Forex consolidation is defined as a period when a currency pair is neither volatile nor trending. When it happens, it means that a currency pair is moving in a tight range. As such, it is a relatively difficult period for making money. In this article, we will look at what consolidation is and some of the top strategies to use.

What is forex consolidation?

A currency pair or any other asset tends to move in three key phases. First, a pair can move in a downward or upward trend. When rising, the currency pair tends to be forming a higher high and a lower high. At this stage, a trader makes money by buying the pair at a lower level and exiting when the price rises.

Second, a pair can experience some volatility. This is where it fluctuates within a given period. For example, a volatile pair can open at 1.1200, rise to 1.1300, and then drop to 1.1100 within a few minutes. Experienced traders prefer volatile pairs because of the significant opportunities that emerge.

Finally, a pair can remain in a consolidation mode where the price struggles to move above and below critical levels.

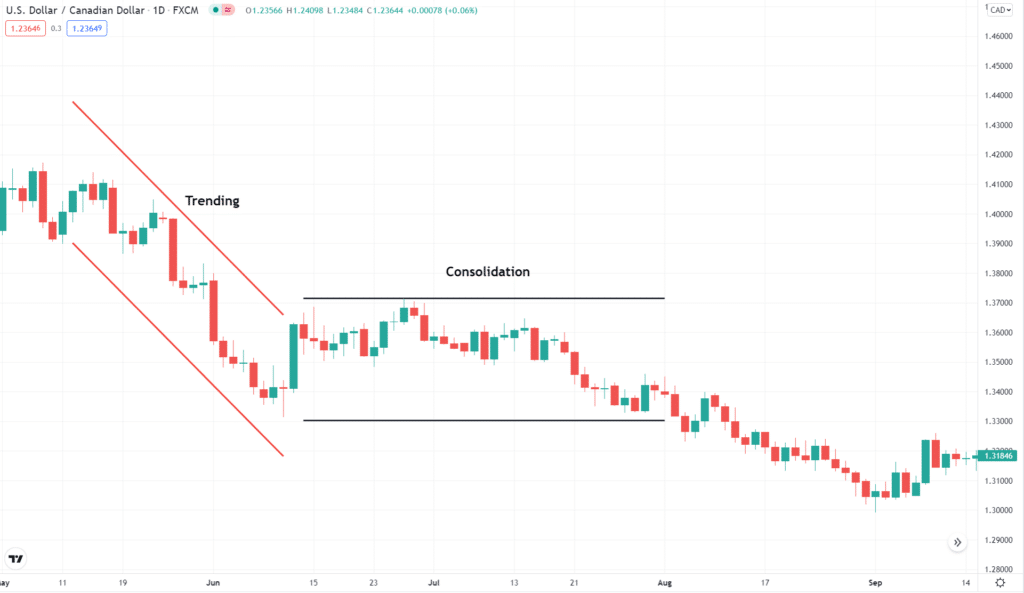

The example above shows the USDCAD in a downward trend. It is then followed by about three weeks of consolidation. In this period, the pair struggles to move above the resistance at 1.2141 and below the support at 1.2030.

Why currency pairs consolidate

Financial assets like currency pairs consolidate for several reasons. Here are some of the most popular ones:

- Low volume – Some currency pairs tend to consolidate because of the low volume in the market. Low volume could mean that there is no adequate demand to push the currency pair upwards or lower.

- Lack of economic catalysts – At times, currency pairs remain in a tight range because there is no major economic catalyst. For example, the EURUSD pair could remain stuck when the US and the Eurozone have not released any major data.

- Waiting for key data – Currency pairs consolidate when investors are waiting for a major data or event. Some of the top data and events that move a pair are employment, election, consumer inflation, manufacturing and services PMI, and retail sales. The pair consolidates ahead of these events because investors are uncertain about what will happen.

- Season – Consolidation could happen because of seasons. For example, currency pairs tend to consolidate at times towards the end of the year or Easter holiday.

- Holidays – At times, a currency pair could remain in a tight range because of a holiday in a specific country. The EUR/GBP tends to waiver whenever there is a bank holiday in the UK.

- Central banks – Central banks can push currency pairs to consolidate. For example, the EURGBP could waver when both the European Central Bank (ECB) and the Bank of England (BOE) turn hawkish.

How to identify forex consolidation?

Consolidation periods are pretty easy to spot. During these periods, prices tend to oscillate in a range between a support and resistance level. To that end, there are four types of ranges you could find yourself facing.

