Most cryptocurrencies trade for less than $5. Think of popular coins like Cardano, Tron, Ripple, Harmony, and GALA. While buying these coins can be profitable, some investors prefer investing in those trading over $50. In this article, we will look at some of the best coins trading above $50. We will exclude Bitcoin and Ethereum, which are trading at $42,000 and $2,900, respectively.

Terra

- Coin: LUNA

- Price: $90

- Market cap: $34 billion.

Terra is one of the biggest blockchain network in the world. Based on its market capitalization, it is the 9th biggest platform globally. At the same time, Terra USD, its stablecoin is valued at over $13 billion, making it the fourth-biggest stablecoin in the world.

Terra is a South Korean platform built on the Cosmos SDK platform. Its main goal was to create a number of stablecoins that are backed on top currencies like the US dollar. UST, its main stablecoin is backed by the US dollar and then stabilized algorithmically. This means that for every UST that is minted, a LUNA must be burned.

There are several reasons why Terra is a good investment. First, it has grown to become the second-biggest DeFi platform in the world with a total value locked (TVL) of near $23 billion. It is second only to Ethereum.

Second, Anchor Protocol, which uses the Terra platform, has grown to become one of the best DeFI platforms in the world. It has over $13 billion of cash in its smart contract. Additionally, Terra’s Chai app has become incredibly popular in South Korea.

Therefore, while LUNA is significantly above $50, there is a likelihood that it will keep rising. Indeed, as shown below, the coin’s price rose sharply in the first part of 2022 even as other coins remained under pressure.

Avalanche

- Coin: AVAX

- Price: $80.

- Market cap: $21 billion.

Avalanche is a third-generation blockchain project that seeks to become a better alternative to Ethereum and layer-2 networks like Polygon. It was built using the proof-of-stake technology that is usually significantly faster and energy-efficient.

Avalanche’s main feature is its speed. According to its website, it is able to handle as much as 4,500 transactions per second, which is remarkable considering that Ethereum handles less than 20 transactions in the same period.

At the same time, Avalanche has announced a major plan to incentivize developers to use its platform. The program is known as Avalanche Rush and had an initial budget of over $150 million. This is one of the reasons why the number of apps built on its platform has increased sharply lately.

Data compiled by DeFi Llama shows that there are 176 apps built in its ecosystem that have a TVL of over $11 billion. Some of the top apps built in the network are Aave, Trader Joe, Curve, and Benqi.

Avalanche is a good investment because of the rising adoption of its platform and the fact that staking it earns a return of over 10%.

Axie infinity

- Coin: AXS

- Market cap: $6.3 billion.

- Price: $52

The metaverse is a growing industry that is expected to change how people interact with each other in the internet. It aims to create a whole new universe that will change many industries. One of these industries is gaming, which is currently dominated by giants like EA Sports and Activision Blizzard.

Axie Infinity is one of the most popular metaverse platforms in the world. It operates a diverse gaming platform that enable people to compete for awards. The developers are also coming up with a land platform where people can buy virtual land and build their universe.

Axie Infinity is also one of the biggest players in the non-fungible token (NFT) industry. Indeed by September 2021, the network had managed to sell NFTs worth over $2 billion. And analysts expect that the volume of NFTs sold will rise when it releases its digital land product.

While the AXS token price has crashed by about 70% from its highest point on record, there is a likelihood that it will rebound as the metaverse industry rebounds.

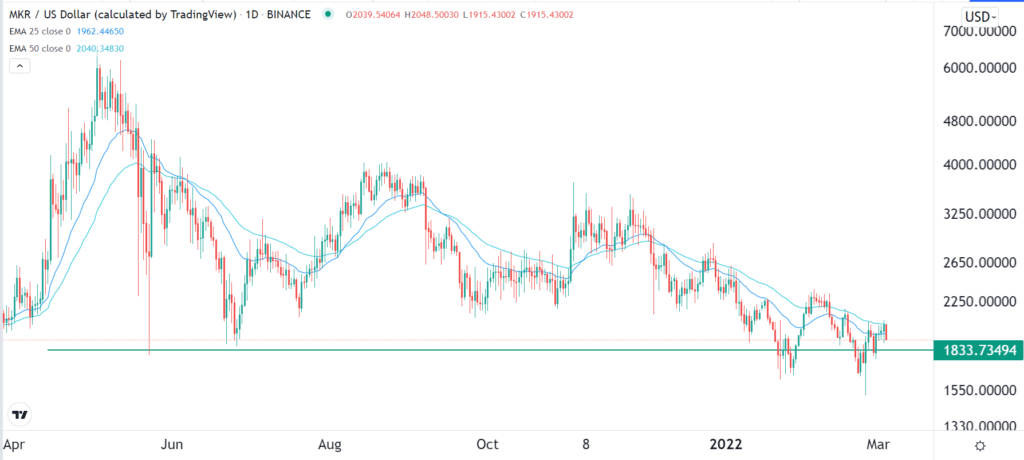

Maker

- Coin: MKR

- Price: $1,929

- Market cap: $1.7 billion.

The Decentralized Finance (DeFi) industry has seen a remarkable growth in the past few years. At the time of writing, over $140 billion were tied in DeFi smart contracts. This is a spectacular growth for an industry that was in its infancy three years ago.

Maker is one of the leading players in the industry. It is a DeFi platform that enables people to bypass traditional lending platforms and access capital within a short period. Unlike banks, it does not even request information about the borrower.

Maker works in a simple way that ensures its safety and reliability. Unlike other lending platforms, MakerDAO does not use ordinary cryptocurrency. Instead, it has developed its own stablecoin known as Dai that is backed by the US dollar. It has a total market cap of $9.2 billion, making it the fifth biggest stablecoin in the world after Tether, USD Coin, Binance USD, and Terra USD.

Maker is a giant platform with a total value locked of over $15 billion. This makes it the second-biggest DeFi protocol after Curve Finance.

Like most DeFi tokens, Maker’s price has fallen sharply in the past few months. Indeed, the current price is about 70% below its all-time high. Still, there is a likelihood that it will bounce back since activity in its network is still rising.

Summary

There are multiple factors that traders look for when thinking of the cryptocurrency to buy. Some investors look at the overall price of the coin and opt to go for the one that is cheap. In this article, we have looked at some of the coins that are trading at $50 and above that we feel have a lot of potential. Some of the notable mentions are Monero, Elrond, Aave, and Bitcoin SV.