DSC Price Action has a truly short presentation that explains almost nothing to us. The system was released about a year ago – June 11, 2020. The last V1.7 was released on June 8, 2021. The system was demo downloaded over 500 times.

Features

The robot has just several lines of features. Many descriptions we predicted:

- The robot is an automatic trading system that places and closes orders for us.

- There are “still” only ten copies left for $499 which is an insane price. The next price will be twice more insane – $999.

- The developer mentioned that we have run backtests “correctly.” It’s nonsense. How is it possible to run them incorrectly?

- The robot opens orders based on the Price Action strategy. The support strategy is Hedge.

- Hedging during trading Price Action is such a risky decision.

- The robot works with a EURUSD currency pair.

- The time frame is M5.

- Our broker must allow us to trade Hedge.

- Our experience tells that it’s a wrong decision especially knowing how quickly Hedge with Martingale accounts burn.

- The robot works with a high accuracy rate.

- It requires high leverage to be even more profitable.

- We have to type “diogo.cansi” in the settings. It’s ridiculous that we have to do something in addition after paying that price.

- The developer provides us with referral links.

- The promoted brokers are XM and IC Markets.

- We trade through IC Markets on our accounts.

- “To release the correct features of the Expert, open an affiliate account and contact us by email.”

- It’s a weird statement.

- The support is provided via email or WhatsApp.

How to start trading with DSC Price Action

We have to run a real or demo account. We have to pay for an advisor and download it afterward. It should be set on proper charts and time frames.

The advisor is available for $499 for a real account license. The offer is overpriced. We have a single rental option for $99. We can download a demo copy to check it up and execute some tests as well.

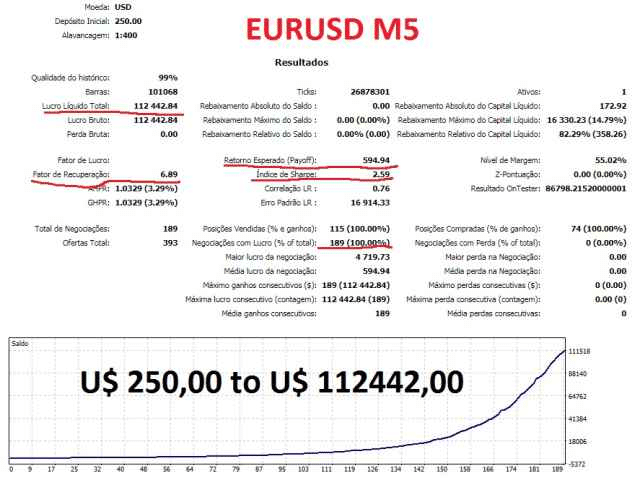

Backtests

There’s a EURUSD backtest on the M5 time frame. The leverage was 1:400. The history quality of the tick data was 99.90%. An initial deposit was set at $250. The total net profit was $112,442. The profit factor was 6.89. The robot has closed 189 deals with 100% of the win rate in both directions.

