Breaking Equity is an online trading platform that offers advanced features, educational resources, and regulated security. It provides traders of all levels the ability to optimize their investment returns with powerful automation tools, technical indicators, backtesting, and a customizable user interface. In this review, we will explore the benefits of using Breaking Equity, provide a step-by-step guide to setting up an account, and discuss how to manage your investments and cash on the platform. We will also cover the pros and cons and offer an overall rating of Breaking Equity.

Features

Breaking Equity offers a variety of features that make it a competitive online trading platform. Here are some of the key features:

- Advanced Trading Features: Breaking Equity provides advanced trading features, such as algorithmic trading, technical indicators, and a customizable user interface that allows traders to analyze trends and optimize their investment returns.

- Demo Accounts: Traders can use demo accounts to practice their skills without risking real money. It’s a great way for beginners to get familiar with the platform and learn trading strategies.

- Educational Resources: Breaking Equity offers educational resources, including articles, videos, and webinars, to help traders improve their skills and stay up-to-date with market trends.

- Regulated Security: The platform is regulated by the Financial Conduct Authority (FCA) in the UK, which ensures compliance with strict rules and regulations to protect investors. Customer funds are also kept in segregated bank accounts for added security.

- Wide Range of Assets: Breaking Equity offers a broad range of assets for trading, including stocks, ETFs, forex, indices, and commodities.

- Customer Support: Breaking Equity provides customer support via live chat and email to help traders with questions or concerns they may have regarding their investments on the platform.

Overall, Breaking Equity’s combination of advanced trading features, educational resources, and regulated security makes it a well-rounded trading platform for traders of all levels.

Setting Up an Account on Breaking Equity Platform

Setting up an account on Breaking Equity is a straightforward process that can be completed in a few steps:

Creating an Account

- Visit the Breaking Equity website and click on the “Sign Up” button.

- Fill in the registration form with your personal information, including your name, email address, and phone number.

- Create a username and password.

Account Verification

- After creating your account, you’ll need to verify your identity by uploading a copy of your ID or passport and a proof of address document.

- Wait for the platform to verify your account before proceeding.

Adding Funds to Your Account

- Once your account has been verified, log in to your account and click on the “Deposit” button.

- Choose the deposit method that works best for you, such as bank transfer, debit card, or credit card.

- Follow the prompts to complete the deposit process.

Choosing an Account Type

- Breaking Equity offers two account types: Standard and Premium.

- The Standard account has a minimum deposit of £500 and offers a commission fee of 0.5% per trade.

- The Premium account has a minimum deposit of £10,000 and offers a commission fee of 0.4% per trade.

- Choose the account type that meets your needs.

Once you have set up your account and added funds, you’re ready to start trading on the Breaking Equity platform.

Trading on Breaking Equity Platform

Trading on the Breaking Equity platform involves the following steps:

Analyzing Market Trends

- Log in to your account and navigate to the trading dashboard.

- Select an asset you’re interested in trading, such as stocks, forex, indices, or commodities.

- Use the technical indicators and charting tools available on the platform to analyze market trends and identify potential trading opportunities.

Executing Trades

- Once you’ve identified a potential trade, click on the “Buy” or “Sell” button on the trading dashboard.

- Enter the quantity of the asset you want to trade and set your stop loss and take profit levels.

- Review and confirm the details of the trade before submitting it.

Managing Your Portfolio

- Keep track of your open positions, gains, and losses on the trading dashboard.

- Monitor the market and adjust your trades if necessary, based on changing market conditions.

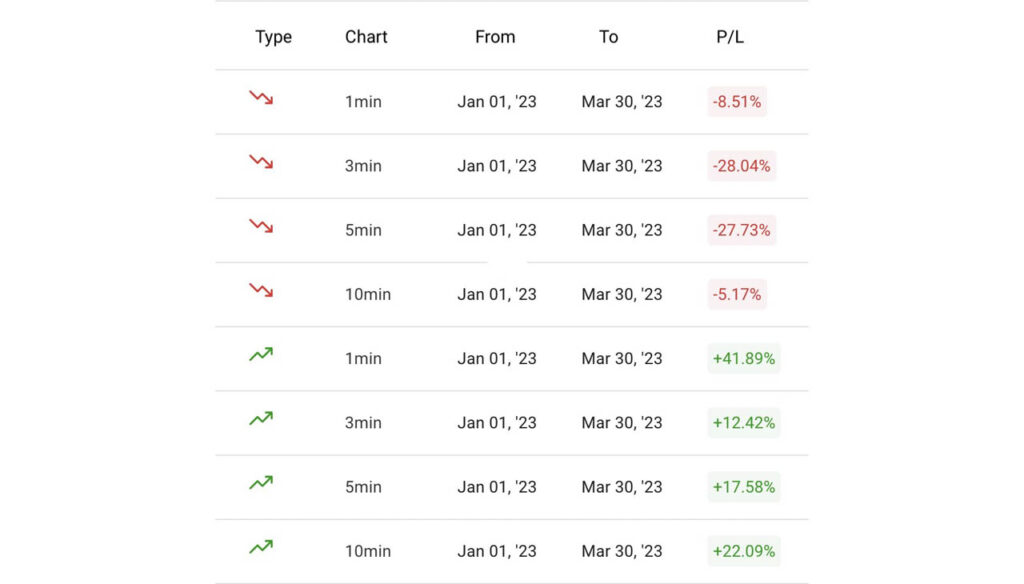

- Use the backtesting and automation features provided by Breaking Equity to optimize your investment returns.

Withdrawing Funds

- If you want to withdraw funds, log in to your account and click on the “Withdraw” button.

- Choose your preferred withdrawal method, such as bank transfer, debit card, or credit card.

- Wait for the platform to process your withdrawal request.

It’s important to note that trading on the Breaking Equity platform involves risk, and traders should carefully consider their investment objectives and risk tolerance before placing trades.

Advantages:

- Offers a wide range of assets to trade

- Easy registration process

- Two account options with different levels of commissions

- Advanced technical analysis tools and charting features

- Automation and backtesting features

Disadvantages:

- High minimum deposit amount for the Premium account

- Relatively high commission fees compared to other platforms

Summary

Breaking Equity is a reliable and secure online trading platform for traders of all levels. It provides an array of advanced trading tools, educational resources, and customer support options to help traders make informed decisions about their investments. Setting up an account on the platform is simple. Trading involves analyzing market trends, executing trades, managing your portfolio, and withdrawing funds when necessary. It’s important to keep in mind that trading involves risk, and traders should always assess their risk tolerance before engaging in any trading activities.

Review

- Reliability: 10

- Security: 10

- Range of Assets Offered: 8

- Technical Analysis Tools and Charting Features: 8

- Automation and Backtesting Features: 7