Success in the forex market is all about coming up with a trading strategy that works. Have you ever asked yourself how traders determine whether a given trading strategy will work or how effective it would be on varying market conditions? Forex backtesting is one of the most under-utilized strategies but crucial to a successful trading career in the forex market.

What is Forex Backtesting?

Forex backtesting is a strategy whereby traders apply a given strategy or trading rules on past data to see how the strategy would work in live markets. Technical analysts use a set of technical rules on historical price data and analyze their returns when applied to whichever currency pair.

The strategy stands out in part because it allows traders to test multiple trading strategies across multiple markets. It is also a useful tool for collecting massive amounts of data and information about a minimal time strategy.

Backtesting is one of the most underutilized trading tools and one of the reasons why 90% of beginners fail to carve a career out of forex trading. Backtesting makes it easy to collect statistics about an edge of a given trading strategy and how best to utilize it to generate optimum returns.

Depending on the information collected while backtesting, it becomes much easier to determine whether a given strategy will work and the kind of results it is likely to generate. Within a hundred tested trades, it should be possible to determine if a strategy is viable.

While backtesting, traders assume that trades and strategies that perform well in the past would often recur in the future, therefore, presenting ideal trading opportunities. Consequently, it is a safe and exciting tool to use to search for a perfect trading strategy.

Importance of Forex Backtesting

Backtesting is a reliable way of analyzing whether a given strategy works and its prospects of generating desired returns in live markets. By testing a set of rules on historical data, traders can ascertain the effectiveness of a given strategy and the necessary adjustments to perfect the strategy.

Testing a given strategy on historical data also helps a lot in determining opportunities that might occur thanks to recurring price patterns trading patterns reoccur from time to time, and having an idea of how they look like allows traders to have an edge in identifying them when they occur in the future.

Backtesting has also proved to be highly effective in building confidence. The strategy allows traders to build confidence by analyzing different price patterns, which goes a long way in building the much-needed experience for future use.

How to Backtest a trading strategy

The best way to analyze how effective a trading strategy and the kind of returns it is likely to generate is to test it in a demo account. A risk-free demo account provides forex brokers ideal platforms for trying everything without the risk of losing anything.

Demo accounts for averting the risk of putting capital risk while trying an unproven strategy to accumulate losses. Virtual accounts stand out partly because they accord traders access to real-time market data without any risk. Likewise, they can trade currency pairs using real-time data while offering access to expert traders.

In a demo account, backtesting entails applying various technical indicators on one chart and studying how price behaved either on coming into contact with moving averages or how traders reacted to overbought and oversold conditions as indicated by oscillators.

Steps 1: Dress The chart

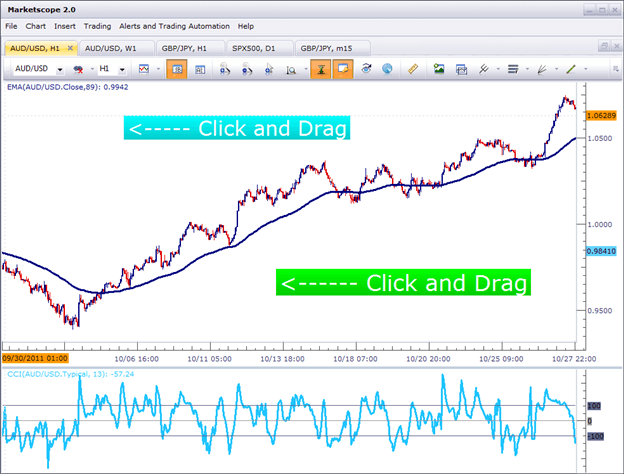

The first step to backtesting a forex strategy entails dressing the charts with all the indicators that make up a given trading strategy.

In this case, you can incorporate moving averages for determining price direction and RSI and Stochastic indicators for determining market momentum. Volume indicators can also be incorporated to ascertain the amount of volume at a given time.

Step 2: Go back in time

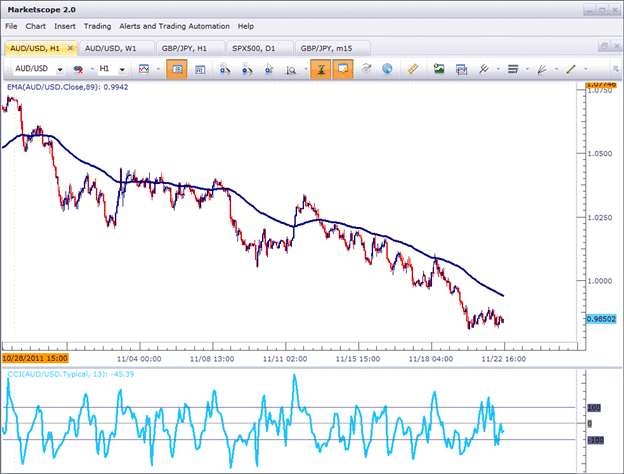

Once all the indicators are integrated into the chart, the next step entails going back in time by dragging the chart back for one or two days to see how the price behaved and how the indicators behaved. While backtesting a forex strategy, it is crucial to maintain a given time frame on the chart for analysis purposes.

It might be wise for long-term traders to backtest a trading strategy while dragging the four-hour chart or daily. For intraday traders, then sticking with a 15 or 5-minute chart would be the way to go.

Step 3: Records the Results

After sliding the charts back and forth while analyzing how indicators moved as price oscillated, it would be essential to tabulate everything. Depending on the time frame in use, it would be important to indicate:

- Where to open a trade based on technical indicators behavior

- Where to place a stop-loss order

- Where to take profits

In addition to these three, you can record any other information crucial to making informed decisions while trading the markets.

The best way to get the most out of backtesting is to keep a trading journal. Here are where you keep a quick tally of all the trades taken and how they performed and the adjustments needed in the future.

Bottom Line

Coming up with a trading strategy is key to becoming a profitable trader. Likewise, it is vital to go the extra mile and backtest, risk-free, whether the trading strategy will work and generate desired results under different market conditions.

Backtesting entails testing a trading strategy on relevant historical data to ascertain its viability before risking actual capital. Simulation of a given trading strategy can be done over an appropriate period while analyzing profitability and risk levels.

If a backtested strategy meets given criteria based on set out goals, then the strategy can be implemented with some degree of confidence in a live market.