Rectangular range

During this range, prices maintain their movements between a horizontal support level and a horizontal resistance. This shape resembles a rectangle, hence the nomenclature. Within this range, the region around the support level constitutes the buy zone, while that around the resistance is the sell zone.

These ranges typically have shorter timeframes, which translate to quick trading opportunities and profits equally as quickly. However, if one is not careful, these ranges can be misleading as they are often influenced by longer-term trends.

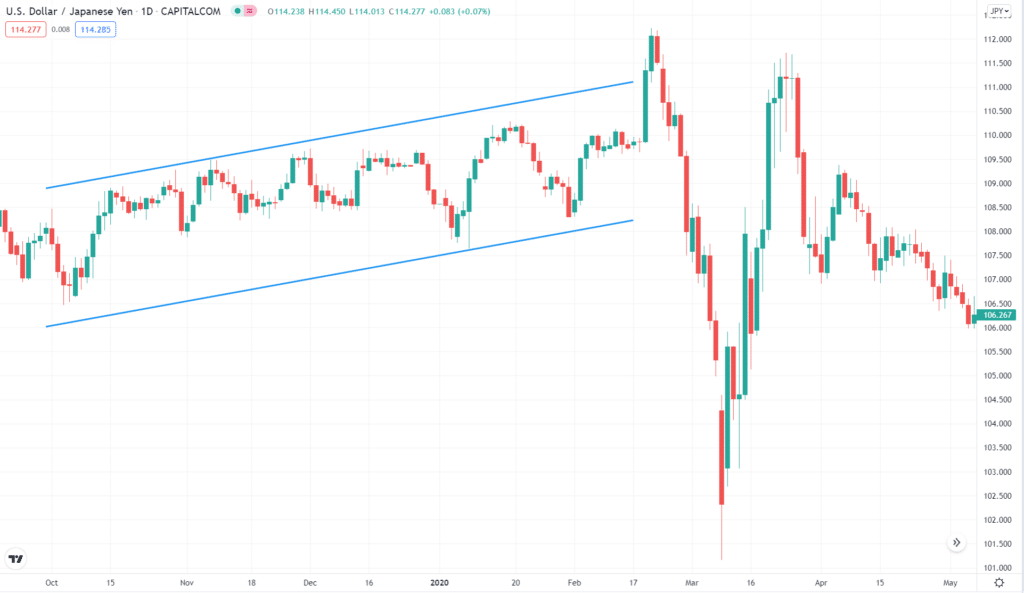

Channel (Diagonal range)

In this kind of range, prices tend to stick between diagonal support and resistance levels, as in the below example. The upper and lower ranges are seldom perfectly parallel, as these levels can form a broadening channel, or a narrowing one.

For these types of ranges, breakouts are usually reversals of the prevailing market trend. Therefore, traders can take advantage of this and predict the direction of a breakout. However, sometimes breakouts can take ages to occur, while others happen quickly. Therefore, it is difficult for traders to determine the timing of a breakout.

Continuation consolidation range

This range usually occurs as part of an existing chart pattern. Patterns such as wedges, pennants, and flags are examples of a continuation range.

These ranges often occur within other market trends, which can present an opportunity to make a quick profit from them, and their resultant breakouts. However, since they are part and parcel of the existing trend, evaluating these ranges can prove troublesome, especially to beginner traders.

