Many cryptocurrency investors and others outside of the crypto industry who have a real interest in investing in it have heard about decentralized finance (DeFi) currencies. DeFi platforms have enabled users to borrow, save, lend, and exchange cryptocurrency without the need for traditional financial market institutions. Because of their popularity, many people consider the top DeFi coins to be a good investment opportunity. There are 225 DeFi projects listed, 50 of which are Polygon-based.

We look at the best 5 polygon DeFi projects applications in this article, and while we think they’re solid investments, we are not offering any professional investing advice. You are solely responsible for your finances if you choose to invest in them.

What is Polygon?

Polygon, formerly known as the Matic Network, is a scaling solution that seeks to give several methods to boost the speed of transactions on blockchain networks while lowering the cost and complexity.

The Polygon platform connects Ethereum-based projects and runs on the Ethereum blockchain. A blockchain project’s flexibility, scalability, and sovereignty may increase with the platform while maintaining the Ethereum blockchain’s security, interoperability, and structural benefits.

MATIC is an Ethereum-based digital currency that is compatible with other ERC-20 tokens. MATIC manages, secures, and pays network transaction fees on the Polygon network.

CelsiusX

Celsius is a DeFi platform that pays interest and lends cryptocurrency. It’s available on the web and as a mobile app for iOS and Android. Financial gatekeepers such as loan officers and banking professionals are not required with this method. Members of Celsius can apply for loans at discounted rates. Others who wish to put their money to work can make a guarantee not to remove the funds, and they will receive interest on their staked deposit.

Celsius has its own loyalty incentive token, the CEL token. It also serves as the primary medium of exchange within the Celsius network. Every week, your earnings are calculated and deposited based on three factors: the interest you earned, your loyalty tier, and the crypto assets you have in your account.

CelPay is a one-of-a-kind feature among loan platforms and cryptocurrency exchanges. It enables users to send crypto payments to friends and family as easily and rapidly as they can with more well-known systems like PayPal.

QiDao Protocol

QiDao is a polygon-based, self-sustaining DeFi system that allows users to borrow stable coins (soft linked to USD) interest-free against their crypto assets. This means you don’t have to sell your assets to utilize their value. It aims to make DeFi accessible to everyone.

Anyone may open a Vault, lock collateral, and generate stablecoins with QiDai. Users can borrow up to 2/3 of the value of their collateral in miTokens. To avoid a partial liquidation penalty, vault owners must maintain collateral to debt ratio of 150 percent or above. This ensures that the protocol is always overcollateralized and healthy.

The protocol’s governance token is Qi. Qi holders vote to manage the system and receive a portion of the Protocol’s revenue.

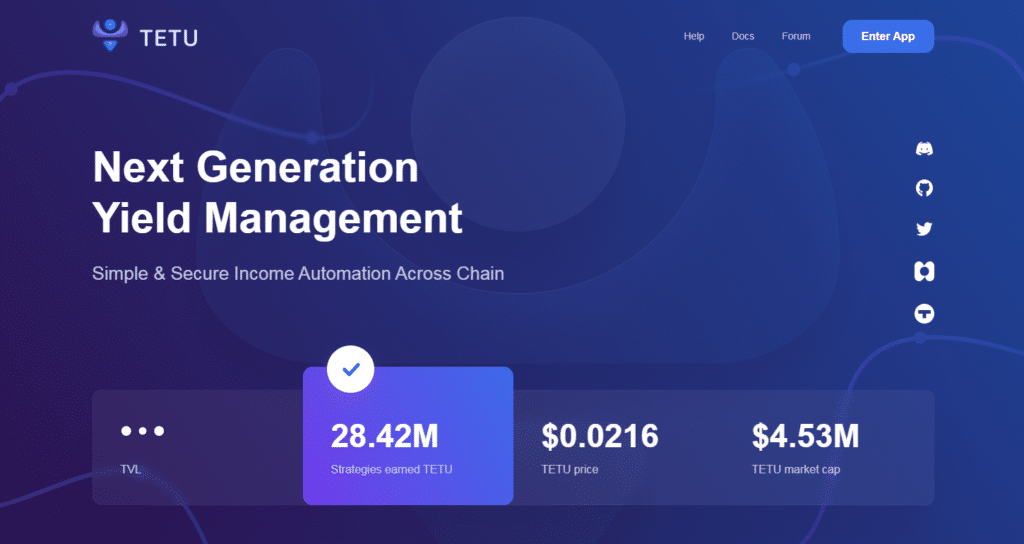

Tetu Finance

TETU is a DeFi application based on Polygon that uses automated yield farming strategies to provide investors with a safe and secure way to earn a significant return on their money. Its core team has extensive experience in the banking business, having built back-end international banking systems and developed leading global payment processing infrastructure.

