Hedging in Forex is a way to limit the risk involved. But you need to be careful if you are using it as a major component of your trading. Only professional traders can identify the market swing and time the trades accurately. Luckily beginner traders can also use the trading approach now because of the automated trading systems based on hedging.

The FXDC HEDGER EA for instance is a system based on hedging. It uses artificial intelligence to ensure minimized risks and better profits. As part of the FX Deal Club trading products, the system does not reveal much about the developer or the location info. Our experts have carried out a thorough evaluation of this system. This review will highlight the pertinent aspects of the system and its reliability.

Features

As a system based on hedge trading, this FX Deal Club product is projected as capable of providing appreciable returns without spending much time and effort on the trading. The strategy is based on resistance levels and price movement besides using the hedging method.

As per the vendor info, the expert advisor uses effective trading methods and simplified settings. High drawdowns are averted by the system by the hedging method. The vendor claims that the system can deliver a 10% daily profit. It works on just a single currency pair – EURJPY.

How to Start Trading with FXDC HEDGER EA

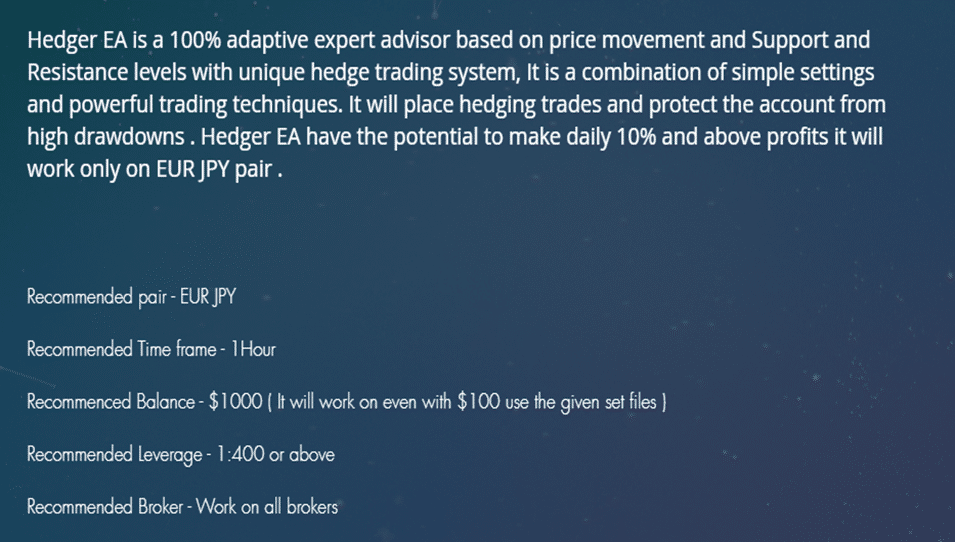

Priced at a single upfront fee of $499, the features offered with the package include unlimited accounts, free updates, and 24/7 customer support. We could not find a refund guarantee for the system which is disappointing as it indicates the system is not a reliable one.

The recommendations include a time frame of one hour, a balance of $1000, and the leverage starting from 1:400 and above. You can use any broker for this system. The vendor cautions against manual trades or the use of a different EA on the account.

