There have been many conversations about so-called Ethereum killers in the last few years. These are projects slated to dethrone Ethereum’s dominant position as the ultimate application-building and smart contract blockchain.

However, they also say if you can’t beat them, join them, and this briefly summarises Polygon, with developers describing it as Ethereum’s internet of blockchains’.

Polygon (previously the Matic Network) is a layer-2 network or scaling solution. Layer-2 simply means a secondary network built on top of an existing blockchain or a layer-1 (in this case, Ethereum).

As with all layer-2 protocols, their main goals are improving processing speeds, transaction costs, and scaling capacity, all qualities which Polygon provides to the second-most valuable blockchain.

Aside from being Ethereum-compatible, Polygon is a standalone platform for developers to build their own dApps (decentralized applications), albeit with lower transaction fees and incredible scalability.

Polygon’s utility token, MATIC, is presently the 17th-most traded in the crypto industry, as per the latest CoinMarketCap rankings. As with virtually all cryptocurrencies, you need an exchange to buy and sell these coins.

Centralized exchanges are the most popular platform for trading digital assets, of which about 86 exist supporting MATIC.

What is a centralized exchange?

A centralized exchange (often shortened to CEX) is a service using external or third-party market makers to facilitate cryptocurrency trading on a dedicated platform. Such organizations use an order book, which is simply a matching engine with a list of buy and sell orders for every cryptocurrency on offer.

We term them as centralized since they retain centralized control on the entire trading process, from sourcing liquidity to keeping user wallet keys (unlike their decentralized counterparts).

While these exchanges are not the best for privacy and cost-conscious traders, they are more accessible, better regulated, more liquid, and user-friendly. When choosing an exchange, users need to consider many factors like trading costs, market selection, wallet provision, and security measures.

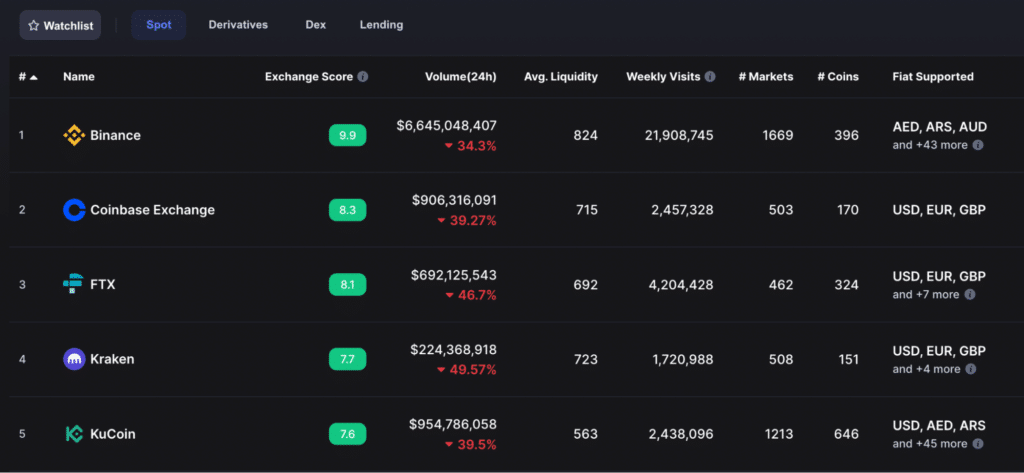

We have ranked the best five exchanges for Polygon based on CoinMarketCap rankings which have sorted them using a more sophisticated approach accounting for web traffic, average liquidity, volume, and confidence.

