Blazing Night Scalper uses a scaping approach to trade the markets on multiple currency pairs. The algorithm does not use martingale and grid methodologies and has a stop loss and take profit attached with each trade. Let us go through the product to find its pros and cons and see if traders can get good profits with the system.

Features

The robot has the following features:

- It can trade on multiple currency pairs: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPUSD, NZDUSD, USDCAD, USDCHF, and USDJPY

- There is no implementation of risky martingale and grid strategies

- Traders only have to attach it on a single chart to trade multiple pairs

- The robot trades best on low spread conditions

- It has a fixed exit point for each trade

- It scalps during the nighttime between the US and Tokyo sessions.

- The developer claims that the trader should trade with 0.05 lots for every $1000 to keep the risk at bay

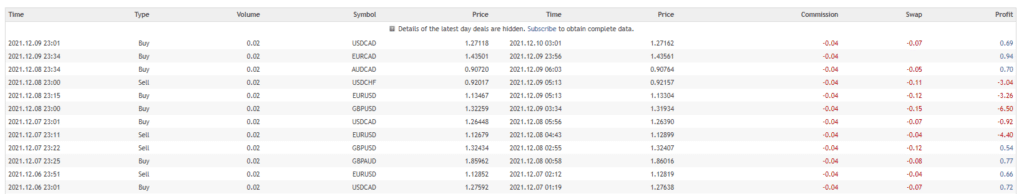

We can observe the poor profit factor from the history of MQL 5 live records. The robot closes out trades when they reach a significant drawdown.

How to start trading with Blazing Night Scalper

To get the service up and running, you the following steps:

- Purchase the system from the developer on the MQL 5 marketplace

- Place it on your charts by dragging it

- Enable the auto trading button

Price

The EA is available for an asking price of $299. Traders have the option to rent it for one month at $149. There is no money-back guarantee.

Verified trading results of Blazing Night Scalper

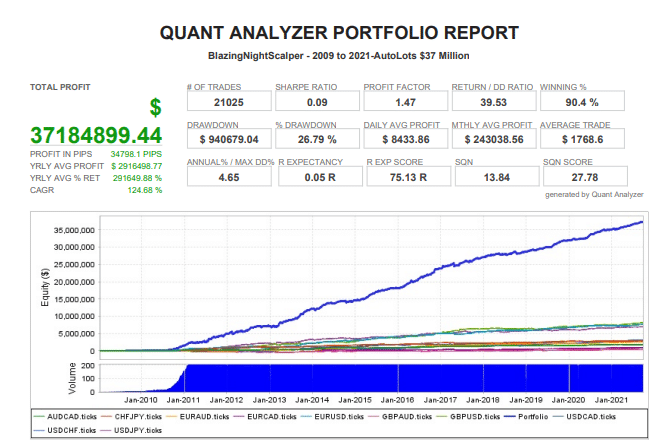

Backtesting results are available in the form of a quant analyzer report. The algorithm bags in $37184899.11 in a total of 21025 trades with a profit factor of 1.47. The winning rate stood at 90.4%, with an annual maximum drawdown of 4.65%. The average winning trade was $6080.52, while the loss was -$38821.88.

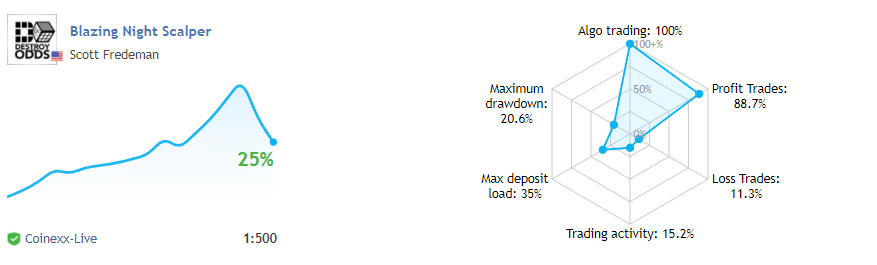

There is a live trading account for this FX system on MQL5. It generates a monthly gain of around 6%, with a drawdown of 20.6%. With a high value of drawdown in regards to the monthly gain, we can deduce that a few losses can be detrimental.

The winning rate stood at 88.7%, with a profit factor of 1.31. The best trade was $1.74, while the worst was -$8.49 in a total of 238 trades.

Average drawdown

The current drawdown of the system is average but can increase in the future due to a high stop loss. This can potentially lead to a margin call if the account is left unchecked or improper lot size is used.

Vendor transparency

Scott Fredeman is the author of the product. He resides in the United States and has a 5 star rating for 83 feedbacks. There are a total of algorithms published by him in the marketplace. According to MQL 5, he has a total experience of 4 years. Unfortunately, there are no statements or certificates that could verify the developer’s background.

Is Blazing Night Scalper a viable option?

The robot has the following benefits and demerits.

Advantages

- Detailed backtesting records

Disadvantage

- High losses and small profits

- Live records are for a short duration

- A bit expensive

Conclusion

Blazing Night Scalper can cause a high drawdown on the account due to a poor risk-reward ratio on trades. It requires a high win rate to stay profitable. A single loss can wipe out all the little gains made by the EA.