Avalanche has grown from a small and new smart contract chain network to become one of the most successful ones. Launched in 2020, it has attracted millions of dollars in investments and hundreds of developers in its ecosystem. In this article, we will look at what Avalanche is and then identify some of the leading applications in its ecosystem.

What is Avalanche?

Avalanche is a blockchain project whose goal is to give developers a platform to build high-scalable applications that are blazingly fast. It also solves the cost problem that Ethereum developers face since the average price to complete a transaction is over $20.

Avalanche also solves the energy challenge that any proof-of-work (PoW) networks face. It is a proof-of-stake platform that relies on thousands of validators from around the world to verify transactions.

Holders of AVAX, the network’s native coin, benefit from the significant rewards that the network offers. They achieve this through staking, which lets them earn a reward by just storing their AVAX token in an exchange like Coinbase and Crypto.com.

The Avalanche ecosystem has been growing rapidly. Some of the projects in the network are built from the ground up using Avalanche. Others are projects developed using networks like Ethereum that use Avalanche to provide an alternative. Some of these apps are Aave, Curve, and Beefy Finance.

Avalanche has achieved its success organically and through its giant incentives programs. In 2021, the developers unveiled Avalanche Rush, a $180 million program to incentivize its developers. And in 2022, they launched another $290 million grant program to incentivize metaverse creators.

In this article, we will look at some of the most popular projects in the Avalanche ecosystem. Precisely, we will assess those that are built using Avalanche and are not available in other chains.

Trader Joe

Trader Joe is a fast-growing decentralized exchange (DEX) that has the biggest market share in the Avalanche ecosystem. It has a total value locked (TVL) of over $1.3 billion and thousands of users from around the world.

Trader Joe provides several services in its ecosystem. First, it is a trading portal that enables people to buy and sell cryptocurrency pairs with ease. It is a highly advanced platform that has top-quality charting solutions to enable people to analyze multiple pairs.

Second, Trader Joe has pooling features. This is where you select a cryptocurrency pair like sAVAX-AVAX pair and then provide liquidity. By so doing, you will be making the project smooth for traders on the other side as you earn a return. You can even create your own pool.

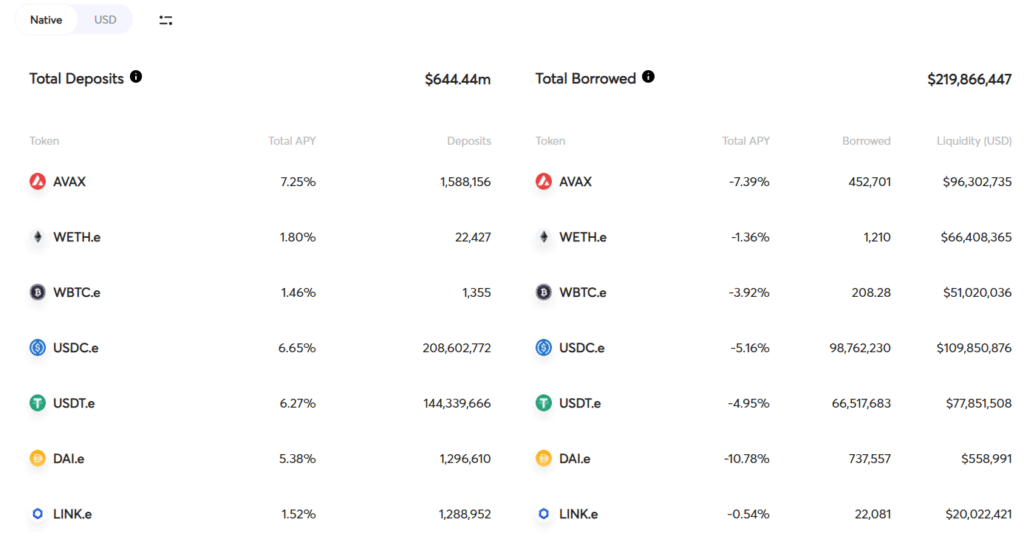

Third, Trader Joe has yield farming features that lets users earn a return of as much as 35% by just adding liquidity. Its other solutions are lending and staking. At the time of writing, its lending feature had over $644 million and $219 million in borrowings.

BENQI

BENQI is another leading DeFi platform built using the Avalanche smart contract platform. Broadly, it offers two main solutions: liquidity market (BLM) and liquidity staking (BLS)

BENQI’s liquidity market is a platform where people can borrow, lend, and even earn a return from their digital coins. It works in a relatively simple way where people deposit digital coins and then earn a return as the other people borrow.

Meanwhile, the BENQI Liquid Staking feature helps people to tokenize their staked AVAX token and earn a return.