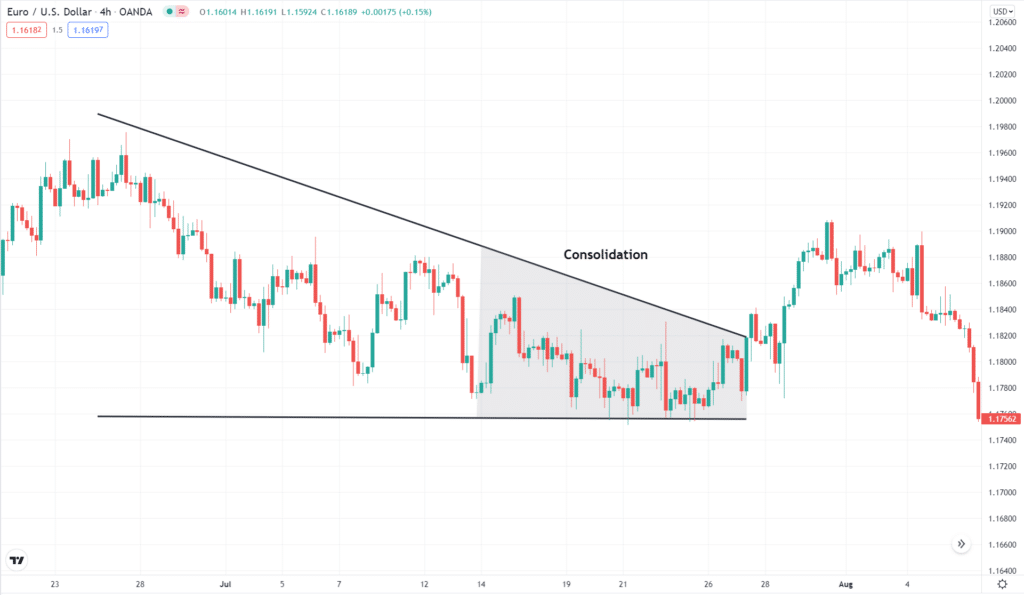

Irregular ranges

Sometimes, a consolidation range does not form an obvious pattern. In the example below, we have a rectangular range adhering to a diagonal resistance level of a larger triangular range.

Such ranges can provide opportune entry and exit points to traders who can keep track of their resistance and support levels. However, due to their complexity, additional analysis tools are required for proper analysis of these ranges.

Best consolidation area indicators

There are several forex consolidation indicators you can utilize to trade in these low volatility zones. Some of these indicators will work well even in trending markets, while others are exclusively consolidation area indicators. Let’s dive into a few of those.

Aroon indicator

Aroon indicator is an oscillator that measures the strength of price momentum. It is used to point out trends as they begin and to predict reversals. Basically, it measures how much time has passed since a currency pair recorded a new high or low.

By default, the Aroon consolidation indicator comes in a 14-period time frame, though this can be adjusted at will. It is made up of two lines. The first is an Aroon-up line that measures how long ago in the last 14 periods a new high was recorded. The second is the Aroon-down line, which works similarly to its counterpart, only it measures when a new low was posted. This indicator has a vertical scale of 0-100, and it is measured in percentages.

How it works

The idea behind this indicator is the higher the reading, the stronger the prevailing trend. In a daily chart, when the Aroon-up is reading above 50, it means prices have recorded a new high in the recent half of the last 14 days, i.e., the last 7 days. Thus, the prevailing trend is bullish.

Similarly, if the Aroon-down reads over 50, our currency pair’s price has hit a new low in the last 7 days. This points to an underlying bearish trend. In both cases, a reading near 100 points to a strong trend.

During consolidation ranges, this indicator’s readings manifest in two ways. One, both lines read below 50. This means that the pair’s price has not recorded any new lows or highs in the last 7 days. Second, both lines fall in parallel.

This means that prices are trading within a range, and within it, no new highs or lows have been hit.

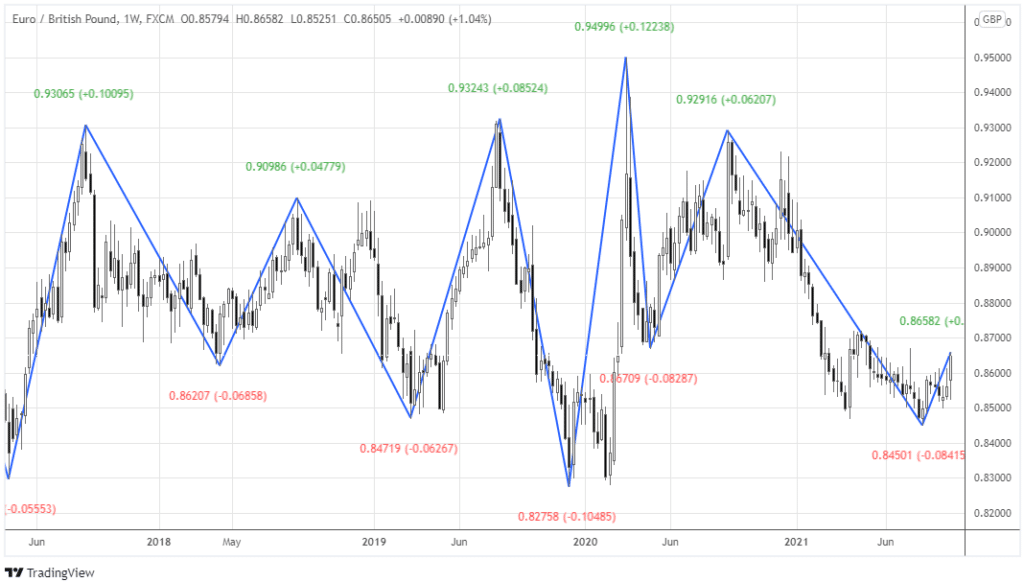

Zigzag consolidation indicator

The consolidation zigzag indicator is a trend following technical analysis tool that is useful in pointing out price trends, areas of resistance and support, and numerous chart patterns.

