Grid trading is a common strategy in the crypto world for people who wish to automate their entire trading activity. The short-term speculation strategy is easy to automate and known to generate excellent profits while taking advantage of short-term momentum.

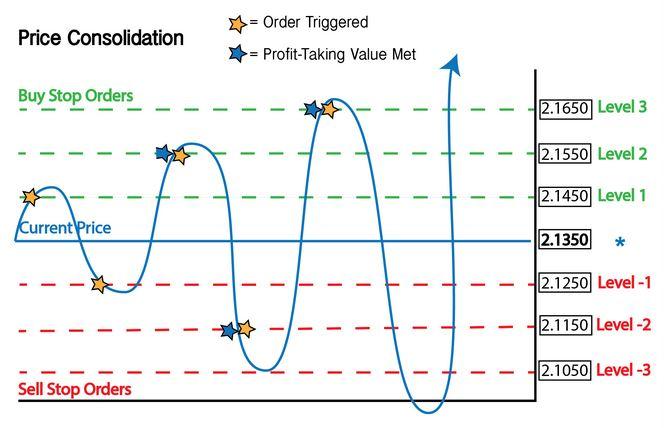

Ideally, it works well with ranges and not trending markets as it involves buying low and selling high. As long as the cryptocurrency oscillates within the predetermined range, it becomes easier to trigger the buy and sell orders and lock in profits.

The strategy works by first ascertaining the upper and lower limits where an automated system will trigger buy and sell orders. Using bots makes it easy to execute and lock in profits without tracking price movements throughout the trading period.

In addition, it allows traders to lock in profits whenever the market is not showing any clear trend. When prices are moving sideways, it becomes easier to trigger both buy and sell orders and lock in profits. The idea, in this case, is to buy low and sell high.

How it works

The strategy works by first defining the grid, which is essentially the range in which price is expected to oscillate. The range must be defined within short-term charts such as minute and hourly for the best outcomes. In most cases, it is performed within the 1 minute 5 minute and 15-minute charts.

In the chart above, it is clear that Bitcoin is extremely volatile in the 5-minute chart, fluctuating between $60,200 and $61,400. A trader looking to profit from the grid strategy would set the lower limit at the $60,100 level to trigger a buy order as soon as the price corrects lower. In addition, he would set the limit at $60,600 to trigger a buy order as soon as the price threatens to break but fails.

With the help of a trading bot, the entire opening and closing of the buy and sell orders at the upper-lower limit would be automated. Consequently, the trading bot would trigger multiple buy orders as soon as the price rises to the upper range and multiple sell orders when the price drops to the lower limit.

Where to place buy orders

- $60,200

- $60,300

- $60,400

- $60,500

Where to place sell orders

- $61,400

- $61,300

- $61,200

- $61,100

Consequently, the trading bot would open buy orders when the price tanks to the lower limit and start retracing up. It will also trigger four sell orders when the price bounces off the upper limit and starts edging lower.

Grid trading parameters

While using this strategy, it is important to keep in mind some parameters for the best outcomes:

Take profit: Given that the crypto is expected to bounce back after plunging to the lower limit or pull back after rallying to the upper limit, the take profit must be set to lock in profits. In the case of a buy order, a take-profit order would be set at the upper limit as the price is expected to get rejected and move lower. Likewise, in the case of a sell order, a take-profit order would be set at the lower limit to lock in profits on price tanking.

Stop-loss: A stop-loss order is part of the risk management play for the grid strategy. Once a sell order is triggered on the upper limit of the grid, a sell order should be placed a few pips above the upper limit. The order will protect against losses accumulating on price edging higher instead of lower as part of the grid strategy. Similarly, the stop-loss order could be placed a few pips below the lower limit while opening a buy order; it will protect against losses accumulating on continuing to edge lower instead of up as part of the grid strategy.

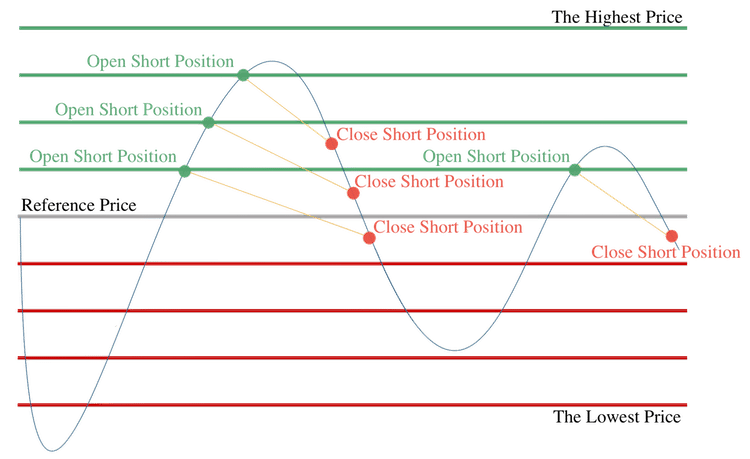

Upper limit: This is the utmost level at which a trading bot will eye sell orders to try and sell the market high. While defining the upper limit, it is important to define the highest level on which buy orders should not be opened as above the level price is likely to continue moving up.

Down limit: This is the level at which the trading bot starts eyeing buy opportunities to try and buy the market low. Likewise, it is important to define the lowest level at which the bot should not trigger any buy positions as it signals price is likely to continue edging lower.

The best time for grid trading

Grid trading works best when there are tiny fluctuations in the cryptocurrency market. Given the volatile nature of the market, it would be essential to focus on markets that fluctuate between 2 and 3% to avoid being caught on a breakout to the upside or downside once an order is triggered.

As long as the cryptocurrency trades between the well-defined grid’s upper and lower limits, opening and closing short and long positions becomes much easier. Consequently, the strategy will work best when the crypto markets are moving sideways on a well-defined range rather than trending.

In addition, grid trading would produce the best results whenever trades are triggered toward the long-term trend. For instance, buy orders are likely to generate significant profits if the underlying trend was bullish before the market corrected and started moving sideways. Likewise, short positions are likely to generate significant profits if the underlying trend is bearish. The prospect of the market edging lower after the consolidation is usually high.

Bottom line

Grid trading is a unique strategy that makes it easy to automate the entire trading process through the use of bots. It entails defining upper and lower limits on which several orders are opened to take advantage of the market moving sideways. The short-term strategy seeks to take advantage of the fluctuations that take place in short-term charts such as 5-minute and 15-minute charts.