BENQI has over $2.5 billion in assets in its automated market maker platform. Most of this liquidity is in DAI, followed by Avalanche, USD Coin, and Wrapped Bitcoin.

Platypus Finance

Platypus Finance is another DeFi platform built in the Avalanche ecosystem. It is an automated platform that is backed by some leading companies like BENQI, Mechanism Capital, Avalaunch, Avalanche, and Keychain Capital.

Platypus solves some of the top challenges that other AMM platforms have. For example, it handles the challenge of slippage, where users get a different price from what they initiated.

Unlike other ecosystems that have a closed pool and multiple tokens, it has an open liquidity pool and a single-sided token. Also, it is more capital efficient.

Platypus Finance has over $780 million in total value locked, while its native token, known as PTP, has a market cap of $61 million.

Pangolin

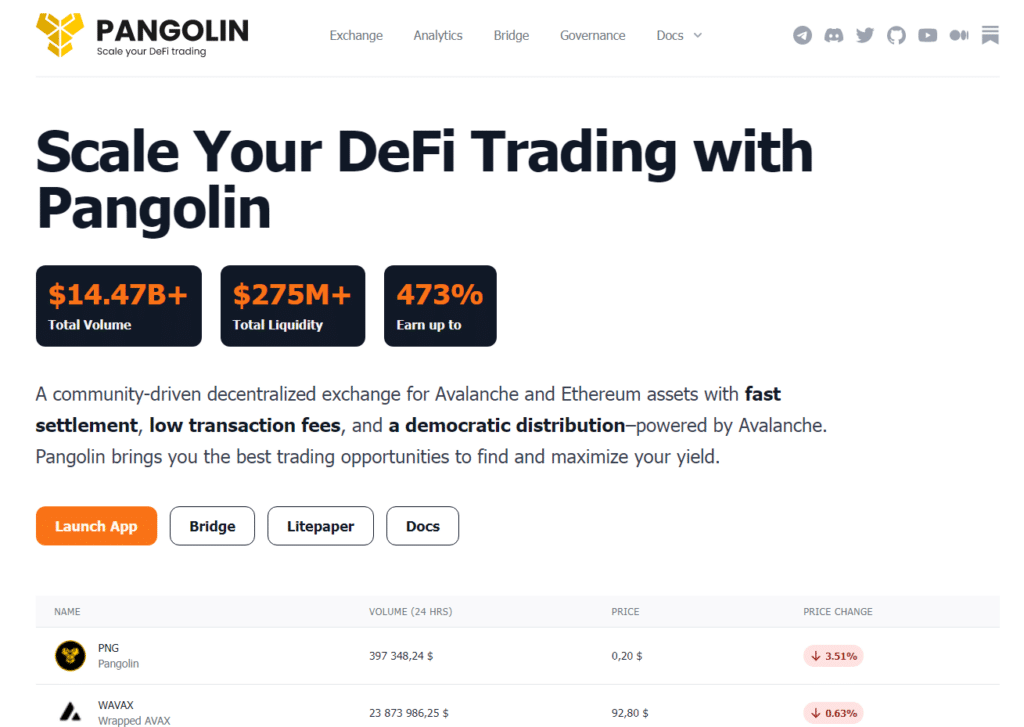

Pangolin Finance is a DeFi platform in the Avalanche ecosystem that uses a model that is similar to Uniswap. It is an open-source project that uses the PNG token to facilitate governance of the ecosystem.

It has three notable benefits such as lower-cost trades, a community-based ecosystem, and a fair token distribution system. As a result, unlike other blockchain projects that enrich insiders, all PNG tokens are distributed to the community. None of them are offered to insiders and investors.

Pangolin has a TVL of over $217 million, while the PNG token has a market value of more than $17 million. Its total trading volume in the past few months has been over $14 billion.

Yield Yak

Yield Yak is another fast-growing project in the Avalanche ecosystem that enables investors to earn returns. It offers several solutions like swap, farms, and stake. With swap, people can easily convert cryptocurrencies to each other in a simple way and at a lower cost.

Yield Yak also has a farm product that lets people earn rewards by just depositing their coins. For example, when you deposit a coin like AVAX, you will be able to earn an APY of about 7.8%. One can also earn by depositing stablecoins like Tether USD and USD Coin, among others.

Further, Yield Yak has its own cryptocurrency known as YAK that it can stake. YAK is a relatively small coin valued at just $15 million.

Summary

Avalanche is a fast-growing ecosystem that has a strong market share across multiple industries like DeFi, gaming, and the metaverse. In this article, we have looked at some of the fastest-growing DeFi projects built using the Avalanche platform. Other gaming and metaverse projects are Atlantis World, Crabada, and Chikin.