How it works

The indicator connects swing lows to swing highs. A swing low is a candlestick that’s lower than candlesticks before and after it. A swing high is the opposite, a candlestick higher than other candlesticks around it.

When prices are in consolidation, the indicator tends to peak and trough between restricted support and resistance levels. In such a region, no definite price trend is observable on the chart.

Instead, prices form a range that could take any of the aforementioned shapes. In the EURGBP chart above, you can see how the zigzag indicator highlights the price swings.

Strategies to trade forex consolidation

It is relatively difficult to make money when currency pairs are consolidating, but if you employ some forex range trading tactics below, you will definitely avail. For one, a pair in consolidation moves just a few pips every day. Still, some strategies can help you make money during such a period.

Consolidations in the forex market are a very common phenomenon. Most traders shy from trading them because they offer reduced profit margins. However, though many traders view trading during these periods as simplistic, it’s one of the easiest ways to make money trading forex. For this reason, it is important to learn how to take full advantage of such periods.

There are three vital steps you should pay attention to when trading in these periods. Let’s take a quick look into those.

Step 1. Identify the range

Consolidations in the forex market can happen for a variety of reasons. The bottom line is, events on the economic calendar are often behind these periods. For that reason, fundamental analysis is vital in spotting these periods.

Step 2. Find opportune entry and exit points

Once the resistance and support levels of consolidation have been identified, it becomes easier to obtain trade signals for as long as the range persists. Usually, traders place their long positions close to the support level and short their positions at the resistances.

In addition, one can employ oscillators such as the RSI, stochastics, and CCI to identify trend reversal points. These oscillators tend to reach extreme values when trends are about to reverse at the support and resistance levels.

Step 3. Manage risks

As consolidation periods do not last forever, they are prone to breakouts which could leave a trader grappling with unbearable losses. For this reason, it is imperative to employ stop losses to protect your position in case the market goes against you.

When buying at a support level, you should place your stop loss a few pips below the line of support. A risk to reward ratio of 1:1 or above is best to use so that you stand to gain more than, or at least as much as you stand to lose. Similarly, when shorting at a resistance level, place your stop loss just above the line of resistance.

Waiting for breakouts

A fact about consolidations is that they don’t last forever. A currency pair in a tight range will always break out higher or lower in due course. Therefore, you could wait for the breakout to happen and then follow the new trend. There are several strategies to approach this.

For example, you could assess whether this consolidation is part of a price action pattern. For instance, if it is happening after a major upward pop, it could be a sign that the pair is forming a bullish flag pattern. In price action, bullish or bearish flags are usually consolidation signs. As such, they tend to signal that the price will ultimately break out in the original direction. A good example is shown below.

Another pattern that has a consolidation at the end is the falling or rising wedge pattern. Wedges are usually reversal patterns, meaning that the price will tend to break out in the opposite direction of the wedge.

For example, a falling wedge will tend to break out higher, as shown in the EURUSD chart above.

Pending orders

Perfect execution approach of trading consolidation is known as pending orders. Unlike market orders, pending orders are usually opened in advance when the price reaches a certain level.

In the example below, a trader would have placed a buy-stop trade at 1.1850 and a sell-stop at 1.1760. In this case, if the price makes a bullish breakout, the buy-stop trade will be executed. On the other hand, in case of a bearish breakout, the sell-stop trade would be initiated at 1.1760. A take-profit and a stop-loss should accompany these trades.

Another approach to trade a breakout is to use the so-called break and retest strategy. This is where a financial asset makes a breakout and then retests the key support and resistance level. The retest becomes the ideal point to buy or sell the currency pair.

Other currency pairs

Useful hint for trading when currency pairs are consolidating is to look at alternative currencies. For example, if you focus on trading currency majors like EUR/USD and GBP/USD, you could look at other currency pairs. The other two types of currency pairs are minors like the EURGBP and GBPAUD and exotics like EURTRY and GBPTRY. These pairs tend to have a wider spread, which makes them a bit more expensive to trade.

Alternatively, you can shift your trading strategy to include other asset classes. For example, if you primarily focus on currency pairs, you can diversify your trading to include stocks, commodities, exchange-traded funds (ETFs), and even cryptocurrencies. Many forex brokers offer these assets to their traders.

Final thoughts

As a day trader, you will often find consolidation pairs. In this article, we have looked at some of the top reasons why pairs consolidate and some of the best strategies to use. We have looked at how you can use pending orders and how to employ price action tools to predict the direction of the breakout.