Darwin Evolution is designed to mimic manual trading. As per the author, Guillaume Duportal, the approach, and design aim at making the ATS efficiently handle your account with minimal risk. He maintains that it is not a fast-scalping system. Guillaume Duportal is from the United Arab Emirates. He has 3 years of experience in developing FX tools. He has two products and 21 signals to his credit. For support, the only method available is the direct messaging feature on the MQL5 site.

Features

The significant features of this FX robot that give it an edge over its competitors are:

- The MT4/5 tool has 8 or more indicators and filters

- It can work on the 28 currency pairs simultaneously

- Optimization is not necessary as the software comes with set files

- The ATS can work in both directions, impulse, and correction

- Indicators and options include trailing SL, indicator closure by hour/profit/SL/opening duration, and more

- A news filter with the facility to disconnect before and after a news event, and independent hours for FOMC, BCE, Fed, and other such news

- Many protective features are added for safeguarding the capital, currency, percentage, etc.

How to start trading with Darwin Evolution

To purchase this FX robot, you have to pay $999. As per the developer, the price is reduced for promotion and its original price is $1490. A rental package costing $690 is also present. The developer does not provide info on the features included with the package. We could not find a refund policy for the package which makes us doubt its reliability.

Recommendations for using this EA include the use of the M1 timeframe on the EURUSD pair. The developer provides 2 set files with all features present. He recommends 5% lot and risk but states that 0.01 lot size can be used initially to understand the working method before increasing the risk. For broker recommendation, any broker that allows positions in both directions is recommended. The leverage starts from 1:30 and the minimum capital is $200.

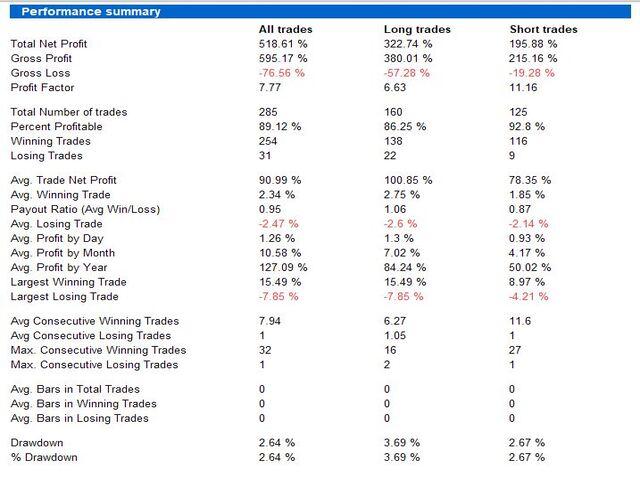

Backtests

According to the developer, the strategy used cannot be backtested as the MT5 format does not give actual ticks and also since the EA uses two approaches, the MT5 terminal cannot test the two strategies simultaneously. A past performance summary for the ATS is provided by the author. Here is a screenshot of the performance results:

From the above report, we can see the EA had generated a total net profit of 518.61% for a total of 285 trades. The profitability was 89.15% and the profit factor was 7.77. A drawdown of 2.64% was present. From the results, we can see that the performance is good and the risk is very low as claimed by the developer.

Live trading results of Darwin Evolution

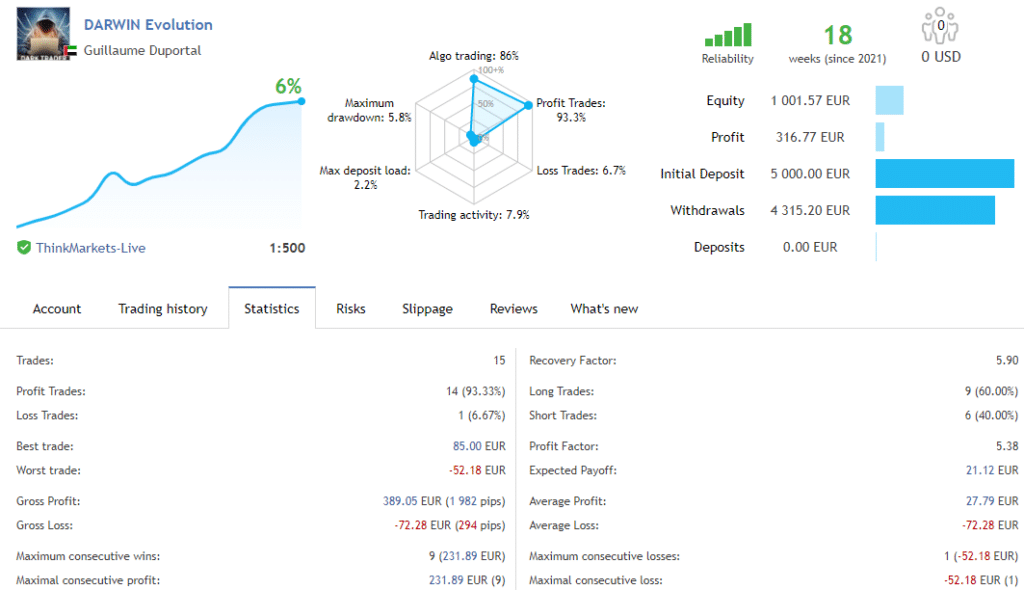

A live signal showing 6.47% growth is present on the MQL5 site for this FX robot. Here is a screenshot of the trading stats:

From the above data, we can see the EUR account started in September 2021 with a deposit of 5000 EUR has generated a profit of 316.77 EUR. A drawdown of 5.8% is present and the profitability is 93.3%. The profit factor is 5.38 and monthly growth of 0.28% is seen. While the drawdown is low indicating a low-risk strategy, the trading frequency is very low at 15 trades for 18 weeks. Only 12 days were used for trading. The low trading activity may be the reason for the low growth percent. When compared to the backtesting report, it is clear that the profits are higher and drawdown is lower in the backtests.

Customer feedback

Unfortunately, we could not find user reviews for this FX EA on reputed review sites like FPA, Trustpilot, etc. We do not consider the reviews present on the MQL5 site as they may be manipulated.

Is Darwin Evolution a viable option?

After assessing the various aspects of this ATS, we found the following advantages and disadvantages that affect the viability of the system.

Advantages

- It is a fully automated software

- Low risk in real trading and backtests

Disadvantages

- The strategies used are not explained

- Price is expensive

- No refund policy

Conclusion

Darwin Evolution uses a scalping approach along with indicators and filters for achieving high returns. The developer provides backtesting stats and real trading data to prove the efficacy of the system. From the low drawdown, it is clear that the EA uses reduced risk. But we found some drawbacks like the expensive pricing, the lack of refund, and the absence of user feedback.