When weighing the risk in the forex market, investors may often find themselves inquiring where and how they should park their money in order to earn a return in accordance with their risk appetites. Flag Patterns are an excellent tool that allows the investors to analyze their risk, enabling them to gauge when to enter and exit a trade.

What are flag patterns in forex?

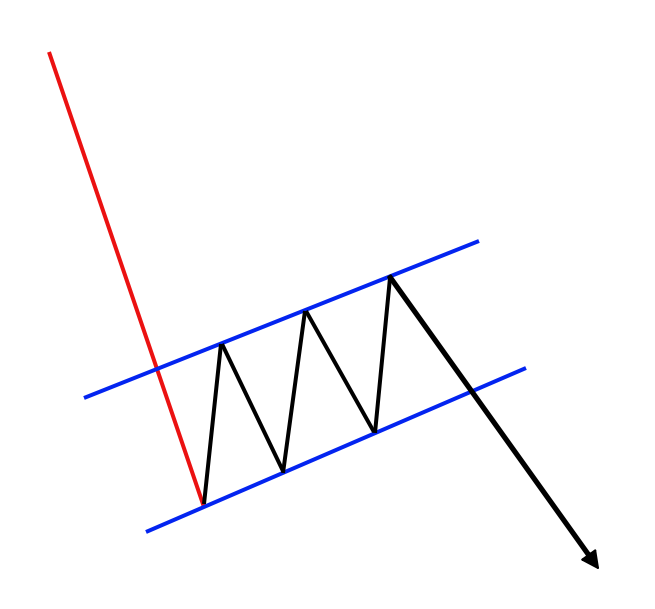

In technical analysis, a flag pattern is a value design that, in a more limited time period, moves counter to the overall cost pattern seen in a more extended time span on a price chart. Flag Patterns are utilized to recognize the conceivable continuation of a past pattern from a point where cost has floated against that equivalent pattern. Should the pattern continue, the cost increment could be quick, making the circumstance of an exchange beneficial by seeing the banner theme.

Structure of a flag

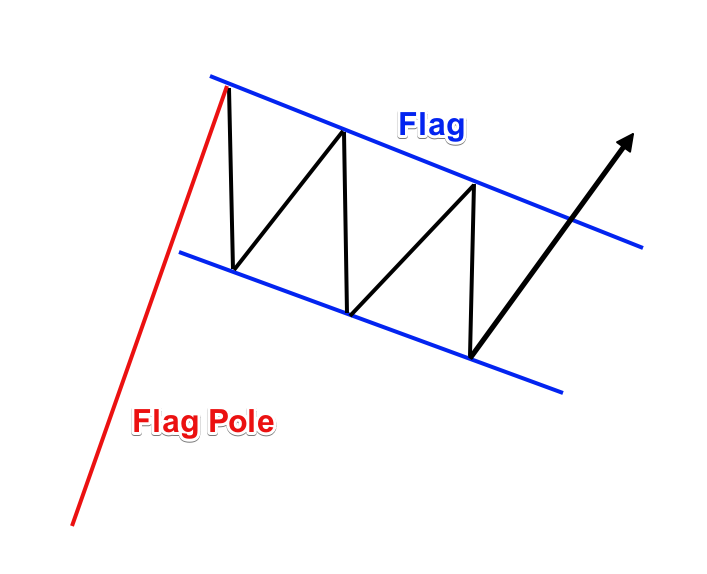

A typical flag pattern will include the following components:

- The flag pole. This element represents a trend impulse on the chart. Every trending move could transition into a Flag, which brings us to the statement that every trend impulse could appear to be a flagpole.

- The actual flag. It comprises price activity with equitably conveyed tops and bottoms. Simultaneously, this price activity has a restorative character on the chart.

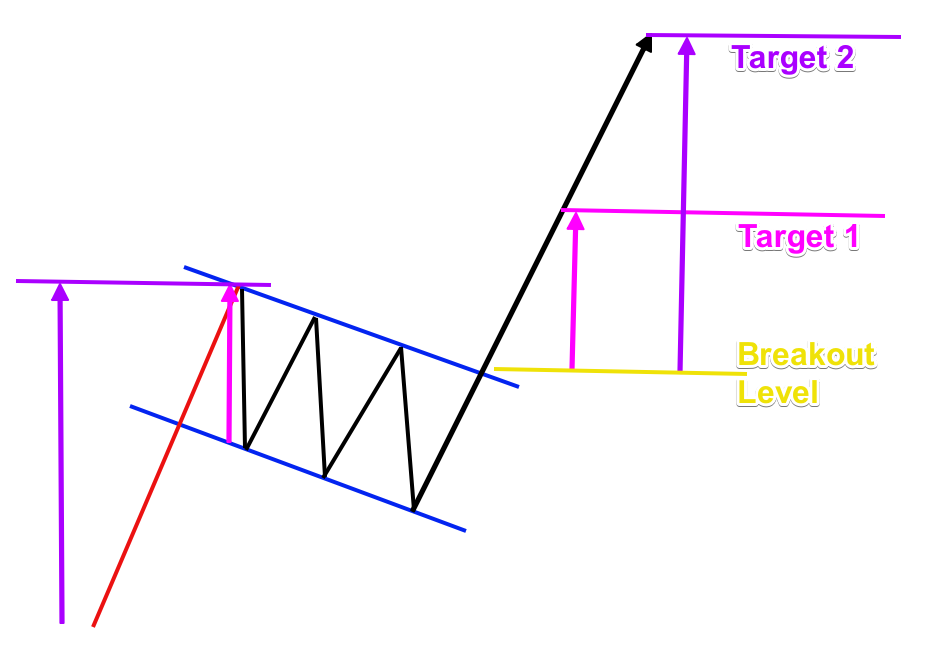

- Target 1 (Size of the Flag). The measured move target is a distance equivalent to the size of the flag. To gauge the size of the flag, you would simply take the vertical separation between the upper and the lower channel inside the flag.