Verified Trading Results of DSC Price Action

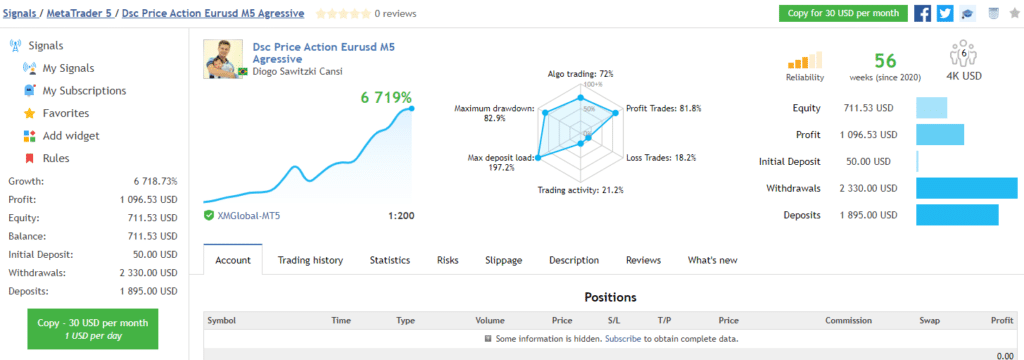

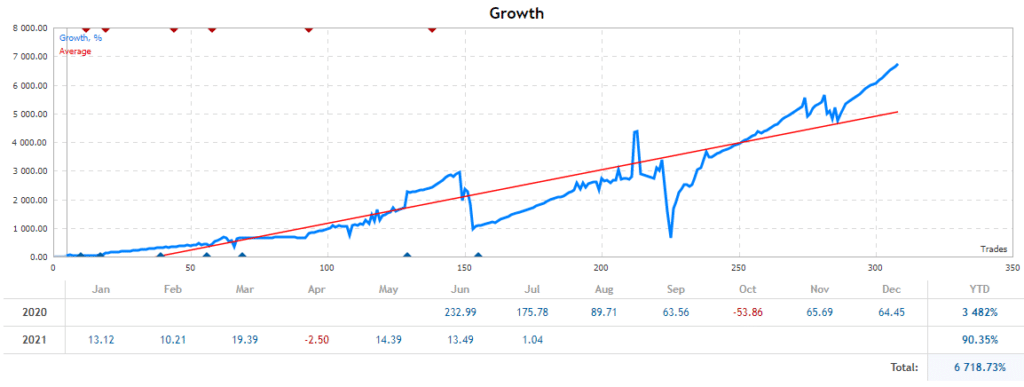

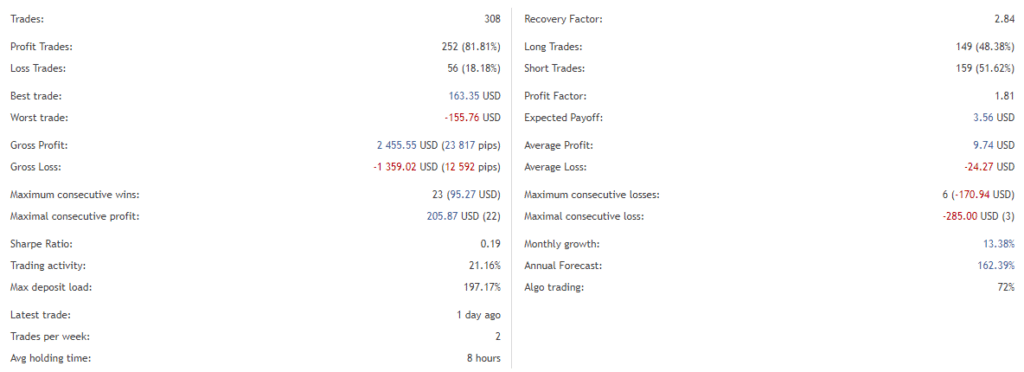

There’s a $500 real account on Alpari on MT5 created. The leverage is set at 1:500. The maximum drawdown is 82.9%. It’s insane. The maximum deposit load is 197%. The trading activities are 21.2%. The win rate is 81.8%. The signals have 3-star reliability. $30 monthly is the price. The account is alive for 56 weeks.

The robot works 156 trading days (40.31%). An average trade length is 8 hours. We have six subscribers on the board. An average trade frequency is only two deals weekly.

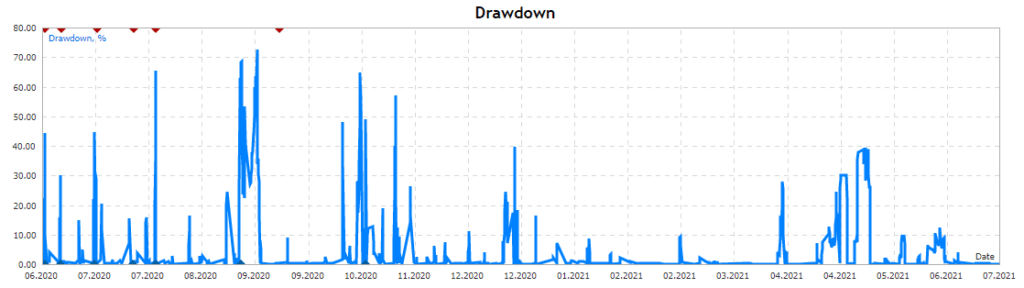

The system can easily halve the account. It’s so risky to work with it.

The drawdowns are high and happen from time to time.

The robot closed 308 deals. The best trade is $163.35 when the worst trade is -$155.76. The recovery factor is 12.46. The profit factor is 2.84. An average profit is $9.74 when an average loss is -$24.27.