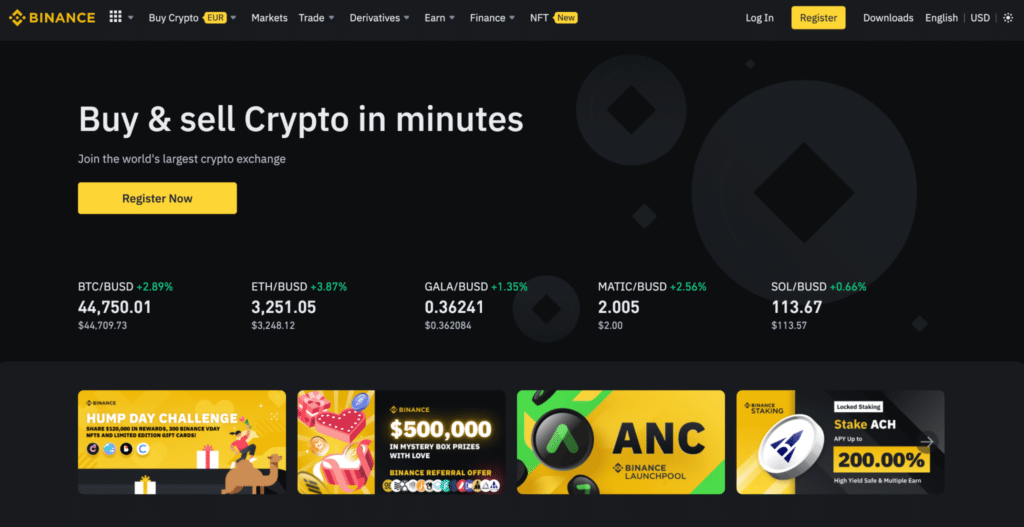

Binance

Binance has remained the largest centralized exchange in trading volume by a country mile, regularly processing several billions of dollars daily. The company was founded in 2017 by the billionaire Chinese-Canadian business executive Changpeng “CZ” Zhao, presently Binance’s CEO.

The exchange’s mission from the get-go has been to become an ecosystem of all things cryptocurrencies.

These include two blockchains, a separate decentralized exchange, a centralized exchange exclusively for US customers, and platforms for derivatives trading, lending, staking, token-launching, NFTs, liquidity farming, etc.

You can trade MATIC against many fiat currencies like USD, AUD, EUR, and GBP. MATIC also forms part of other markets like futures and perpetuals pairs, along with those crypto-related like Bitcoin and Ethereum.

Moreover, you can also store MATIC on the normal Binance CEX or alternative Binance DEX (decentralized exchange)

Coinbase

Coinbase is one of the oldest crypto exchanges (established in 2012), which is particularly prevalent for American customers. However, it’s an internationally-acclaimed brand listed on the NASDAQ stock exchange.

Such is Coinbase dominance that enthusiasts have coined the phenomenon known as the ‘Coinbase Effect,’ which describes how a newly-listed token performs well price-wise after being added on Coinbase.

Despite its popularity, Coinbase’s product offering is relatively stripped-down as it primarily focuses on exchanging crypto-to-crypto and USD/GBP/EUR to crypto.

In the case of MATIC, you can trade this token against the aforementioned fiat currencies, along with Tether (USDT) and Bitcoin (BTC). Coinbase has a hosted wallet (through the exchange) or a self-custody wallet (through Coinbase Wallet) for storing MATIC.

FTX

Polygon is a relatively new addition to FTX as it was listed on the exchange in January 2022, adding to its already comprehensive list of over 300 available cryptocurrencies.

FTX is another popular crypto trading platform founded in May 2019. This exchange is mainly focused on derivatives such as leveraged spot, futures/perpetuals, options, volatility, and even stocks, prediction, and fiat markets.

Moreover, FTX has its own utility token, FTT, providing many perks ranging from reductions on trading fees to staking rewards. With Polygon’s MATIC, you can trade it against USD, BTC, and other interesting markets like perpetual futures. Fortunately, FTX has an in-built hosted wallet to keep your MATIC tokens.

Kraken

Along with Coinbase, Kraken is another trusted, distinguished American-based crypto exchange that surprisingly has its own bank. Kraken was founded in 2011 and is highly recognized across nearly all US states and most parts globally.

MATIC was listed on this exchange in July 2021, forming part of Kraken’s massive selection of about 150 coins. You can trade this token against USD and as a futures market with up to 1:50 leverage. Kraken doesn’t provide a wallet service, unlike the three previously mentioned exchanges.

KuCoin

Founded in 2017, KuCoin is a prominent crypto exchange based out of Seychelles. Akin to Binance, KuCoin is an all-encompassing trading, leveraged derivatives, DeFi (decentralized finance), and NFT platform with a comprehensive line of crypto-related products.

One of KuCoin’s attractive features is KCS, its utility token offering trading cost discounts, daily rewards from the company’s trading fee revenue, and exclusive access to new blockchain projects.

You can trade Polygon as a perpetual swap and a spot market against BTC. Luckily, KuCoin offers a wallet directly on its exchange to store MATIC or allows users to connect to a third-party facility.

Curtain thoughts

While Ethereum is an immensely well-known project, it has been plagued by many burdens, namely unusually high fees, transaction delays, low output, poor user experience, and governance deficiency.

Although Polygon is not the perfect solution, it at least provides a better developer/user experience, greater scalability, and interoperability with Ethereum. Presently, Polygon has partnered with close to 1500 applications (according to Polygon’s website) to form part of its ever-growing ecosystem, including the exchanges we’ve discussed here.