- Target 2(Size of the Pole). It is the vertical distance between the high and the low of a pole.

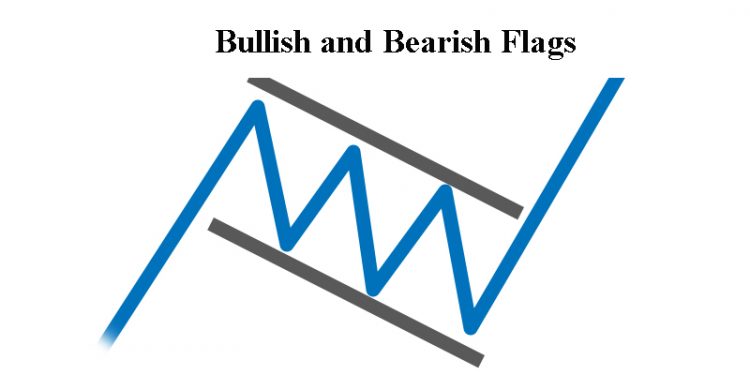

Based on the shape and inclination of a flag, there are two types of flag patterns possible: bearish and bullish.

Bullish Flags

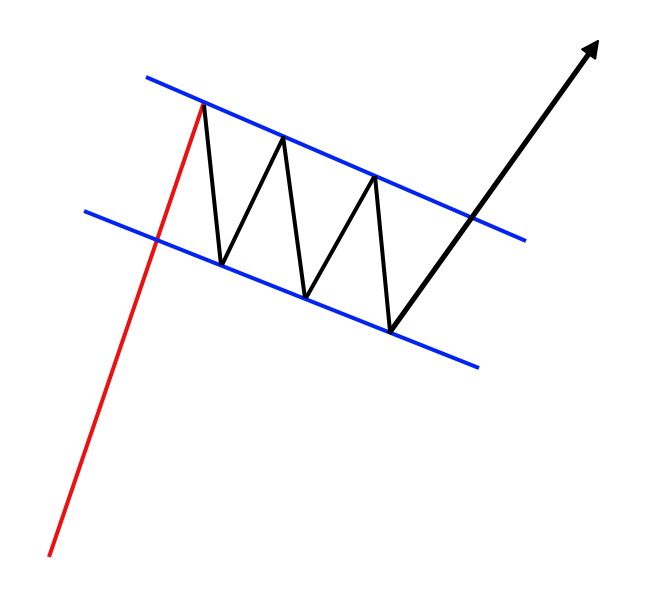

Bullish Flags are developments that happen when the slope of the channel interfacing highs and lows of uniting costs after a huge climb is equal and declining. The pattern before the flag must be upward. The pattern starts with a bullish trending move, which by then stops and changes into a minor bearish adjustment. The tops and the lower part of this remedy are equal also.

Bearish Flags

Bearish Flags are courses of action that happen when the incline of the channel interfacing highs and lows of merging costs after a huge descend is equal and rising. The pattern before the flag must be down. They are formed during bearish trends. The figure begins with a bearish pattern impulse and transforms into a rectification, which is coordinated upwards. During the correction stage, the tops and the bottoms are equitably appropriated, making an equal-parallel channel.

The affirmation of the Bear Flag setup comes when the value activity breaks the flag channel limit downwards. Exactly when the breakout happens, we have the occasion to short the cash pair. The bullish Flag pattern starts with a bullish Flag Pole, which turns into a bearish correction. Upon a breakout of the upper channel line, we hope to see a continuation of the predominant bullish trend.

How To Use Them?

Flags can be used to interpret tremendous breaks in cost. On the off chance that the value gets through the flag to the drawback, there might be a huge descent. Additionally, if the cost gets past the flag to the potential gain, there might be a huge climb. You may use these to help perceive patterns or to affirm a Gartley or butterfly design.

Now that you are familiarized with what Bullish and Bearish Flags are, you can now zero in on building procedures for trading with the flag setup. To enter a flag pattern exchange or trade, one should initially accomplish an affirmation signal. The affirmation of the Flag accompanies the breakout. In the event that you have a bullish flag, you will purchase the Forex pair when the cost activity shuts a flame over the upper side. On the off chance that you have a bearish flag, you would sell the pair when you see the light shutting underneath the lower level of the pattern at that point.

Once an investor has entered the trade, they should always minimize losses by setting up a stop-loss order that protects the trade against any unexpected price movements. In case the value penetrates the contrary side of the breakout, at that point, you ought to promptly leave the exchange on the grounds that the example is, in all probability, bogus. The most legitimate area to put the stop loss would be past the most extraordinary swing inside the Flag structure. The profits, on the other hand, can be made at target points, while keeping a close watch on the flag trend.

Final Thoughts

Flags infer that the market can’t conclude whether to separate or down. When the flag is broken by the value, there might be a considerable move toward the break. Bull and bear flag patterns are value designs that happen every now and again across different time periods in monetary business sectors. These patterns are viewed as continuation patterns in technical analysis terms, as they have a propensity for happening before the pattern which went before their arrangement proceeds. These patterns can help determine when a trader should enter and exit the trade, set a stop loss, and earn profits on the set target points if these patterns are well analyzed.