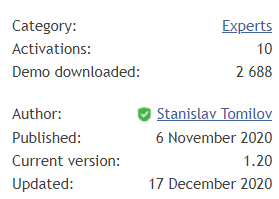

Euro Master is a just-released robot on the MQL5 site on November 6, 2020, by Stanislav Tomilov. The last version (1.20) was released on December 17, 2020. The developer’s portfolio amounted to six products where five of them are for MT4 and MT5.

Features

The list of Euro Master’s features is low:

- The system runs automatically on the chart.

- The vendor suggests we use AXI and IC Markets brokers for trading.

- It was designed only for EUR/USD.

- The system is based on a “unique artificial intelligence technology for market analysis to find the best entry points.”

- The robot includes “self-adaptive market algorithms with reinforcement learning elements.”

- It doesn’t run risky strategies like Grid, Martingale, or Hedge.

- The robot can overtake any market conditions.

- It works on the M5 time frame.

- The account should be $100 or higher to start trading.

- The system calculates levels of Take Profit and Stop Loss for all trades.

- The robot is quite a simple solution to deploy.

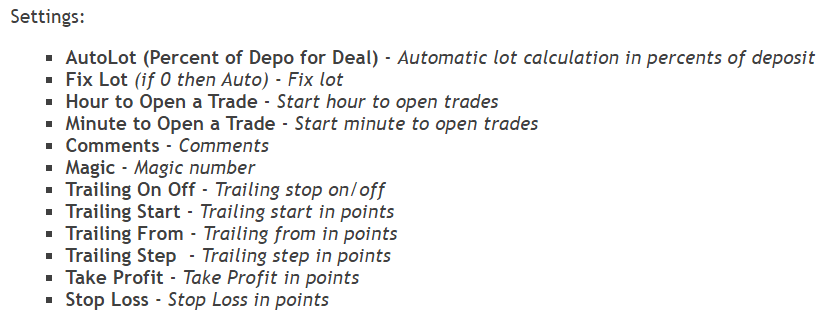

- The presentation is featured by a list of the robot’s settings. As we can see, there’s a Trailing Stop Loss feature.

How to start trading with Euro Master

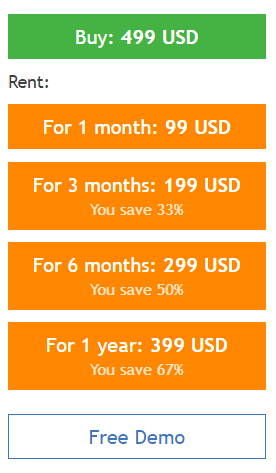

The main offer of the Euro Master robot is $499 for a copy (was $299). Now, we have rental options. Several weeks ago, there were no them. The one-month rent costs $99. The three-month rent costs $199 (33% OFF). The half-a-year rent costs $299 (50% OFF). The annual rent costs $399 (67% OFF)—the packages aren’t featured by a money-back guarantee.

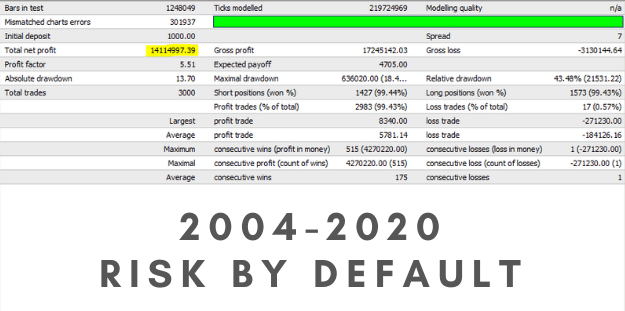

Backtests

It’s a report of the EUR/USD symbol on the M5 time frame based on the broker data from 2004 to 2000 years. The modeling quality is n/a. An initial deposit was $1000. The total net profit amounted to $14,11M. The Profit Factor was 5.51. The maximum drawdown was 18.4% ($636k). The largest profit trade was $8340 when the largest loss trade was -$271230.