Yield Farming on the platform can provide you with a high yield. The rewards are dispersed automatically through xTETU, which generates money through Tetu buyback. It has a maximum quantity of 1 billion TETU tokens, which will be minted over the course of four years, with the whole supply expected in August 2025.

The Tetu system is designed to increase the user’s profits. The system’s sophistication allows for more steady returns for volatile assets and larger returns for stable assets, all while concentrating the platform’s returns in the TETU distribution through Profit Share xTETU.

Market.xyz

Market.xyz allows users to earn yield by supplying their cryptocurrencies as collateral to an isolated lending market or pool. There are now four pools, each with its own lending/borrowing market for pool tokens. Anyone who is whitelisted can create a pool without needing authorization.

Market.xyz is based on Rari’s Fuse, although it was built on Polygon and has since evolved into additional L2 solutions, including Arbitrum, Optimism, and Fantom. Rari Fuse is built on the Compound Protocol, and each market may be thought of as its own Compound Pool.

To adequately incentivize borrowers and liquidators, Rari’s Fuse has a minimum borrow limit of 1 ETH on the Ethereum mainnet. Many smaller DeFi players have been priced out as a result of this restriction, as they may not see it as economically viable.

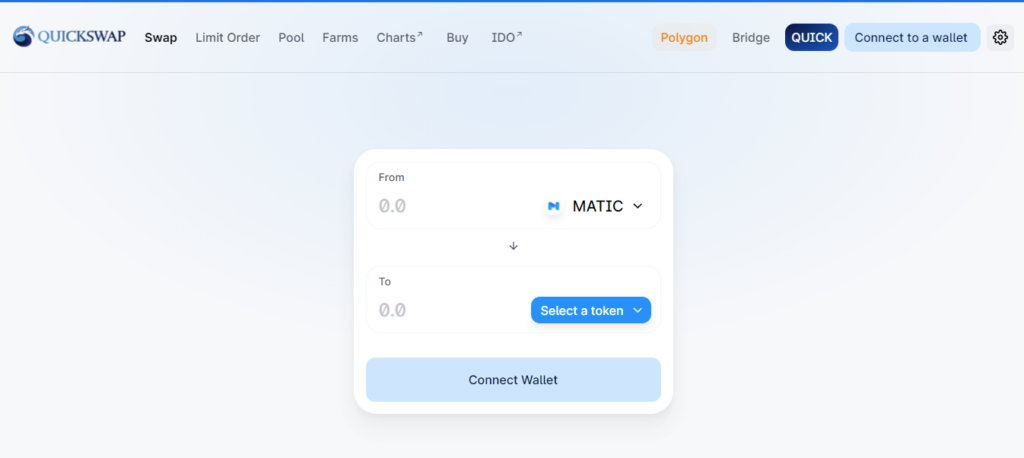

Quickswap

In DeFi, Automated Market Makers (AMMs) like QuickSwap are extremely popular. QuickSwap has gained popularity owing to its speed and inexpensive fees. It’s also Ethereum-compatible, allowing you to swap ERC-20 tokens. However, there is always the possibility of temporary loss.

Its cryptocurrency is called QUICK. It’s simple to purchase and sell on Binance. You can also use QuickSwap’s liquidity pools to exchange other tokens for QUICK. Users can trade any pair with QuickSwap by bridging ERC-20 tokens from Ethereum to Polygon, as long as there is a liquidity pool for it. Anyone with a token pair can start a new liquidity pool and earn transaction fees from other users.

Summary

DeFi protocol uses decentralized networks to turn old financial products into transparent and trustless protocols that operate without the use of middlemen. Polygon is currently best suited to DeFi projects that are already running on Ethereum and would benefit from the lower transaction costs and speed. CelsiusX, QiDao Protocol, Tetu Finance, Market.xyz, and Quickswap are the top five polygon blockchain DeFi projects.