FXHUNTER tries to convince traders to invest in their algorithm and PAMM service using the backtest and live results. Unfortunately, while they may seem promising at first, the performance is actually lacking. Our article will discuss the essential aspects of FXHUNTER and break down the reasons why you shouldn’t invest in it.

Features

The robot has the following features coded in its algorithm:

- It comes with the ability to work in a single or both directions, i.e., buy or sell

- Uses money management to see if new orders can be opened or not

- It has settings for volume specification

- Has a unique control indicator with additional options for risk management

Strategy

The developer openly claims that the robot uses a grid trading strategy. He states that the algorithm enters the market if the right conditions are satisfied. It uses a bunch of indicators and capitalizes on over-bought and sold states to enter the market. If the price moves against the desired direction, it will continue to receive more orders. There is an option to hedge or grid.

The trading history is hidden in the live trading results. However, we can see the robot trades on six currency pairs that are NZDCAD, AUDCAD, AUDNZD, EURGBP, EURNZD, and GBPCAD.

How to start trading with FXHUNTER?

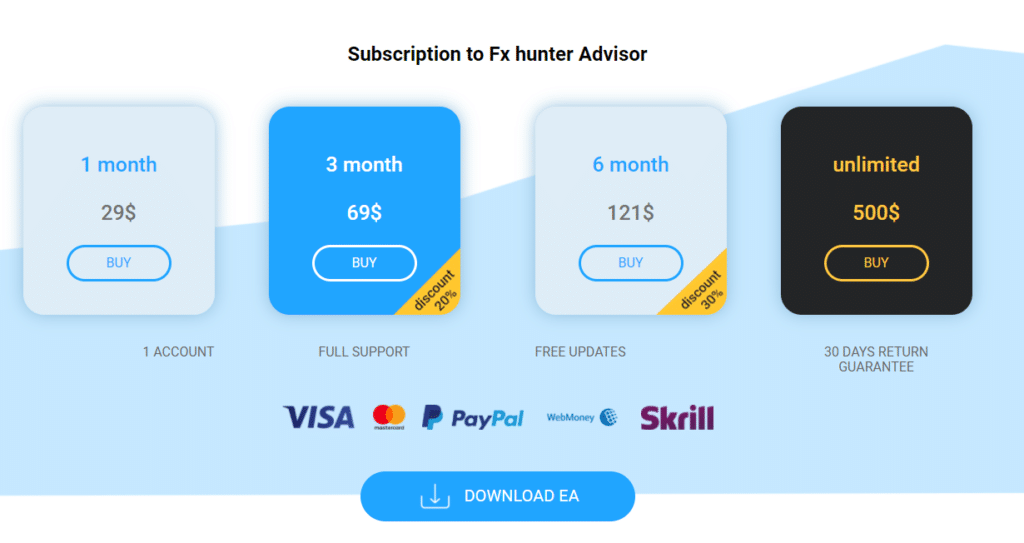

The robot comes with a subscription service that starts with as low as $29 a month. For complete ownership, there is a one-time fee of $500. You can also invest through their PAMM service, which is available on Alpari broker. There is no fee here, but you have to pay them a portion of your profit.

You can download the robot from their website once you purchase and enter the password. Then, place the ex4 file in the MetaTrader and enable auto trading for it to work.

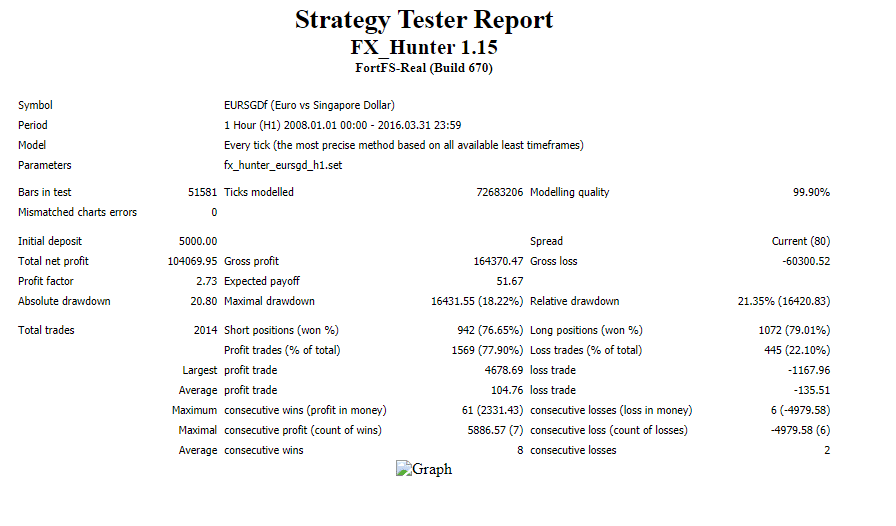

Backtests

Backtesting results are available with five currency pairs. Each worked on a different time frame which was probably best suited for that currency. The drawdown levels hang around 20% with the average win rate between 60-80%. The results are from January 1, 2008 till March 31, 2016. There was an exceptional performance for EURUSD and NZDCAD which made over $10000 in profits. Trading history is not available with backtests.

