DDMarkets offers trades for forex and the crypto markets. There are different packages available such as swing and day trading, which traders can choose according to their liking. The company tracks the performance of all the trades through their website, which can be reviewed to analyze the performance. We will highlight all the essential points of the signal provider below.

Features

The signal provider has the following features:

- They have multiple plans from which traders can choose

- They offer signals for forex as well as crypto markets

- Traders can see the output of the signals through the website

- It comes with various payment options

Strategy

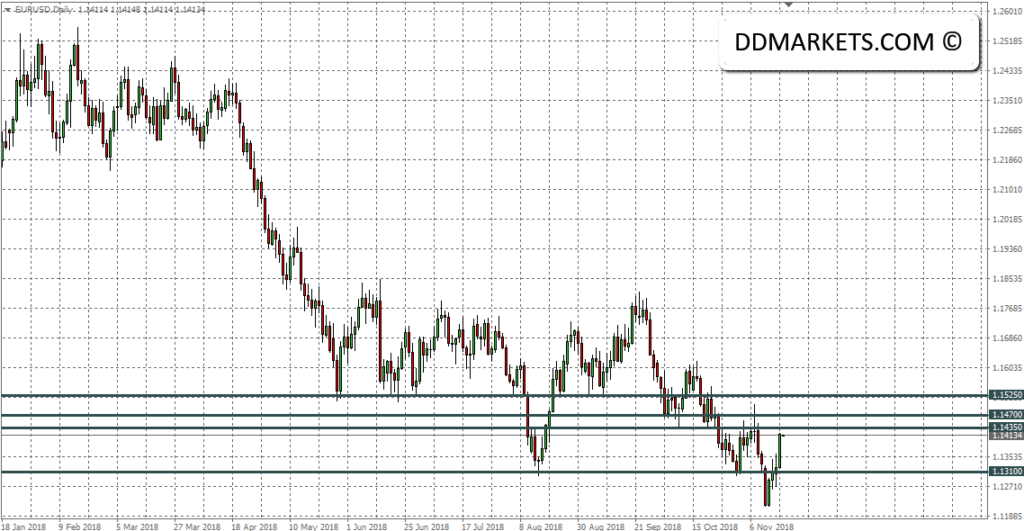

The providers are not fully open about the strategy they are using to trade the markets. They do mention that they use a single-stop loss and take profit for all their positions. Diving deep into the website into the past trade section, we could see that the developer is implementing fundamental and technical analysis to send out trades. They promise to try and trade with a risk-reward ratio of 1:3. There are the only support and resistance lines on the chart. The number of open trades is limited at each time to avoid risking the account. Depending on the situation, trades can be swing or intraday.

How to start trading with DDMarkets?

The company will send out trades to the email id of the trader. Investors will then have to copy it to the platform and set the proper stop loss, and take profit. Traders will have to be vigilant to close out the traders when required.

There is no information on the recommended balance, leverage, and broker type traders can use, guaranteeing the best outcome.

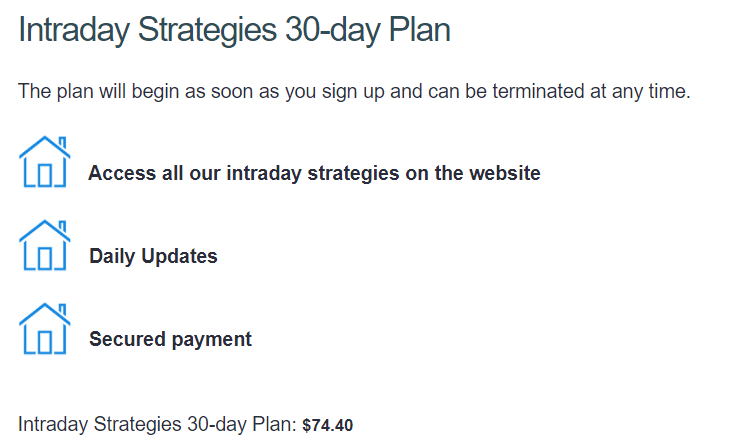

There are multiple packages to choose from for 14, 30, and 90 days. The intraday 14-day plan will cost you $49.70, while the 30 day requires $74.40.

