BestFXNetworks is a trading algorithm that works with neural networks with no averaging or scalping strategies. The system is said to be the best choice for anyone interested in hands-free trading. So far, it has shown impressive results on FXBlue. But since the grid approach is also part of the trading plan, we are not sure if the performance can be sustained for long.

The developers of this EA have been trading in this market for years. They also research and create expert advisors, utilities, and indicators.

Features

BestFXNetworks is designed to work on the MT4 platform, and since it comes with an easy parameter and built-in magic number, you don’t need to disconnect it during news release. The system works with all brokers, supporting all account types, including micro, ECN, STP, or cent accounts. The devs provide full time support, which they claim to be very helpful and possessive. You can easily install the advisor in a few steps, and no additional actions are needed after it is activated.

How to start trading with BestFXNetworks

The EA’s strategy is dependent on neural networks, which essentially predict how the Forex market behaves. The networks then deduce the data and draw conclusions from it. Lastly, buy/sell orders are generated based on the findings.

If you want to use this robot for your trading purposes, there are three options to choose from. We have the business, standard, and premium packages that cost between $129 and $169. Depending on the pack you purchase, you can trade on 1-3 real and demo accounts. Other features present include a lifelong license, email support, 100% automated trading, and free upgrades.

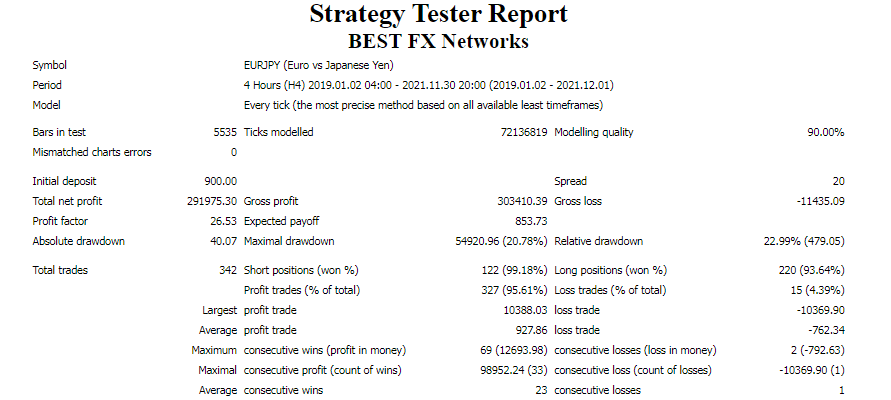

Backtests

We have a strategy tester reporter for the EURJPY currency pair, which was tested on the H4 chart with a deposit of $900. During the 2019-2021 testing period, the system executed 342 orders and obtained an outstanding profitability rate of 95.61%. As a consequence, a profit amount of $291975.30 was realized. The maximum drawdown (20.78%) was within acceptable levels meaning that the strategy present wasn’t that risky. A profit factor of 26.53 was reported.

Verified trading results of BestFXNetworks

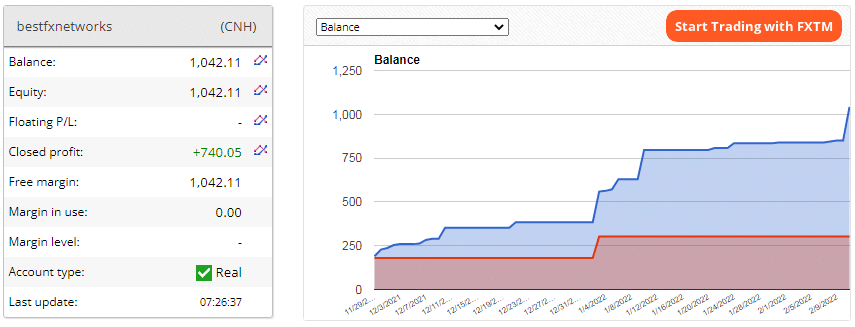

This account was launched in November 2021 and deposited at $302.06. The EA’s trading activities on the account have led to a profit of $740.05 till now. The free margin is $1042.11.

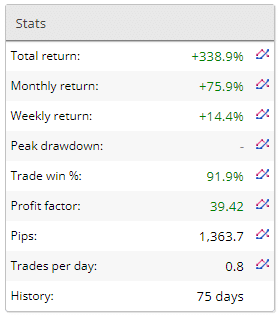

The software has made a total return rate of 338.9% for this account within 75 days of trading. About 0.8 trades are implemented daily, and on average, they make weekly and monthly return rates of 14.4% and 75.9%, respectively. The trades have an impressive win rate—91.9%. We don’t know the kind of risks that are involved in trading because the owner doesn’t share the value of the peak drawdown.

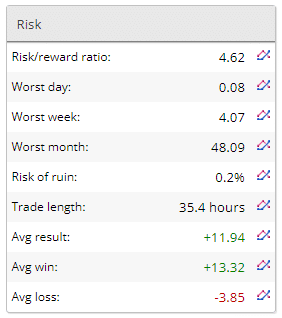

An open position is held for about 35.4 hours, and to date, the recorded average win ($13.32) is higher than the average loss (-$3.85). This suggests that the EA is able to identify profitable opportunities most of the time. A healthy risk/reward ratio (4.62) has been generated; that’s why the account’s risk of ruin is still low—0.2%.

Considerable profit amounts have been attained from various trades made. The EA mainly relies on the grid strategy to make profit.

Customer reviews

As we searched for customer reviews for this robot on the web, we discovered that the company has an active page on FPA, but with zero reviews. It is possible that traders have not ordered the system yet.

Is BestFXNetworks a viable option?

Advantages

- Backtest results and verified live trading stats are available

- Supports all account types

Disadvantages

- Zero customer reviews

- Inadequate vendor transparency

- The grid approach is present

Wrapping up

The devs showcase the robot’s performance, which can help traders to know how it works before purchasing it. Unfortunately, the grid strategy is used in trading. Furthermore, the lack of user feedback makes it difficult to establish if customers can obtain the same impressive results shown on FXBlue.