Forex swaps refer to the interest that a trader accrues when he keeps the trade open overnight. Two kinds of swaps exist in forex: swap long – for long/ buy positions and swap short- for short/ sell positions. These two categories are expressed in pips per lot. In a swap long, money is debited from the trader’s account since the rate is negative. The money is credited in the trader’s account in a swap short since the rate is positive.

On the other hand, forward markets or contracts are agreements placed by currency exchange traders to protect them against market volatility (especially the unexpected increase or decrease in the market). Using a forward contract/ agreement, the trader locks in an exchange rate for a future expiry date. The agreement here is between two parties with set currency exchange values.

Trading Strategy

- Forward markets

Forward markets help traders to lock in an exchange rate so that they can buy or sell currencies within an agreed period.

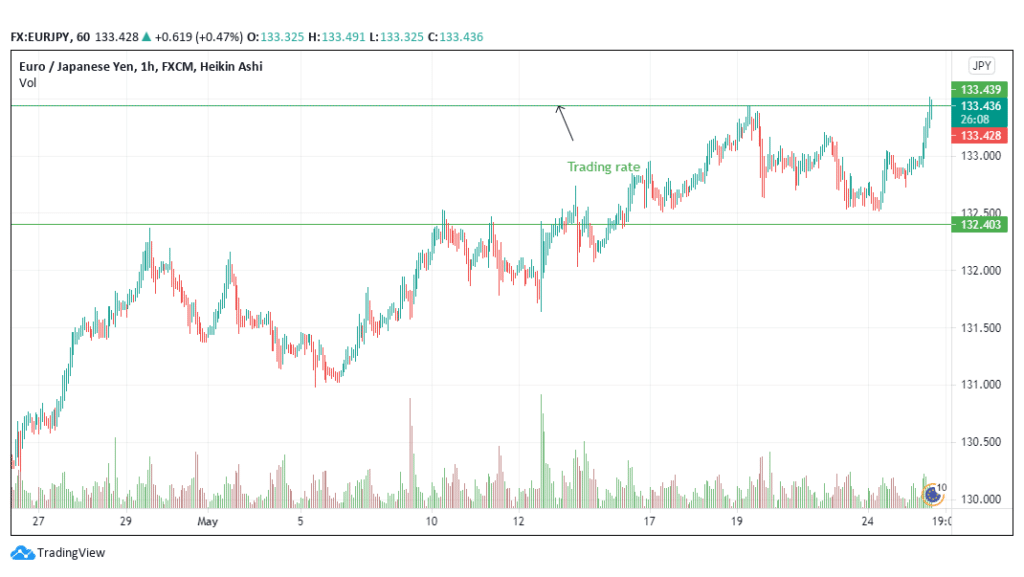

Figure 1: EUR/JPY trading rate as of May 25, 2021

For example, a trader in the EUR/JPY may intend to sell €50,000 and buy it as Japanese yen in 6 months. The trader may desire to enter into a forward contract to reduce exposure to the market volatility. The exchange rate can be fixed based on the intended market rate.

If the trader entered the trade on May 25, 2021, the exchange rate of the forex pair was 133.439. The trader knows that in six months, in whichever way the market trends, he will receive JPY 6,671,950. The agreed time, six months, is the future expiry date of the contract.

This fixed exchange rate protects the trader from the negative market trend that may weaken the euro against the Japanese yen. There is an agreed margin when trading through a broker, say 5% of the currency amount owed. Therefore, rather than receiving JPY 6,671,950, the trader or client will receive JPY 6,338,352.50 (less €2,500).

- Swap long/ short trades

In a swap trade, the currency pair has a standard lot that is multiplied by the pip value, and a swap long/ short trade. Pips in a swap long trade at -0.48 while pips in a swap short trade at 0.01 (according to contract specifications).

Figure 2: USD/CHF trading pair

For instance, if we want to short the USD/CHF pair on May 25, 2021 – a Tuesday, we will keep this position open overnight and close it on Wednesday (May 26, 2021). Since the swap value is the interest earned for keeping the value open, we will use the swap formula to calculate the value.

Note that on May 25, 2021, the USD/CHF pair traded at 0.8934

Swap = standard lot (1 pip * Swap short)

In the case of USD/CHF- 1 standard lot is 10,000, 1 pip is 0.0001, and the swap short is 0.01.

10,000 * (0.0001*0.01) = 0.01

Therefore, the swap interest rate earned in the USD/CHF pair is $0.01.

In the case of a swap long, the formula will be as shown below:

100,000 (0.0001* -0.48) = $-4.8

Therefore, if the USD/CHF is kept overnight from Tuesday (May 25, 2021) and the traders open a long position, it will earn -$4.8 per night. If the trader is a swing trader and intends to leave the trade for 3 more nights (until Friday- May 28, 2021), the Swap long for the three nights will be calculated by multiplying the three nights (Wednesday night until Friday night) by -0.48

That is 3 * (-4.8) = 14.40. The trader will therefore pay $14.40 interest for keeping the trade open overnight for the three nights. The more nights the trade stays open, the more interest a trader earns. In this case, the swap market acts as a digital rental facility in forex for swing traders. Swap trades count even during the weekends.

If the trader goes short for three nights, then the calculation will be three multiplied by 0.10 which is $0.3. Long swaps are negative, while short swaps are positive.

Swaps are “carry trades” charged by brokers and are also called tomorrow next (due to their rollover feature. As tradable elements, they fluctuate based on the market expectations. Different brokers can have varying rates for swap long or swap shorts.

If the rate for USD/CHF offered by a broker for long swaps is -14.40, and short swaps are +3.0, then the swap value will be calculated as follows;

With the USD as the account base, 1 point is 0.0001, and the exchange rate at 0.8934, the trade size for one lot will be $10,000.

(0.0001/0.8934) * (10,000 * -14.40) = -$16.12. This amount ($16.12) will be deducted from the trader’s account

If we were to short the contract, then the trader will receive $3.36 per day.

(0.00001/ 0.8934) * (10,000 *3) = $3.36

Please note that the standard lot will change depending on the foreign currencies being traded. For example, when the trader wants to swap EUR/USD, then the standard lot will be €100,000.

Figure 3: EUR/USD trading rate

Therefore, if the EUR/USD is trading at 1.2251 on May 25, 2021, with brokers offering long swap rate at -12.00 and short swap rates at +5, then the calculations will be as follows:

(0.00001/ 1.2251) * (100,000 * -12.00) = -$9.80. The trader will have $9.80 deducted from his account in a long swap.

In a short swap, the calculation will be as follows:

(0.00001/ 1.2251) * (100,000 * 5) = 5.60. The trader’s account will be credited with $5.60 in a short swap.

Conclusion

Forward contracts allow traders to lock in exchange rates so that they can protect their investments from market volatility. Swap rates are interest rates charged on clients when they keep trades open overnight. Long swaps are debited from traders’ accounts, while short swaps are credited in the traders’ accounts.