Introduction

An economic calendar is a financial resource that provides a schedule of most economic events in the market. Traders use the calendar to plan their trades, avoid costly mistakes, and to conduct their fundamental analysis.

Economic calendars are usually provided for free by most forex brokers. There are also several companies that provide calendars for free. Most importantly, some trading platforms like the MetaTrader 5 and TradingView have an inbuilt economic calendar.

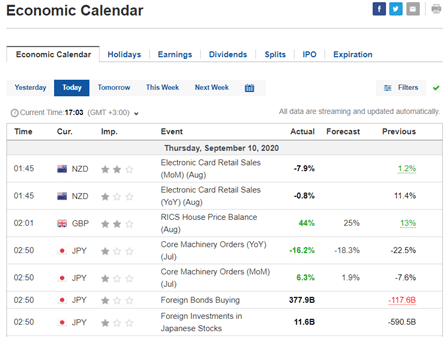

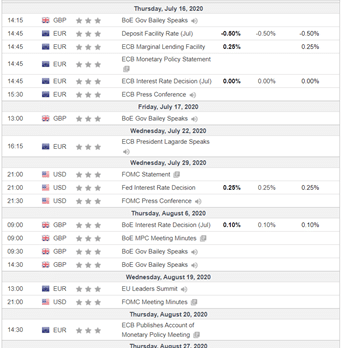

An economic calendar has several components such as the date and time, economic event, the value or impact of the event, the actual data, forecast, and the previous reading as shown below.

Economic calendar example

Employment data

Employment data are important components of the economic calendar because they reveal the strength of an economy. They are also useful to central bankers when they meet to set interest rates of a country. Ideally, a central bank will be motivated to hike interest rates when wages are high and the unemployment rate is low.

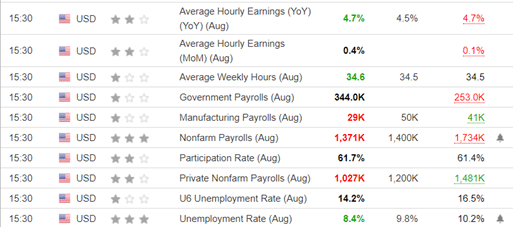

While the employment numbers of all countries are important, the US nonfarm payrolls are the ones that are closely followed. These numbers are released by the Bureau of Labour Statistics (BLS) every first Friday of the month.

Traders follow closely several parts of this release. First, they look at the number of people who were employed in the previous month. Second, they look at the unemployment rate, which shows the percentage of people of working age who are not working. Finally, they look at the wages and the participation rate. The chart is an example of nonfarm payrolls in an economic calendar.

Nonfarm payrolls

Inflation data

Inflation is an important component of the economic calendar because of its role in influencing interest rates and other monetary policy tools. In an ideal situation, a central bank will hike interest rates when inflation rises and cut rates when inflation falls. The goal of leaving interest rates low or cutting is to provide people and businesses to spend money and stimulate the economy.

Inflation of a country is released by the bureau of statistics, which assesses the change in the price of products in a country. In the European Union, it is released by Eurostat while in the United States, it is released by the Bureau of Labour Statistics.

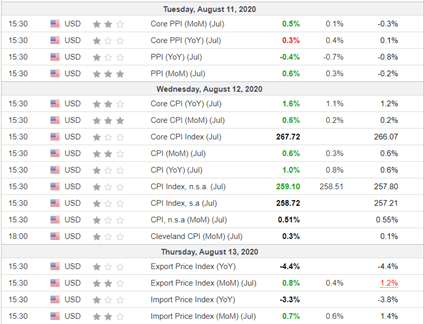

There are two primary types of inflation data in the economic calendar. First, there is the Consumer Price Index (CPI), which measures the change in the price of all products that consumers buy. These include fuel, food and beverages, and cars. Second, there is the Producer Price Index (PPI), which measures the change in the price of the selling prices received by producers. It is also known as a factory-gate index.

In most cases, a higher inflation rate tends to favour the country’s currency because it increases the likelihood that the central bank will hike rates.

Other types of inflation data in the economic calendar are the house price index, and the export and import price index. The chart below is an example of inflation data in an economic calendar.

US inflation data example

Economic activity data

The economic calendar has several measures that show the performance of the economy. Most of these numbers are provided by government agencies while some are provided by industrial groups and external research agencies. Some of the most common economic activity data are:

Retail sales

These numbers measure the performance of the retail sector in a country. In the United States, they are released by the Census Bureau while in Europe, they are released by Eurostat. The retail stats are important for two main reasons. First, the sector is usually one of the biggest employers in most countries. In the United States, they employ more than 4.7 million people. Therefore, robust retail sales mean that the economy is doing well.

Second, robust retail sales are indirect measurements of inflation and interest rates. That is because prices tend to rise when people are shopping more. And, as mentioned above, when prices rise, it tends to give central banks an incentive to hike rates.

Purchasing managers index (PMI)

PMI is an important survey data that is mostly conducted by private organisations. The data measures the performance of key sectors such as manufacturing, services, and construction. The PMI data ranges from zero to one hundred.

As such, a PMI reading of 50 and above is usually seen as a sign that the industry is expanding. At the same time, a PMI reading of 49 and below is a sign of contraction. For example, at the peak of the coronavirus pandemic, the US manufacturing PMI dropped to a record low of 36.1.

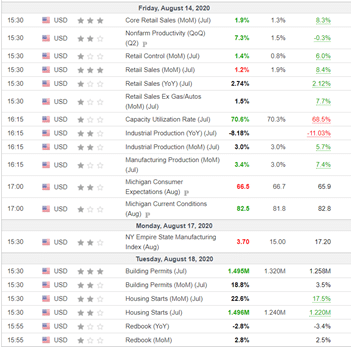

Other economic measures data in the calendar are housing starts, building permits, car sales, factory orders, durable goods orders, and industrial production, among others.

Key economic activity data in the calendar

Central bank meetings/interest rates

Central banks are among the most important institutions in the financial system. For one, they are the only ones given the authority to set interest rates and print money. Therefore, a central bank’s decision can lead to a sharp decline or uptick of a currency.

In most countries like the United States, the United Kingdom, and the European Union, central banks meet once per month. In these meetings, they deliberate on whether to hike or lower rates or whether to use additional tools like quantitative easing.

The most important central banks to watch out for are the Federal Reserve, European Central Bank (ECB), Bank of England (BOE), Bank of Japan (BOJ), Bank of Canada (BOC), and Swiss National Bank (SNB).

In addition to interest rate releases, other central bank-related data in the calendar are minutes releases and speeches by bank officials.

Key central bank events in the economic calendar

Other economic data

There are other important economic calendar events that you need to look at when trading. These events tend to have a major impact on key currencies and other assets.

They are:

- Crude oil inventory data – This data is released by the Energy Information Administration (EIA) every Wednesday. It tends to move crude oil prices and oil currencies like the Canadian dollar and Norwegian krone.

- GDP data – This data shows the performance of an economy. It is important because it tends to influence the actions of the Central Banks. For example, the bank will slash rates if the economy shows a sharp contraction.

- Confidence – Consumer and business confidence are important because they tend to be good predictors of spending. Consumers who are confident about the economy tend to spend more. Similarly, companies that are confident about the economy tend to spend more and hire more people.

Final thoughts

An economic calendar is an important tool that many traders use every day. A common strategy is looking at a calendar before you go to bed and every morning. Doing that will help you plan your trading day and be a more organised trader.