Automation is an important aspect of forex trading. Automated trading systems such as expert advisors have made it possible for traders to capture the best opportunities without spending much time glued to the screen.

Contrary to perception, automating a trading process is not as complex as most people think. In most cases, it involves setting trading rules and indicators on a computer program integrated into a trading platform.

For the longest time, MQL has been the standard for coming up with automated systems in the capital markets. While the programming language has proved to be effective in developing highly effective systems, it can only be used on the MetaTrader platform.

In an era where many platforms away from MetaTrader have cropped up, it’s become inevitable for programmers to master other coding languages to develop automated trading systems for the forex market.

Below are some of the best MQL alternatives for anyone looking to integrate trading tactics into a computer program for use on other trading platforms.

cAlgo

cAlgo is one of the best alternatives of MQL programing language for anyone proficient in C# language. Operating as automated trading software allows users to come up with highly effective systems. It is also perfect for developing technical indicators for analyzing the forex market. In addition, the automated trading software also comes with built-in indicators that people can use within the trader platform.

It stands out as one of the best because it is easy to use and comes with a coding-friendly environment. Consequently, it is perfect for developing and testing trading robots and custom indicators.

NinjaScript

A much younger version of the MQL programming language, NinjaScript is perfect for anyone looking to automate trading operations in the futures market. With NinjaScript, you can program trading rules capable of performing various operations.

The coding language is perfect for anyone with expertise in C# language, as is the case with cAlgo. Its automated trading interface comes with efficient protocols for communicating trading signals from various sources. It also boasts popular charting applications such as TradeStation signal, NeoTicker, and Investor RT.

Pine script

Pine Script is the latest in the burgeoning space and is already giving MQL a run for its money. Created by TradingView, it is proving to be effective in the backtesting of trading systems and the creation of custom indicators. Unlike other options, it is user-friendly to people with the least programming experience.

Coming up with trading systems and indicators and integrating them into a program can be achieved in a few lines of code, given that Pine Script is not based on any language. The Pine Script code can be accessed within the Pine editor inside the TradingView online charting platform.

It stands out as one of the best, given that it is backed by a plethora of data from the TradingView platform. In addition, the Pine Script syntax is easy to understand compared to other programming languages.

General-purpose languages

In addition to specific coding languages in finance, it is also possible to develop automated trading systems using general-purpose languages such as Python Go and C++. However, there must be a direct connection between a broker’s server and the program created for this to work.

For instance, coming up with a trading plan using Python, there must be an Application Programming Interface to leverage the programmed strategy in a given trading platform. Given that not all brokers provide API could prove to be a challenge.

Expert advisors builders

Expert advisor builders are tools that allow people to come up with automated trading systems or expert Advisors. They stand out partly because they don’t require people to have in-depth knowledge and skills for coding or programming. In this, they can allow traders to come up with custom indicators and EA without programming skills.

Some of the best EA builders include:

Forex Strategy Builder Professional: It is a powerful EA building tool for anyone using the MetaTrader 4 or Metatrader 5 trading platform. The tool is perfect for building, testing, analyzing, and optimizing a trading strategy.

Visual forex Strategy Builder: It is an ideal fit for anyone looking to build custom indicators and trading strategies on top of java programming. Being a high-quality EA builder, it can be used for manual and automated trading.

FX EA Builder: A user-friendly and simple to use Expert Advisor builder. Web-based it is available for free and be used it come up with trading robots for trading on the Meta Trader platform,

Molanis Strategy Builder: This EA builder comes with predefined trading locks for coming up with forex signals and Expert Advisors. While priced at about $250, it can be used to come up with custom indicators at a rapid pace without any coding requirement. It is also good for backtesting a trading approach within minutes.

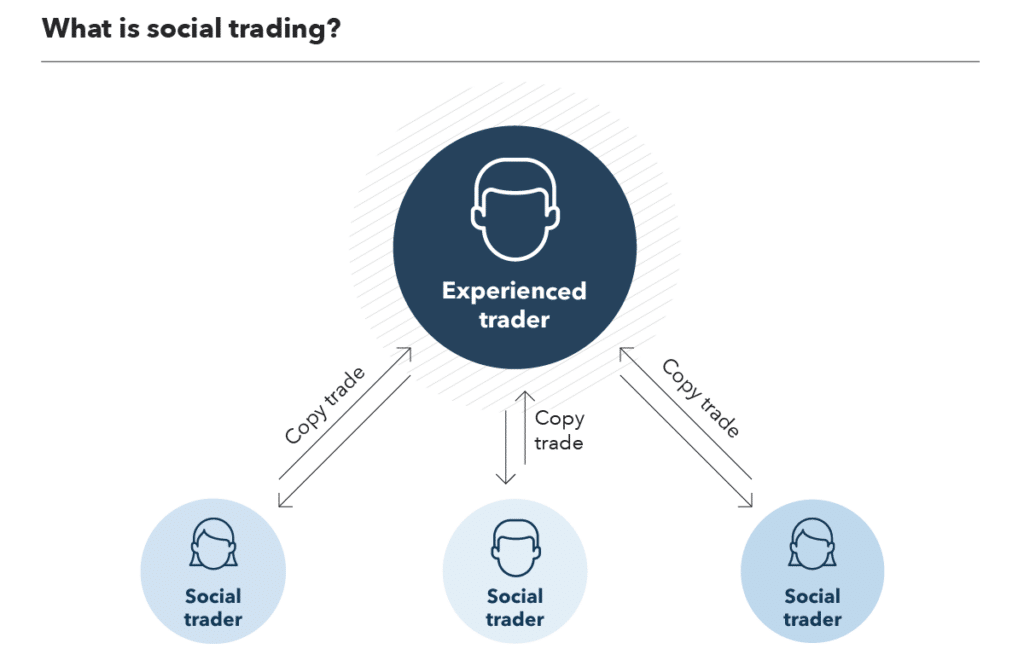

Understanding social trading

Trading can be complicated, especially when one must scan the market for opportunities or, let alone come up with an expert advisor. However, that should never be the case, especially for novice traders who are yet to master the ongoing in the currency market.

Social trading is the latest sensation that is allowing all kinds of would-be investors to invest. It is simply a special type of investing whereby one observes what professionals are doing and copies all their trades.

The tactic requires very little information or resources as one only needs to do what a professional is doing. For instance, if a professional was to open a buy position on EURUSD, a social trader would also open a buy position in their trading account.

Social trading is growing in popularity thanks to the proliferation of platforms that allow traders to interact with one another and share various trading opportunities.