Verified Trading Results of Euro Master

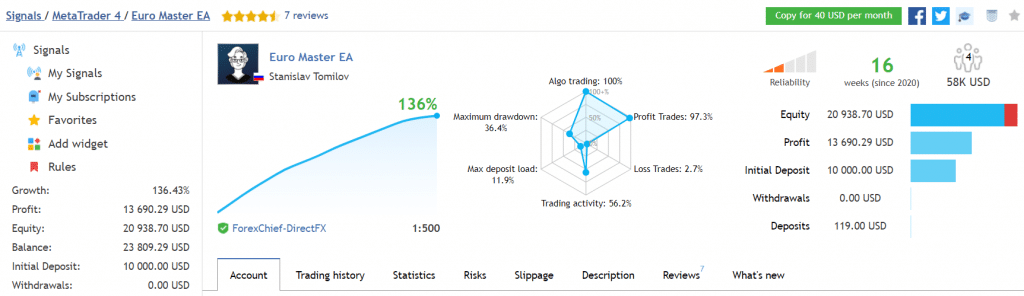

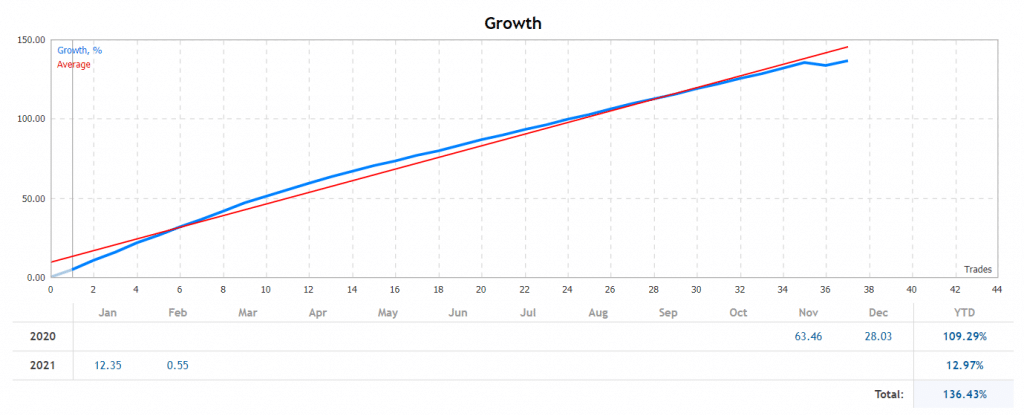

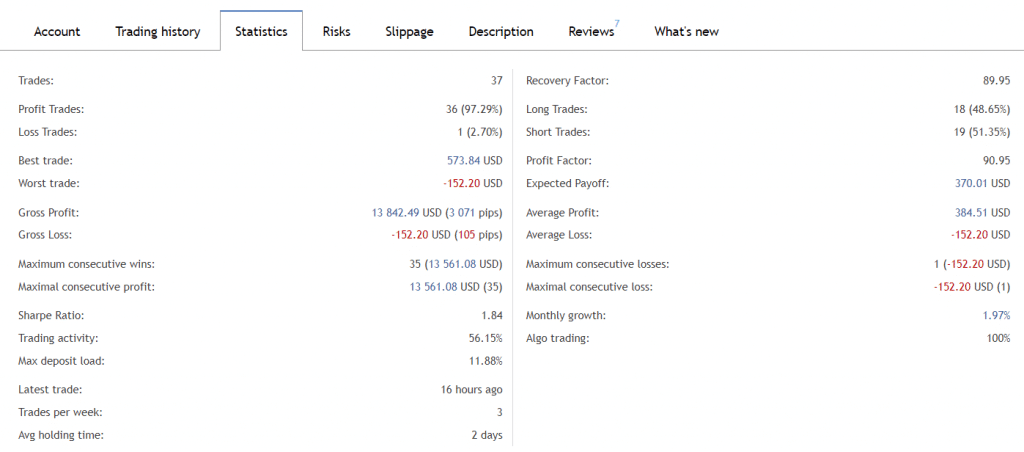

We have a real account on a ForexChief broker. The leverage is set at 1:500. The account was created on November 11, 2020, and funded at $10000. Since then, the growth has amounted to 136.43%. The Profit is $13690. The system uses algo trading on 100%. Its maximum drawdown is high as well – 36.4%. The accuracy rate is high – 97.3%. The trading activity is low – 56.2%. This robot has been running the account for 16 weeks. The reliability of the signal provider is low.

As we can see, after decreasing risks, the robot started being almost not profitable. There’s February 24 so far. The February 2021 gain is only 0.55%.

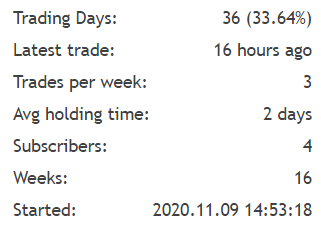

There were only 33.64% trading days. An average trade length is over two days.