Backtests

There are no backtesting results available. Although this is a signals service, it is possible to use forex simulators for testing out the strategy on historical data. The company has been around since 2014, and it should have presented this form of testing.

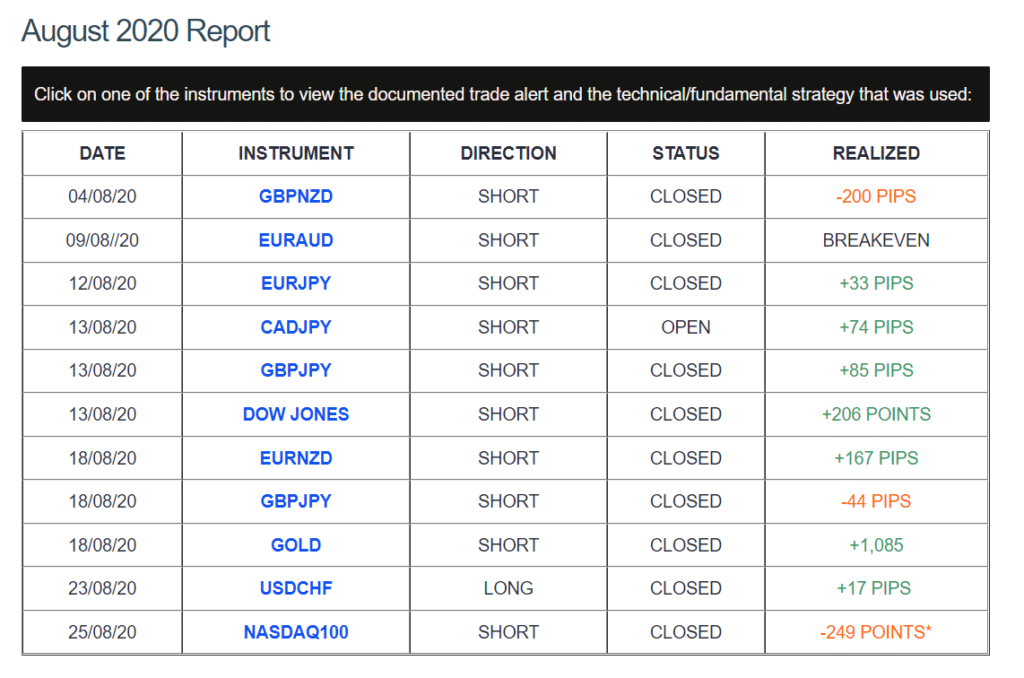

Verified trading results of DDMarkets

The company presents its records manually on the website. They share the output at the end of each on the website. It is quite easy to manipulate such records forms; therefore, we can not accept this form of performance. They can turn the losers into winners to attract new traders. Lack of verified records through performance tracking website is a poor omen for the system.

Vendor transparency

The company is not transparent about the background and the location of the signal providers. We do not know if pure novice traders or professionals hand out the trades. They only state that they have been in the markets since 2014 but provide no proof of such a record.

Is DDMarkets a viable option?

DDMarkets does not provide a verified track record of its results. There should be performance tracking through Myfxbook or FXBlue so that we could analyze the results in one go. It is quite easy to manipulate results that are recorded manually.

Advantages

- There are multiple packages to choose from

Disadvantages

- It does not present verified track records

- There is no transparency on the developers

- There are no recommendations available on the minimum deposit, leverage and broker

Conclusion

DDMarkets is not a reliable investment for any trader as there is much lack of transparency. Many companies are handing out trades online but do not track their performance as they are bent on scamming new traders. Traders should stay away from the company if they value their investment.