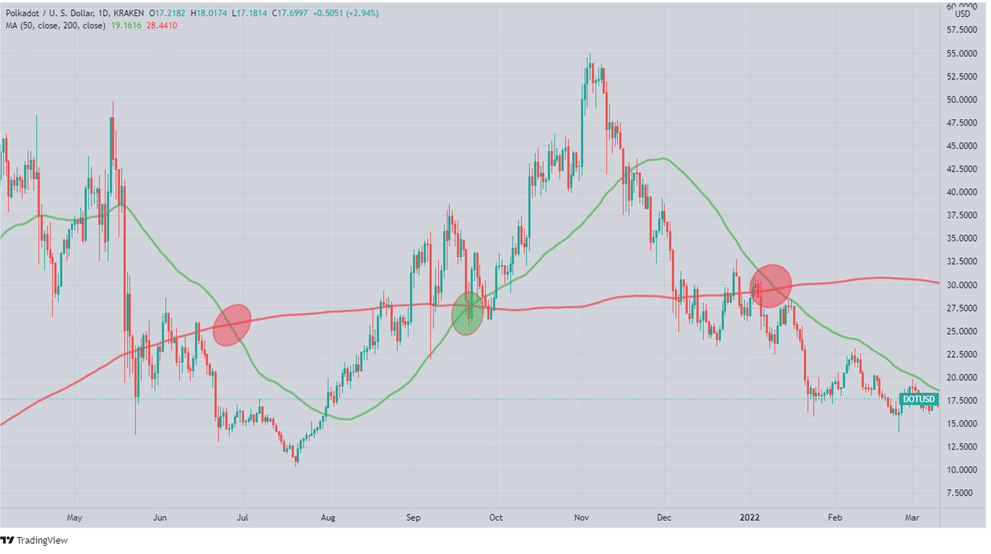

Traders utilize two Moving Averages (MAs) in the “golden cross/death cross” approach, which is an indicator that represents the asset’s long-term average price.

You should be on the lookout for two kinds of crossovers:

- As soon as the 50-MA crosses over to the 200-MA, we get convergence (the golden cross).

- We get a death cross if an asset’s 50 MA crosses below its 200-period Moving Average.

This is a buy signal as long as the short-term momentum is outpacing the longer term. Price increases are the result of a resurgence in demand from purchasers. A divergence indicates that short-term momentum is weakening while long-term momentum is increasing. In other words, you should get out of the market.

You’ll seek crosses between the 50 and 200 MAs using this method. They are the averages of the preceding 50 and 200 days. Preferably, you should use large time frames like the daily and weekly charts. Nonetheless, traders may also utilize shorter average price fluctuations to identify golden crosses.

When searching for a golden cross, the longer the averages used, the more accurate the indicator predicts upward price movement. Observing price movements over lengthy periods of time is another long-term trading method that is most effective after 18 months and beyond.

The chart above shows how the price starts to appreciate after a golden cross (green highlight) and depreciates after a death cross (red highlight).

In summary

Cryptocurrency trading, as a whole, is riddled with risks and complications. To reap the long-term rewards of crypto trading, traders must devise enjoyable and safe strategies. The strategies listed above are some of the most common in cryptocurrency trading and have proven to be profitable over time.