Foreximba is a fully-automated Forex expert advisor that works on multiple pairs. It is easy to set up and the vendor claims that anyone can use it, irrespective of their trading experience. This robot is supported by verified trading statistics and historical test results.

On the official website, the vendor has briefly described how the robot functions and what it offers. We have multiple links for backtesting and live trading results. The pricing details have also been clearly outlined, and there is a contact form you can use to send a message to the service team. Noticeably, there is no proper explanation of the trading strategy.

There is not enough information on the parent company behind this EA. We don’t know when it was founded or whether it has built trading systems in the past. The vendor has not revealed the identities of the team members and there is no official contact information.

Features

This is a robot that trades with a fixed lot size. It avoids using risky strategies like martingale where the lot sizes are enhanced to generate bigger profits. Foreximba has a drawdown control feature, but the vendor has not clearly explained how it works. It is not a broker-dependent EA, so you don’t have to worry about the special conditions of a particular broker hampering your trading operations. This EA only supports two pairs, namely AUD/USD and EUR/USD.

Nowhere on the official website has the vendor explained the trading strategy used by this robot. We don’t know whether it trades with the trend or against it. As such, we cannot determine which trading styles this EA is suitable for.

How to start trading with Foreximba

Foreximba carries a price tag of $194.99. Compared to other EAs, it is not that expensive. By purchasing this EA, you get a single lifetime license for a real-money account and three lifetime licenses for virtual-money accounts. The vendor also provides customers with a user manual. There is a 30-day money-back guarantee for this robot.

To get started with this Foreximba, you need to make a small minimum deposit of $60. It has high and medium risk settings, and you can choose one based on your requirements. For the live trading account, it uses 1:500 leverage.

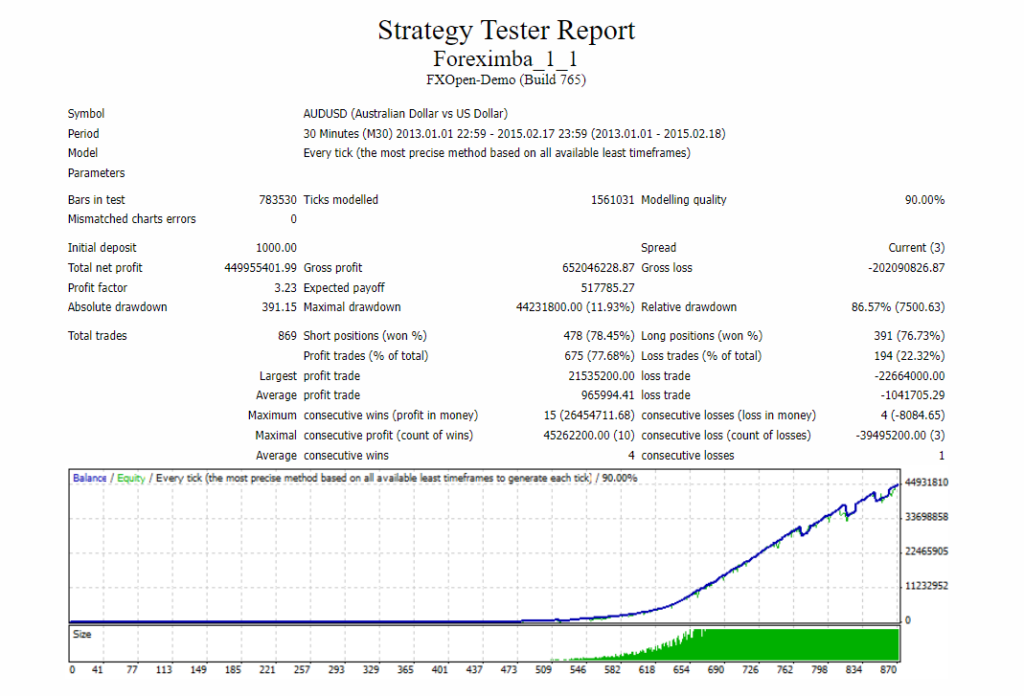

Backtests

This backtest was conducted on the AUD/USD pair using an every tick model for the M30 timeframe. The EA conducted a total of 869 trades, winning 77.68% of them and generating a total profit of $449955401.99. It achieved all this with an initial deposit of $1000. The relative drawdown for this backtest was extremely high at 86.57%. Thus, it is obvious that the robot was following a risky strategy. There were 15 maximum consecutive wins and 4 maximum consecutive losses for the testing period.

Verified trading results of Foreximba

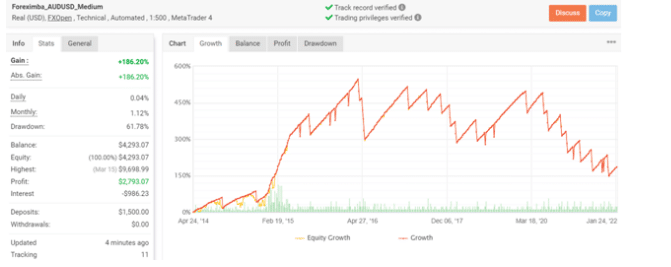

This is a real-money trading account on Myfxbook operating with medium risk and placing trades through the FXOpen broker. Since April 24, 2014, 917 trades have been placed through this account, and 72% of those have been profitable. Compared to the backtest, the win rate is slightly lower. The total profit is currently $2793.07, while the daily and monthly gains are 0.04% and 1.12%, respectively.

Looking at the high drawdown of 61.78%, we can say that the EA is prone to suffering losses frequently. The account has a decent profit factor of 1.08 and a time-weighted return of 186.20%.

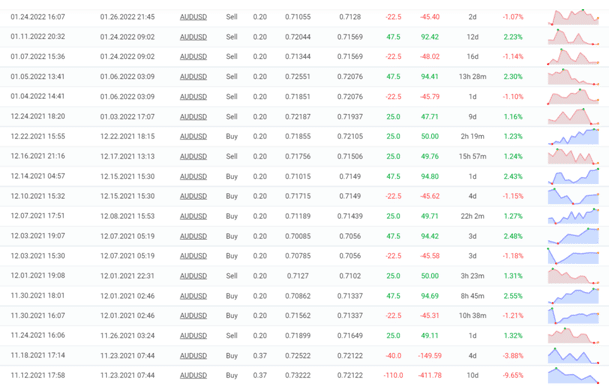

Here you can see the recent trades placed through this account. The EA trades with a fixed lot size of 0.20 and holds its trades for long time periods. In the month of November 2021, it suffered a couple of heavy losses, but since then, its performance has been quite steady. The average win and loss for this account are 28.21 pips/$59.62 and -64.03 pips/-$142.24, respectively.

Customer reviews

We were unable to find any user reviews for this Forex robot on third-party websites. It doesn’t seem like too many traders are currently using this EA.

Is Foreximba a viable option?

Advantages

- Affordable compared to other EAs

- Money-back guarantee

Disadvantages

- High drawdown

- Lack of vendor transparency

- Lack of strategy insight

Wrapping up

Foreximba is a system sold by a development company that we don’t have much information on. The vendor has not clearly explained the trading strategy, and the robot trades with a high drawdown. This is a robot that is affordable and comes with a money-back guarantee offer, however, there are no customer reviews for it.