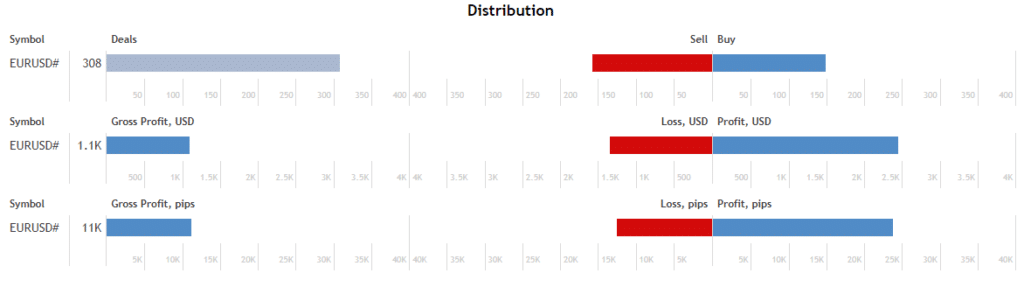

The robot works with EURUSD in both directions equally.

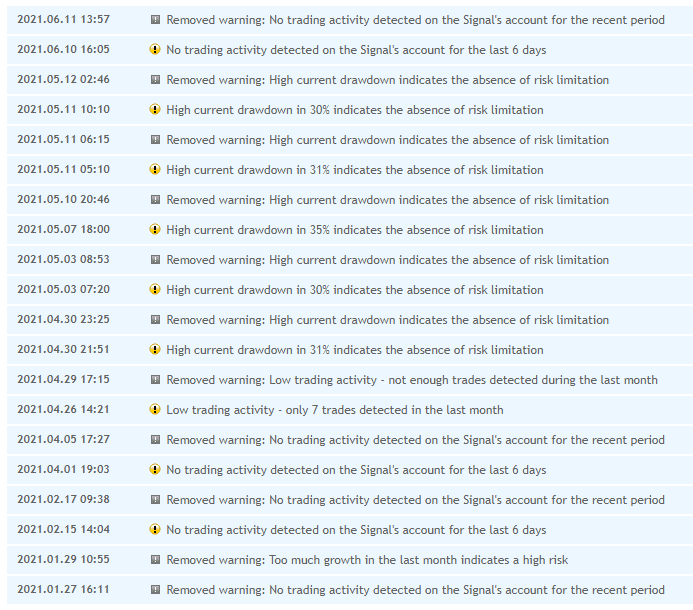

There’s an endless wall of warnings from the MQL5 bot.

People Feedback

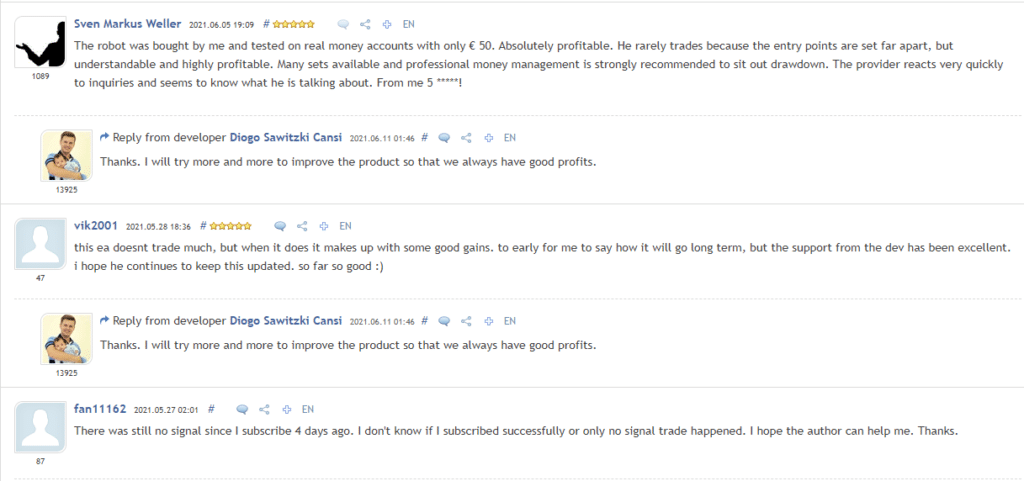

We have a few comments published about the robot’s functionality and profitability.

Is DSC Price Action a viable option?

Advantages

- Backtest report provided

- Real-account trading results provided

Disadvantages

- No risk advice given

- No money-management advice provided

- The system trades unpredictably and rarely

- The system receives many warnings

- No refund policy provided

- Lack of people testimonials

Review Summary

DSC Price Action is a trading advisor that works with EURUSD executing a Price Action strategy. Trading results showed that the robot could easily lose half of the funds monthly. So, using it on a real account sets it at high risk.