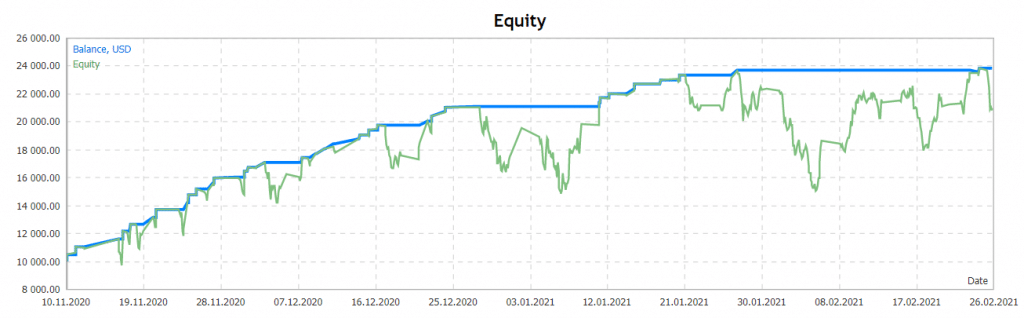

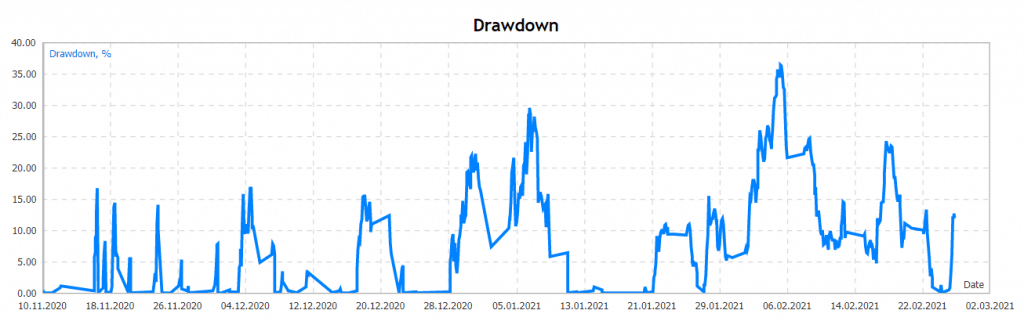

The robot has experienced systematic drawdowns for the last two months.

As we can see, the drawdowns are high for a long-term period.

The EA has closed 37 deals. The win-rate is 97.29% (36 won deals). The Profit Factor is 90.95. The gross profit is $13842 when the gross loss is -$152.20 only. The maximum deposit load is 11.88%. An average trade frequency is three trades a week.

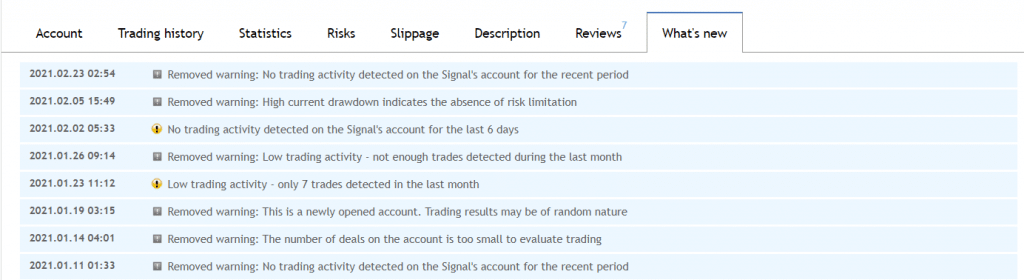

The system warned that trading activity is low and should be improved.

People feedback

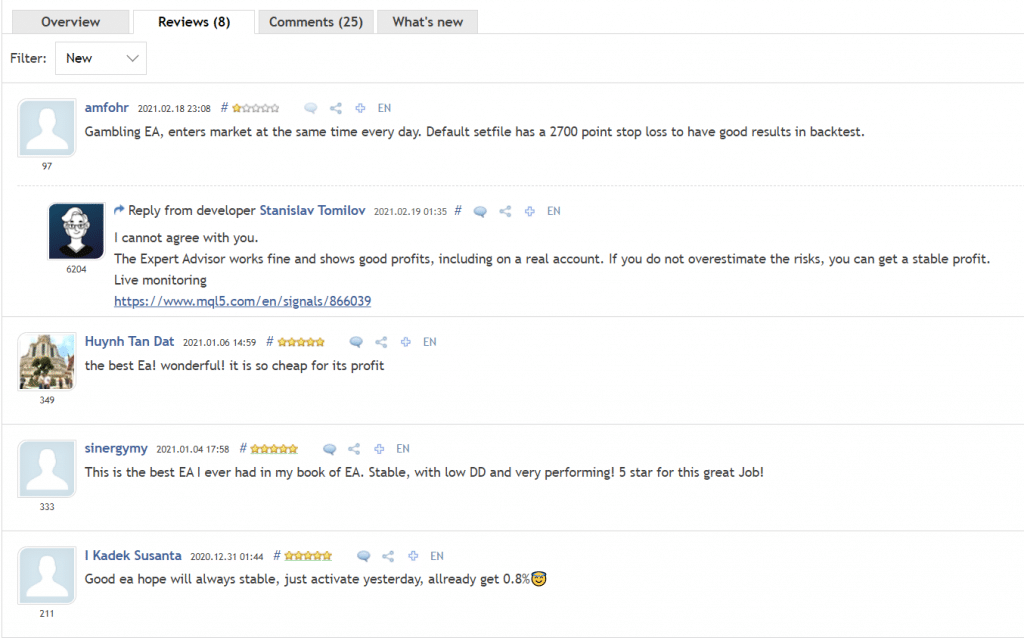

There are positive as well as negative testimonials. The person noticed that there are huge Stop Loss levels that will be an issue if the robot losses several deals in a row.

Other notes

The developer has a 6204 rate and signals with 11 products in the portfolio. There are 1585 friends on the list. The developer is originally from Russia.

Is Euro Master a viable option?

The robot executes just several deals weekly. It’s insanely low frequency when we talk about a $499 robot.

Conclusion

Euro Master is an awkward robot. The robot trades just several deals in a week. It’s not well for many traders who are ready to spend $499 for a copy without refunds. How much time will the trader need to understand that the robot is good or bad with this frequency? Weeks, months? Several weeks ago, its cost was $299. It could be an option for this price. Now, the robot doesn’t fit the average trader’s expectations.