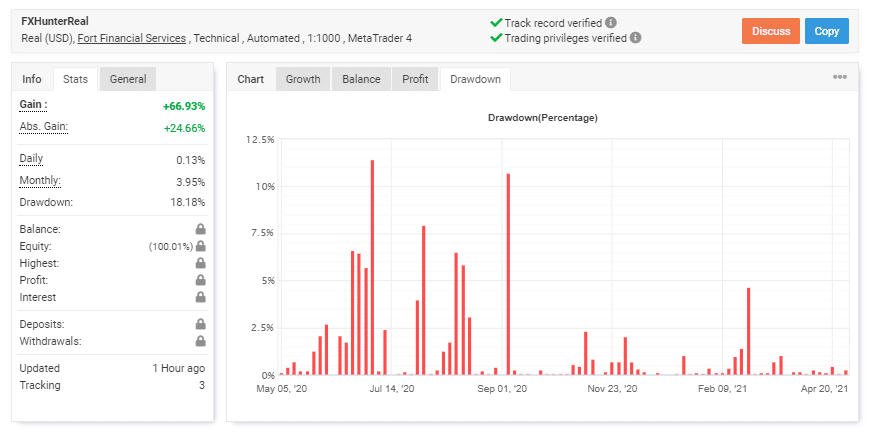

Verified Trading Results of FXHUNTER

Real (USD) account for the robot shows a monthly gain of 3.95% and a drawdown of 18.18%. The robot has been in action since April 30, 2020. The profitability was really high in the initial months but slowed down later on. Maybe the developer realized that it would reach a margin call if traded with high lots. The drop in the equity curve and the drawdown percentage confirm this. The system had a winning rate of 68%, with a profit factor of 2.48. Most of the information in the live results in a bid to mask the poor performance. This raises red flags and questions transparency. The output is undoubtedly different from backtesting results, where there is a much better ratio between percentage gain and drawdown. The winning rate and profit factor are more or less likely the same.

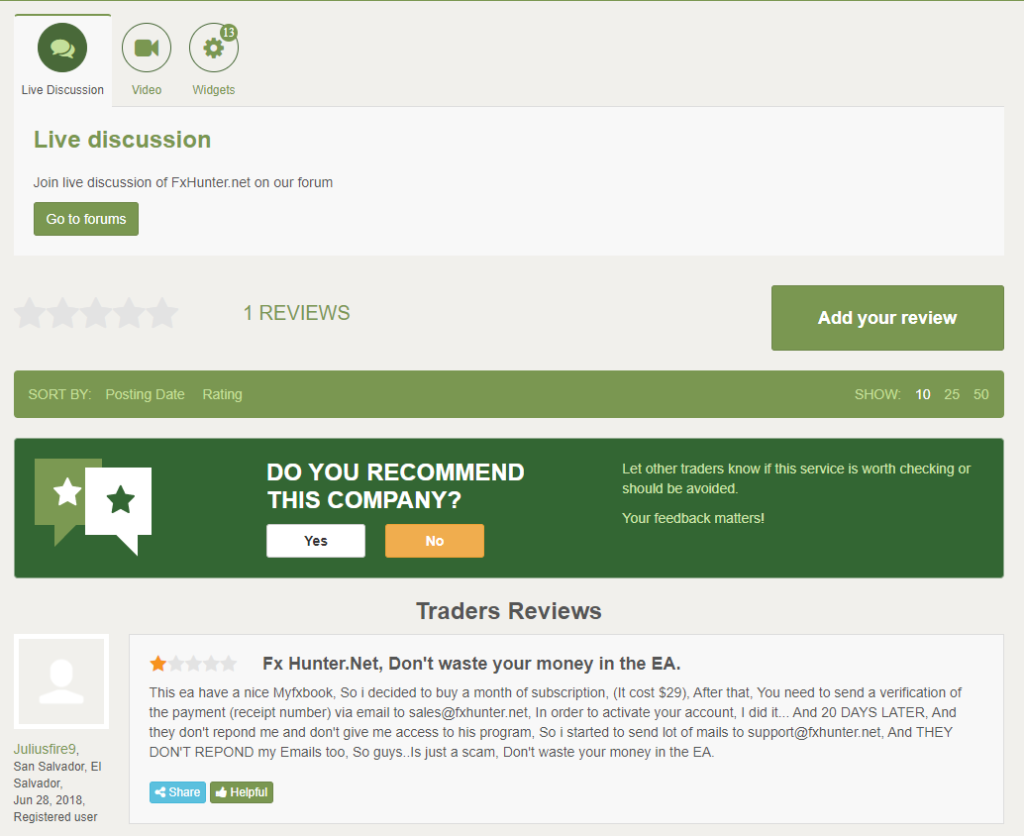

Customer Reviews

There is only one review available of Forex Peace Army, which indicates that the service is a hoax. The trader subscribed to the signal but did not receive the robot.

Is FXHUNTER a viable option?

The robot has low performance in contrast with similar grid systems in the market. There is also a high chance of liquidation. There is no transparency of the developing team as well.

Advantages

- Trading records available for the PAMM account are available for many years

Disadvantage

- There is a high drawdown

- No information is available for the developer

- Negative customer review

Conclusion

FXHUNTER EA does not satisfy the required performance criteria for it to be a good investment service. As mentioned before, the robot lacks transparency and good results and will only waste your money.