Simple beginner’s guide to forex fundamental analysis

In the world of forex, we distinguish traders into technicians and fundamentalists. These distinctions are according to the type of analysis they conduct to make decisions about what they will buy or sell. Technical analysis deals primarily with the intricate and mechanical aspects of price movements through the use of repeatable chart and indicator patterns.

On the other hand, fundamental analysis is the examination of economic, social, and political data of a specific currency. Arguably, the economic aspect means more to fundamentalists than any other fundamental data due to its accessibility and quantifiable comparisons.

The significance and disadvantages of fundamental analysis in forex

Fundamentalists like to believe that fundamental analysis is the underlying reason why an instrument’s price moves in a particular direction. Quotes are driven by millions of different market participants, all with a myriad of sentiments over a currency. According to fundamental analysts, the main reason for the price to move is due to the economic outlook over a currency. Their consequent expectation is that traders are acting on this very outlook.

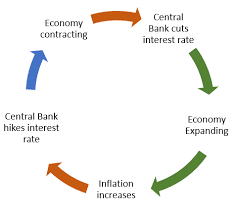

The significance of fundamental analysis can be seen even in the real world from the common man’s perspective. For example, inflation is one economic phenomenon that affects everyone in the world where the buying power of currencies becomes gradually weaker as the years go past.

Another real-world example is interest rates. Any accredited lender comes with its own interest rates for providing credit to consumers. These rates are never constant as they change depending on the fundamental factors of a currency.

If we apply these facts to the actual markets, several other economic indicators can contribute to the strengthening or weakening of currencies. Besides inflation and interest rates, other factors that do have some bearing on a currency include the GDP (Gross Domestic Product), the CPI (Consumer Price Index), and employment figures, to name a few.

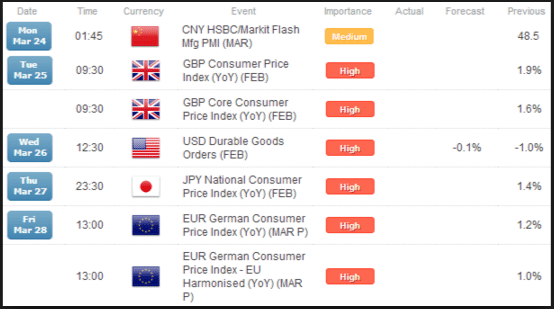

The host of different economic indicators is probably the main con of fundamental analysis that makes it complex and laborious. Each day, the economic calendar provides a list of many macro data releases, some of which have no significance in the markets and others with very little to significant impact.

Types of economic indicators

Analysts describe economic indicators as leading or lagging indicators. The former denotes indicators that change before the economy begins to follow a specific trend. In contrast, the latter denotes indicators change after the economy has already started following a particular trend.

Anticipating and interpreting economic data

Simplifying fundamental analysis involves picking specific economic indicators as your primary focus. This data should align with the type of trader one is. On the point of trader type, true fundamental analysis is more beneficial for long-term traders. While there are plenty of scalpers and day traders who trade the news (mostly high-impact news releases with quick and large volumes), the impact of nearly all fundamental indicators are only seen over weeks, months to even years.

‘Technicians’ (technical analysts) have long argued fundamental analysis is, for a large part, useless since any news release doesn’t always immediately result in a significant price move. Hence, this is the primary reason swing traders and, more so, position size traders appreciate this type of analysis.

Traders should familiarise themselves with the fundamental data which they believe is most comfortable to grasp and is the most significant with their investing horizons. Analysts measure fundamentals by growth (GDP), by inflation (PPI, CPI, etc.), by employment, by interest rate, and so forth. Each of these different classes individually can move the markets to varying degrees of distance. At this point, traders attempt to establish a bias by looking at two separate currencies instead of one, further adding to the complexity.

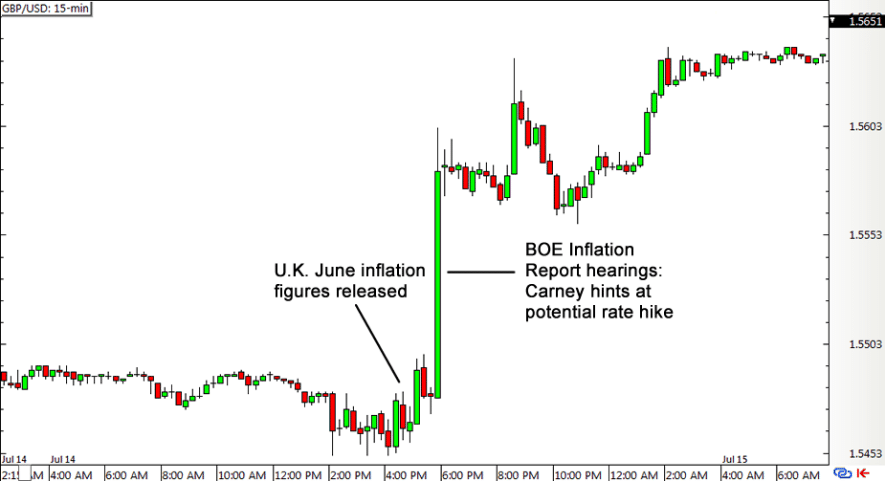

We interpret the actual economic data itself according to the previous, forecasted, and the actual figures that are eventually released. What’s tricky about fundamental analysis is there may not be something ‘to write home about’ between what the broader market anticipates about the figure (forecasted) and the figure that comes out.

Alternatively, a prevalent scenario may be that the market is not responding to, for example, an interest rate increase of 0.1% as it should. In a typical case, the expectation is bullish market as a higher interest, depending on other factors, is taken as a bullish sign. However, if the announcement is that a certain central bank won’t hike the rates until further notice, that may be the real catalyst for an extended bull market.

Overall, there are several different methods to interpret fundamental data that vary from one trader to another.

Conclusion

- Fundamental analysis isn’t inherently better than technical analysts. However, there are pure technical analysts and pure fundamental analysts. These choices are preferential.

- All economic data has minimal, medium, or significant impact in the markets. Traders should study the data that has the most relevance to them.

- For simplicity purposes, traders should further specialize in fundamental data either by growth indicators, confidence indicators, employment indicators, etc. in line with their trading goals.

- Proper fundamental analysis is best suited for long-term traders as only they can see its real consequent impact.

- Many nuances exist between the forecasted data, the actual data released, and even the aftermath of the release. These individual events can all have a bearing on where price may go in the future.