Proprietary or prop trading firms are companies that provide capital to traders and then share the profits with them. The companies take more risks since most of their traders are spread around the world. In this article, we will look at what prop trading firms are and then compare the 5%ers and Day Trade the World (DTTW).

How prop trading works

There are several types of proprietary firms. For example, companies like Susquehanna, Hudson River, and Jane Street are prop trading firms. These companies house highly-skilled traders who use proprietary software to execute trades.

Another type of prop trading is companies that provide funds to traders from around the world. These traders pay a small fee and receive more money, which they can use to trade. Their income comes from the profits that they share with the prop trading firm.

There are several reasons why many people prefer prop trading other than retail trading. For one, as a prop trader, you get access to trade with more money than when you are a retail trader.

For example, if you have less than $500, you’re likely to take excessive risks to make meaningful profits. However, as a prop trader, you can get access to more money than that, as I will describe below.

Additionally, many prop trading firms provide better education about how to open trades and how to conduct analysis. Prop trading is also suited for someone who wants to become a professional trader.

DTTW vs. The 5%ers

In this section, we will look at what DTTW and 5%ers are and how they work. We will first start with DTTW.

What is DTTW?

Day Trade the World is a prop trading firm that is owned by Select Vantage, which is a Canadian company. The firm was started in 1997 and has grown over the years. Today, it is one of the biggest day trading companies in the world, with customers from around the world.

DTTW uses a relatively unique business model than other prop trading firms. First, the company encourages its customers to open their trading floors or offices. This is a situation where the office manager leads a team of about five traders.

The essence of having a trading floor with a big team makes sense. For one, the trading environment typically feels more professional than when you are trading with a Robinhood account. Also, having a trading office means that traders can work in shifts. This means that they can maximize their returns over time.

DTTW traders have access to advanced technology and more assets. For example, after registration, customers are required to pay a refundable $500, after which they receive the PPRO8 cube. This is a tool that connects them to the global markets.

Additionally, traders have access to more markets like stocks, cryptocurrencies, commodities, and exchange-traded funds. Most importantly, it provides direct market access (DMA), where customers have access to market makers.

What is The 5%ers?

The 5%ers is a proprietary trading firm that is relatively different from DTTW. For one, the company mostly focuses on forex trading, while DTTW is a multi-asset prop trading firm.

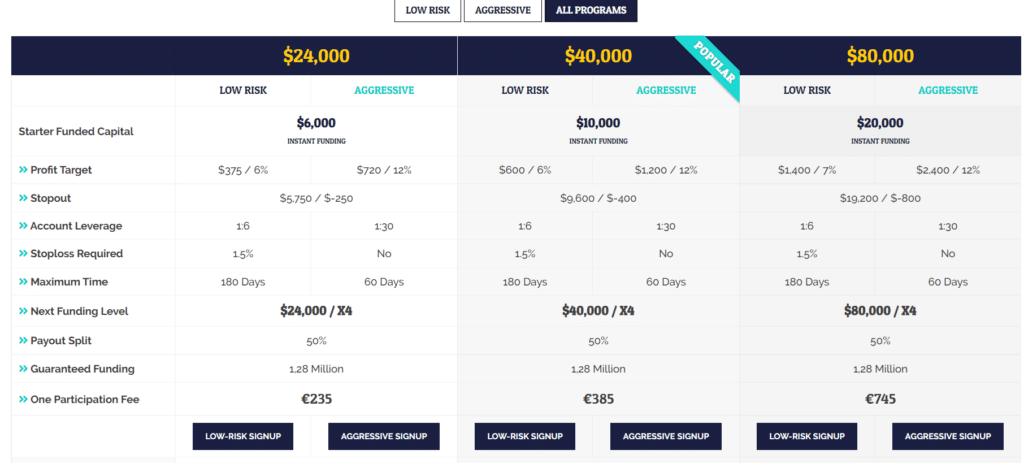

5%ers works in a simple way. First, customers from around the world visit the website and identify their solutions. Second, they select the package that they want to use, as shown below.

As shown above, one can select either of the six packages. In the first package, one pays 235 euros, and they get instant funding of about $6,000. In the second one, they deposit 385 euros, and they receive $10,000.

Finally, they pay 745 euros and then receive 20,000 euros. With these funds, they can then select whether they want to be low-risk managers or aggressive ones. If they choose the low risk, they will receive an account with smaller leverage. On the other hand, if they choose to become aggressive, they get more leverage.

The 5%ers will then share the profits that the traders generate. The traders will keep more than 70% of the total profits that they make.

Day Trade the World vs. The 5%ers: which is better?

There are several ways to look at the better option between DTTW and the 5%ers. First, if you are looking at the amount you can start trading with, then The 5%ers is better. That’s because you can start your trading career with as little as 235 euros.

DTTW is more expensive. In addition to the refundable $500 you are required to pay, there is another $3000 you should pay for margin. The company uses these funds to safeguard its accounts. Therefore, in this case, 5ers is a better option.

However, DTTW has more benefits than the 5%ers. First, it offers more markets. It offers stocks from more than ten exchanges globally. This means that you can trade stocks of the US, UK, Germany, France, and Switzerland.

Second, for some exchanges, the company offers direct market access (DMA). This gives the traders the ability to select their market maker. As a result, they will get better pricing for their assets.

Third, DTTW offers the ability for a trader to create a trading floor. The company will guide you on how you can hire these traders and provide them with the education that they need to succeed.

Fifth, DTTW also gives its traders access to some of the best traders on its floor. For example, they operate a YouTube channel known as TraderTV that has more than 250k followers. The channel shows these traders doing live trading, which can help you be a better trader.

Summary

In this article, we have looked at the concept of prop trading and analyzed two of the biggest firms in the industry. We have looked at how the two firms work and their pros and cons. Most importantly, we have explained why we believe that DTTW is better than the 5%ers.