Consumer Confidence Index can be explained as a measure of consumer certainty with respect to the economy.

Assume you are having a casual conversation with your front door neighbor. With so much excitement he/she tells you that they plan on starting a hardware business within three months, his son recently landed a dream job at a bureau, and the wife is expecting a baby. What can drown from this conversation?

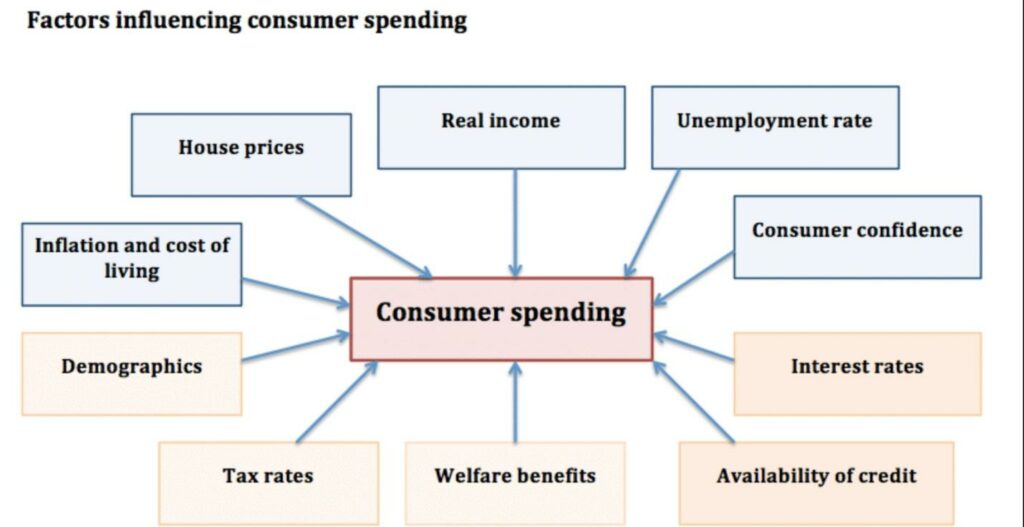

Holding everything constant, it is logical to say that our spending habits depend on the amount of money we have and whether or not we anticipate more of it in the near future. In most developed countries, consumer spending habits drive the economy, in some cases making up to 70% of the GDP. A good example is the United States. With that said, let us all first take time to understand what is Consumer Confidence Index.

What you need to know about CCI

As much as the name Consumer Confidence Index may sound technical, it isn’t anything you don’t know about. It is simply a measure of consumer optimism or pessimism level with respect to their financial stability and the general state of the economy. With this, one would wonder, who compiles the CCI report?

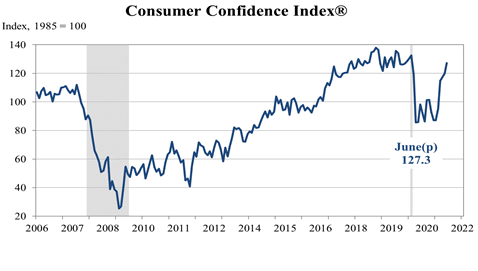

CCI is prepared by The Conference Board, a non-profit research institution tasked with the mandate of preparing monthly CCI reports geared towards helping users better understand the economy and prevail through tough economic conditions. The first CCI was calculated and released in 1967. Back then, The Conference Board released the report once every two months. However, this changed to a monthly release in 1977. CCI 1985 was approved as a benchmark [That is CCI 100 = 1985] largely because the economy at this time was rather dormant with nothing much going on.

The CCI report is published on The Conference Board Official website the last Tuesday the month at 10 am ET.

How it’s measured and calculated

To prepare the report, data has to be collected — this is done in the form of five questions, a brief survey. Two of the questions enquire about present financial and economic conditions, and the remaining three about future anticipations. Hence, we can deduce that CCI is made up of 60% future predictions and 40% opinions. In total, 5000+ consumers are surveyed.

The respondents give positive, neutral, or negative answers by the values 1, 0, and -1, respectively. These values are the only data used to calculate Consumer Confidence Index. But first, we have to calculate the relative value for each question, and this is done by adding up the positive and negative responses. Earlier, we talked about the 1985 CCI being the reference value. The relative values are compared to those of 1985 to get a deviation — the index values are then summed up.

Interpretation

According to a report on CCI for June 2021, CCI increased to 127.3 from 120.0 in May. This is a record high since the onset of the pandemic back in March 2020.

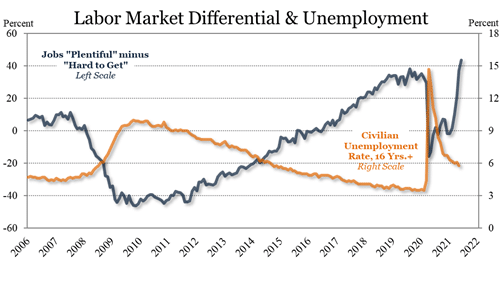

The latest report by The Conference Board confirmed the further economic growth in Q2 with the present situation in the labor market.

Digging deep, the specific respondents for each question were as follows:

Current situation

- 24.5% positive Present appraisal of business conditions 19.5% negative.

- 54.4% positive Present appraisal of employment conditions 10.9% negative.

Near future expectations

- 33.3% Positive Expected conditions of business if the upcoming 6 months 10.6% negative.

- 25.7% positive Expectations around employment conditions in 6 months time 16% negative.

- 18.6% positive Expectations around total monthly income in 6 months 8.5% negative.

With 1985=100, CCI above 100 is interpreted as consumers feeling more certainty about the general state of the economy and their personal financial stability both in the present and near future. When reading below 100, it signals uncertainty and pessimism — economists take this as a red flag. In the meantime, traders go short or wait to buy the dip.

This information is useful to all the market participants, from the government to small and large retailers, manufacturers, and credit unions. Based on the CCI report, manufacturers know when it is time to launch new projects and increase production output, while credit unions can also deduce what to look forward to. An uptrend shows an upcoming rise in the number of credit applications, including mortgages.

A downward trend, on the other hand, has a negative implication for the economy. As the name suggests, low consumer confidence shows that consumers are uncertain about their financial stability and the economy. For this reason, the chances are that they will cut on their expenditure and instead opt for more savings. Retailers and manufacturers rely on this information to reduce production, especially for perishable goods. They can also hold on to launching new projects.

The biggest player forming CCI is the government. This is where fiscal and monetary policies come into play to stabilize the economy.

Other uses and applications of CCI

- Testing policy effectiveness — consumer confidence is used to measure whether policies implemented are effective in stimulating the economy. It is safe to say that most economists rely heavily on CCI trends to advise the government on appropriate measures to take to ensure that the economy doesn’t go into recession in a downward trend CCI.

- Leading indicator — CCI scores over time can be used to predict trends and changes in the economy. Remember how economists on the future of the economy? CCI report always comes in handy.

- Lagging indicator — CCI scores are used to follow and confirm trends in the economy. For a long time, there has been a divided debate on whether CCI is a leading or lagging indicator. In this case, CCI is useful in evaluating present economic conditions.

Key takeaways

The Consumer Confidence Index is a key economic indicator. Along with several other fundamental economic indicators is an indispensable tool in forex trading. Whether you are a technical trader or the one relying on the news, knowing how CCI is calculated, interpreted, and applied by the government will make the Forex market a lot more predictable to you.

We also highly recommend studying the fundamental aspects the impact the prices of particular currencies or major currency pairs, like EURUSD.