Cryptocurrency prices have done well in the past few years. As a result, the prices of most of them have soared to above $100. Bitcoin has moved from less than $5 a decade ago to over $42,000, while Ethereum has risen to more than $3,000. In this article, we will look at some of the best strategies to trade crypto under $1.

Examples of crypto under $1

Before we identify some of the best strategies to trade cryptocurrencies trading under one dollar, we need to give some examples of these coins. Some of these coins are listed below.

- XRP – Ripple is a cryptocurrency trading at $0.77 and has a total market cap of over $37 billion.

- Dogecoin – DOGE trades at $0.14, making it the second-biggest cryptocurrency trading under a dollar. It has a market cap of over $19 billion. It is a meme coin that has been promoted heavily by Elon Musk.

- Shiba Inu – Shiba Inu is a meme coin that is growing its ecosystem in industries like Decentralized Finance (DeFi), metaverse, and non-fungible tokens (NFTs).

- Theta Fuel (TFUEL) – Theta Fuel is part of Theta’s decentralized video infrastructure platform. The coin is used to reward users of Theta’s ecosystem.

- MIOTA – MIOTA is a leading cryptocurrency that powers the IOTA ecosystem. IOTA is a network that is disrupting the Internet of Things (IoT) industry.

- Basic Attention Token (BAT) – BAT is a cryptocurrency that powers the Brave Browser ecosystem.

Other cryptocurrencies trading under a dollar are Amp, Loopring, XDC Network, Radio Caca, Sapphire, and Velas among others.

It is worth noting that there is simply no problem with cryptocurrencies that are trading under $1. In most cases, it does not mean that a coin trading under a dollar is cheaper than Bitcoin, which is trading at above $40,000.

The pricing normally depends on the initial price that the developers provide and the number of tokens in circulation. For example, while Shiba Inu trades at $0.000025, its market value is over $15 billion because the network has a maximum circulation of 1,000,000,000,000,000.

Therefore, these cryptocurrencies are usually moved by the same forces that affect big coins like Ethereum and Bitcoin. These include monetary policy, network upgrades, new exchange listing, and major news events.

Scalping

One of the most popular trading strategies when focusing on coins under a dollar is known as scalping. Scalping is a day trading strategy where traders focus on extremely short-term moves. In most cases, these scalpers make money by buying or shorting a cryptocurrency and then holding a trade for a few seconds or minutes. Their goal is to make a small profit tens of times per day.

Scalpers are usually mostly focused on chart analysis and don’t care much about fundamentals like news and product launches. As a result, they typically use charts ranging from 1-minute to 5-minutes.

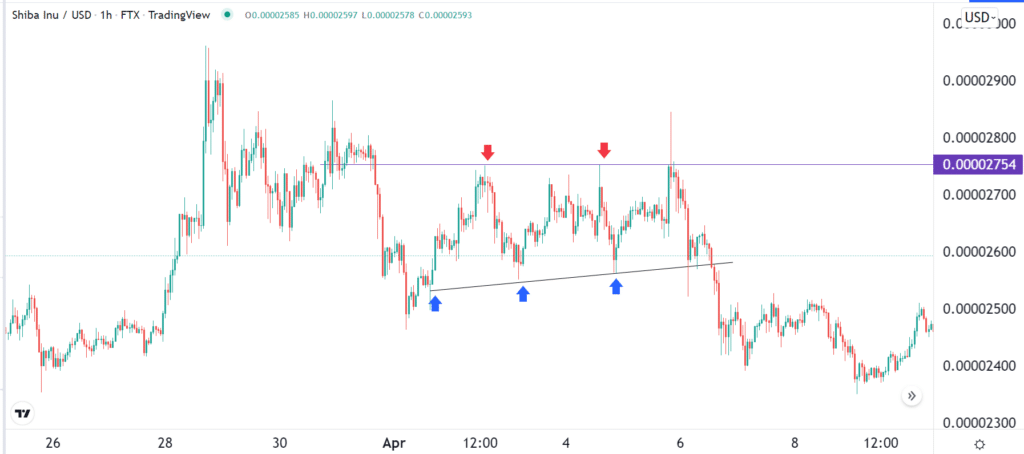

There are several approaches when scalping. First, there is a method that focuses on micro trend-following. This is where a trader identifies a new or existing trend and then executes a trade to follow it. The idea is to follow the trend for a while and then exit before it turns around. A good example of this is shown in the chart below. In it, a trader would have placed a short trade at $0.000027 and then exited it a short period later.

Second, some scalpers use a breakout strategy. The idea is to time when a breakout is about to happen and then ride the wave. A popular strategy is using an indicator like Moving Average or the volume-weighted average price (VWAP). In most cases, a sell trade is triggered when the asset’s price moved slightly below the indicator as shown below.

There are other scalping strategies used by traders, such as chart patterns like triangles and wedges and candlestick patterns like doji, harami, and bullish engulfing patterns.

Cryptocurrency swing trading

Another strategy to trade cryptocurrencies under a dollar is known as swing trading. It differs from scalping in that scalpers focus on longer timeframes. Their idea is to identify a pattern in the market and then ride it for a few days. Typically, these traders hold their positions for two to three days.

A major difference between scalping and swing trading is the chart timeframes that the two use. Scalpers use extremely short timeframes that are less than 5 minutes. Swing traders, on the other hand, use longer timeframes that range between 15 minutes and 1 hour.

Swing traders use the same approaches as scalpers in how they identify entry and exit positions. For example, they use technical indicators like the Donchian Channels, Bollinger Bands, and Keltner Channels to identify trends and ride them until the end.

Further, some use channels to buy and sell cryptocurrencies under a dollar. A good example of this is shown in the chart below.

In this channel, the trader would buy whenever the coin fell to the support level and then exit when it reached the upper side.

Algorithmic trading

Another trading approach for cryptocurrencies under a dollar is algorithmic. This is a method that involves using robots or expert advisors to buy and sell cryptocurrencies when certain conditions are met. While it is possible to build these bots, most people prefer to buy them on the internet. Buying bots is easy, and the process takes a short period to implement.

Before using algorithmic bots in trading, we recommend that you push them through a process of back and forward testing. This is a process where you use historical data to test the bot’s performance. You should also use a demo account to test whether the bot works.

Summary

You can use other strategies to trade cryptocurrencies trading under a dollar. These are channel breakouts, correlations, and dollar-cost averaging (DCA). It is also possible to use copy-trading, where you copy trades from other experienced traders.