Backtests

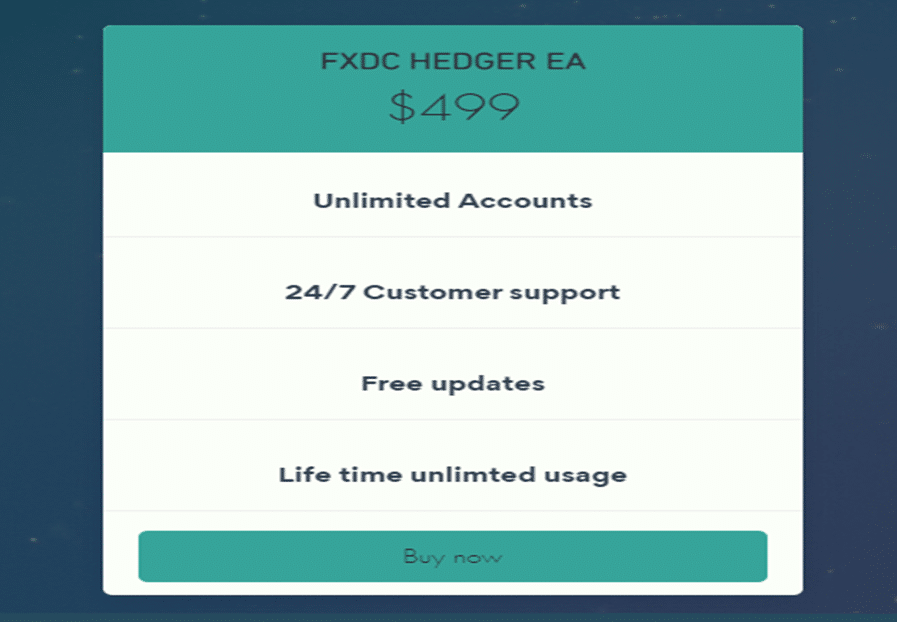

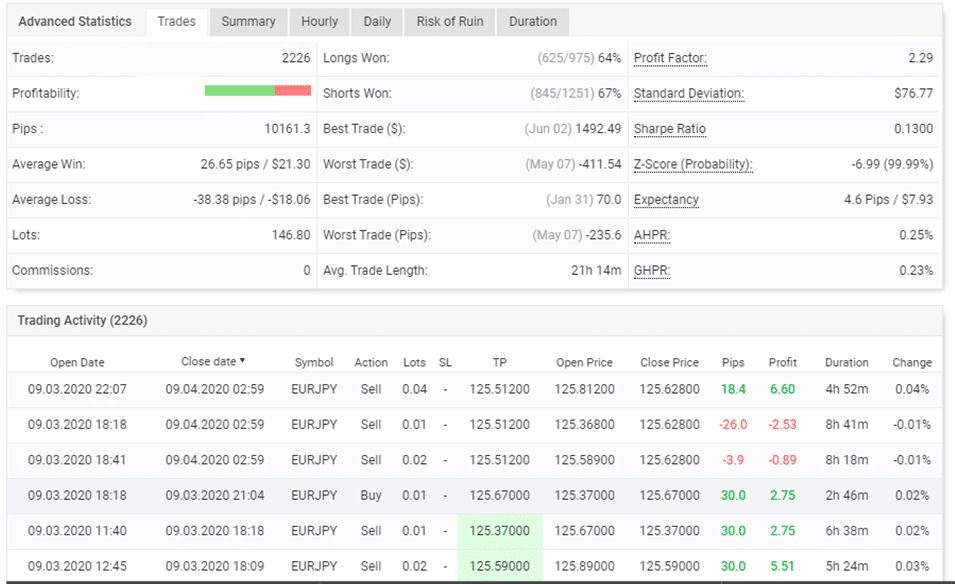

Three backtesting results are displayed on the official site. But the link appears to be broken as we couldn’t view the strategy test report details. However, we found the backtesting report on the myfxbook site. Here is a screenshot of the results:

From the strategy report stats, we could see the test started in January 2020, and ended in September 2020. The modeling type is Every Tick and the quality is 99.9%. For a deposit of $100, the system has delivered a total gain of 17656.52%.

The daily gain is 0.86%. This is not anywhere near the vendor’s assurance of 10% daily profits. A drawdown value of 82.43% is shown which is too high by any standard. The profit factor for the system is 2.29.

Trading Results of FXDC HEDGER EA

The vendor does not provide trading results for the system. Trading results form a vital part of any automated software system. With the vendor not obliging us with the results, we are unable to assess the performance of the system. The results verified on sites such as myfxbook, FXBlue, etc. reveal crucial details such as the total gain, drawdown, lot sizes, profit factor, and more. Without the results, we do not know whether the system is capable of providing the results that the vendor claims.

Customer Reviews

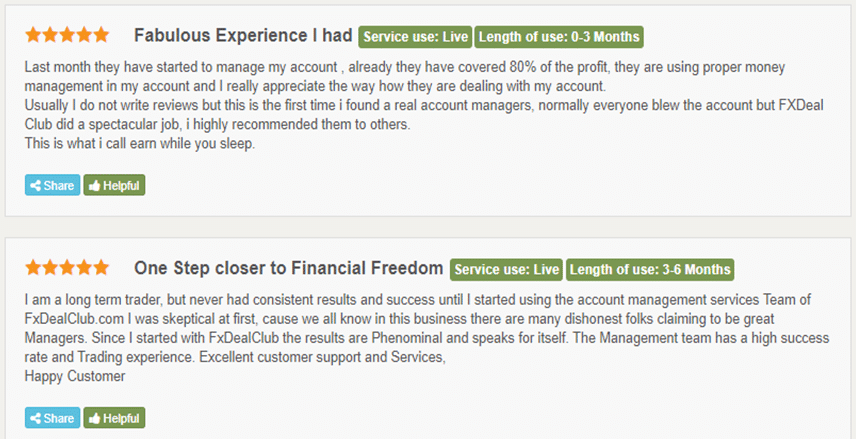

We could not find user reviews for the FXDC HEDGER EA system. However, there are reviews for the FXDC site on FPA. A screenshot of the results is shown here:

From the reviews, it is clear that users of the managed account service are satisfied with the vendor. But the lack of user reviews for the Hedger system looks suspicious. The failure of the vendor to address the lack of customer reviews makes the system unprofessional.

Is FXDC HEDGER EA a Viable Option?

After evaluation of the different and innovative aspects of the system, we have identified the following advantages and disadvantages:

Advantages

- Fully automated system

- Backtests verified by myfxbook

Disadvantages

- Price is expensive

- Trading results are not disclosed by the vendor

- No user reviews

- Vendor transparency is absent

Summary

Concluding our FXDC Hedger EA, we have identified many discrepancies in the system. For starters, the vendor is not transparent when it comes to revealing the developer’s name or the development team. Other factors that keep the system from becoming a reliable software include its difficult-to -decipher strategy, the expensive price, and lack of trading results. While the vendor provides backtests of 99.9% modeling quality verified by the myfxbook site, we could not find any real trading account of the system with verified results. From the backtesting, the high drawdown is a source of concern as it shows the risks taken are high. Most of the pertinent aspects of the system do not serve to make it look reliable. We would not recommend this system.