The company states that its EA has a 96.46% winning rate in the markets. They have tested out their strategy in 12 different brokers using different settings and price conditions. In our article, we dive down into the various statements and confirm if they are true or not.

Features

The robot has the following features coded in its algorithm:

- Automated trading while watching the markets constantly day and night

- Can work with micro, mini, and standard lot sizes

- Runs on demo and live account and any PC with no restrictions

- Free lime time updates, dedicated customer support, and easy 5-minute installation

Strategy

The developer provides no information on the trading strategy utilized by Galileo FX. On the images on the website, we can see that the robot comes with different set files that can be used on various timeframes and multiple currency pairs. This lack of transparency introduces numerous red flags for the expert advisor. We also cannot use the trading history from the live results as they are not available on the website.

How to start trading with Galileo FX

In order to start trading with the robot, you have to place the EX4 file in the experts’ directory of the meta trader platform. Enable auto trading from the tab and place the robot on the respective charts to begin trading. The team members do not mention the minimum initial deposit required to start trading with the system. As mentioned before, they have multiple set files and time frame recommendations on their website.

The robot comes at three different price points that differ on the amount of profits generated each month. A profit cap of $1000 a month comes at a price point of $249.95, while unlimited will cost you $949.95.

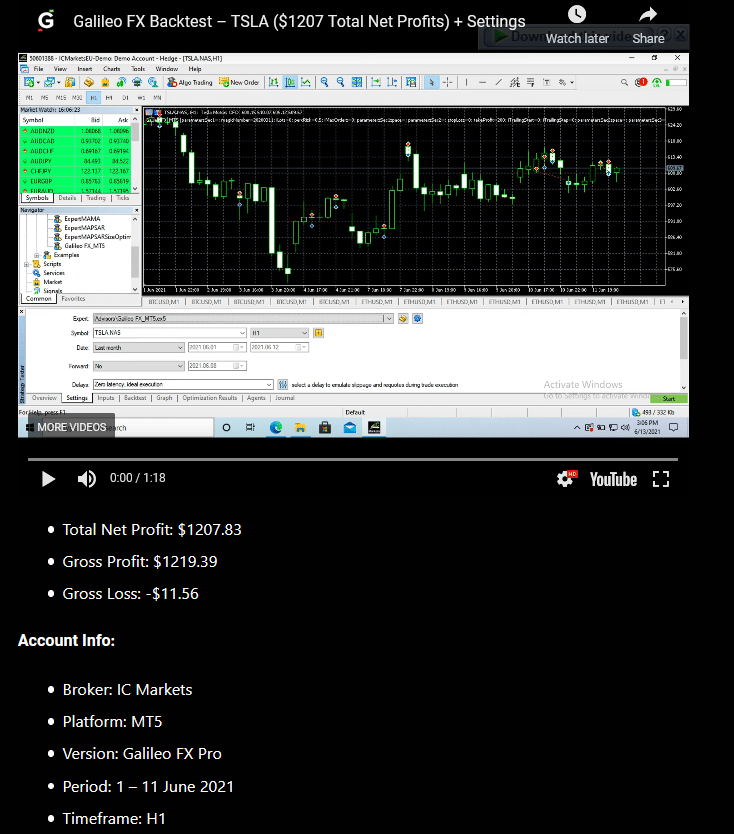

Backtests

Galileo FX does not hesitate to provide backtesting results for multiple instruments. They do not share a detailed statement or track them via noted tracking websites such as Myfxbook; instead, they provide a YouTube link for analysis. It is strange how all the backtests are available only for the MT 5 platform. The developer probably shared the best ones, and even then, the results are not satisfactory where the drawdown levels are up to 10%.

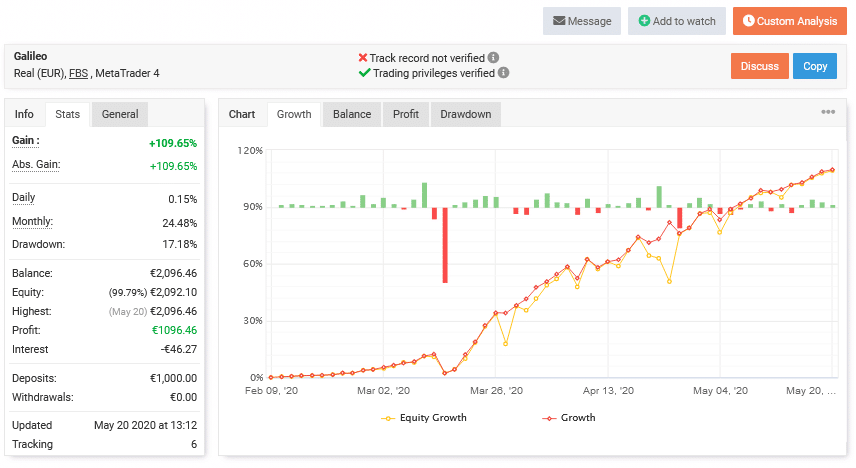

Verified Trading Results of Galileo FX

There are no life trading results available on the website to confirm the algorithm’s performance. This raises a lot of red flags for the profitability of the expert advisor. By performing a custom search on Myfxbook, we were able to get out some statistics. The records are not verified.

According to the results, the EA has a drawdown of 17.18%, with a monthly gain of 24.48%. It had a winning rate of 65% with a profit factor of 1.47. The best trade was 173.25 Euros while the worst was 364.46 Euros. The average trade duration was 19 hours and 16 minutes. The separation between equity and balance curve shows that the robot has been using risky strategies such as grid and martingale.

Customer Reviews

The company openly boasts its reviews on TrustPilot, where a total of 1457 give it a rating of 4.8. Unfortunately, most of the reviews appear as if the company has bought them. On the Forex Peace Army, the feedback is exceptionally negative that gives it 0 points. Customers state that the service is a scam.

Is Galileo FX a viable option?

Galileo FX fails to provide verified live trading results that could hint at its profitability. In addition, the robot has poor reviews on FPA that render it a bad option for trading.

Advantages

- Money management

Disadvantage

- No money-back guarantee

- Poor reviews on FPA

- No transparency of the developer

Conclusion

Galileo FX hints that it uses a risky strategy for trading and therefore should not be used as it can result in a margin call. Systems that hide their verified records usually sell using various tactics and fake reviews. This is the case with Galileo FX as well.