The developer posted Euro Hedge on the MQL5 marketplace on March 29, 2021. Since then, it has caught the attention of many traders who have gone ahead to download its demo version. Some have also bought the EA.

Euro Hedge is being sold by an individual from Indonesia called Sugianto. His profile on MQL5 is not that detailed. For this reason, it is unclear if he has a background in trading and whether he knows his way around Forex. Going by his portfolio, Sugianto is portrayed as a quite accomplished individual with many products to his name. Some of his other creations include Gold Pyramid, One Direction Pro, Net Z, Go Trendline, and many more.

Features

The features of the robot are listed below:

- The suggested trading pairs include XAUUSD, EURUSD, GBPUSD, and EURGBP.

- It runs on the MT5 platform.

- Needs a VPS with a good internet connection.

- Allows traders to control the drawdown.

Euro Hedge uses many strategies at once. We have hedging, averaging, pyramiding, lot martingale, and anti-martingale approaches. The EA can close partial losing positions as well. Even as it implements these methods, the developer asserts that the goal is to enter and exit the market quickest possible so as not to be trapped by unforeseen market changes.

We are concerned that some of these strategies-martingale, anti-martingale, and hedging-can be very risky. With no clear loss mitigation measures, we doubt if this EA is safe for you.

How to start trading with Euro Hedge

Euro Hedge is an expert advisor. What this means is that it has been programmed to automatically assess the market, open trades, and close them without your intervention. So, by acquiring this product, you are basically handing over your trading activities to it.

To get Euro Hedge’s lifetime license, the developer is requesting you to pay $349. But if you are not sure that the system can meet your trading expectations, it is highly recommended that you rent it for a month first at $30. A money-back guarantee is not part of the package.

Backtests

The presentation of this system does not include any backtest results. These analytics are essential because they can assist you to make impartial decisions regarding the strategy. As a result, you are careful not to overrate its profitability. This way, you will refrain from risking your hard-earned cash on a robot that is destined to fail.

Unverified trading results of Euro Hedge

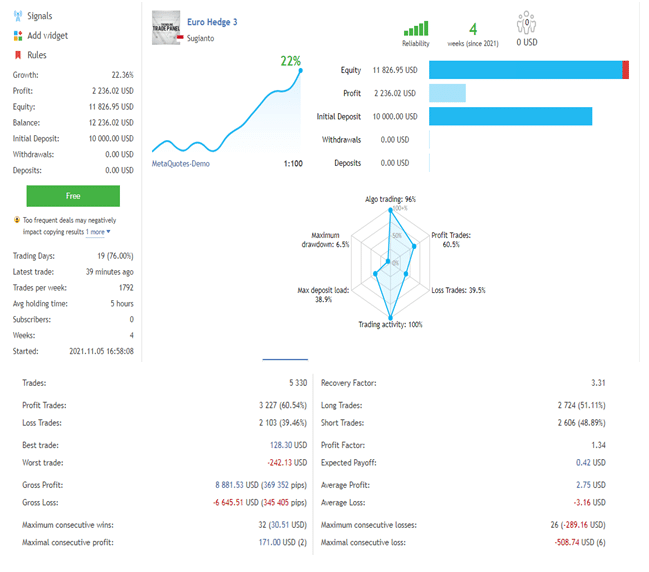

There is no verified trading data for this EA. Instead, we have a demo account that is being monitored by the developer. We have assessed the stats below:

According to these stats, the EA began running this account about a week ago, November 5, 2021. During this period, it has supposedly placed 5330 orders, with the average holding time being 5 hours. The resulting profit is $2236.02. Even then, we can tell from the profit factor (1.34) that the trades haven’t been bringing considerable earnings. The poor win rates for long (51.11%) and short trades (48.89%) further prove our assertion. There’s a drawdown of 6.5%.

Customer reviews

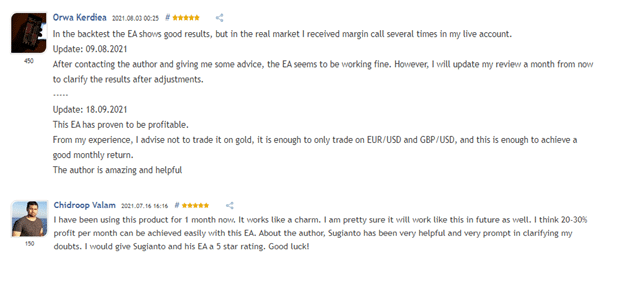

We have 2 positive customer reviews for Euro Hedge on MQL5. This is expected given that this site hardly regulates these reviews. So, the developer may easily manipulate them and even delete negative testimonials. In short, we cannot rely on the available feedback.

Is Euro Hedge a viable option?

Advantages

- Fully automated

Disadvantages

- No backtest results

- Vendor transparency is wanting

- Risky strategies used

- Unverified live trading stats

Summary

We simply advise you not to waste your time and money by investing in Euro Hedge. The EA is not a viable option because it lacks vendor transparency and uses risky algorithms. Furthermore, the developer is not confident about the efficiency of the product. Otherwise, he would have supplied us with reliable live trading data and showed us its historical performance.