Grid Trading Bot is an automated cryptocurrency bot available on the Pionex website. It is one of the 16 integrated EAs available on the platform where the developer offers two types of Grid Trading Bots: “Use AI Strategy” and “Set Myself.” The algorithm gains profit from the ups and downs in the market, i.e., buying when the market is falling and vice versa. We will explain the success, supported exchanges, and all other details in this review to help you make an investment decision.

How does this crypto bot work?

Grid Trading Bot is a built-in algorithm in Pionex exchange that trades on auto mode using orders (buy and sell) when the market fluctuates. Traders can set the price range and the number of grids they want. The platform offers two strategies, one is automated, and the other is manual operated by the trader.

Getting started with Grid Trading Bot

Traders can start with the platform in the following steps:

- Sign up on the Pionex exchange

- Select a Grid Trading Bot from the list of available options on the platform

- With the automated technique, the AI will suggest the parameters according to the 7-day backtesting results

- The options such as the number of grids, upper, lower limit price, etc., are selected by the trader

Company information

Pionex was launched in 2019 with the company headquarters based in Singapore and regulated from the US. It was developed by the BitUniverse team with about 50 employees currently working in the company.

Features of Grid Trading Bot

The key features of the Grid Trading Bot can be listed as:

AI Strategy

This technique is governed by a Pionex AI adviser, which suggests the parameters for the EA based on backtesting records of a week.

Customized parameters

It is also known as the “set myself” strategy, where the investor sets all parameters. The trader selects an upper, lower limit price, total investment, and the number of grids.

No coding

There is no coding required to trade with this bot, as it is a built-in algorithm and can be selected from the list of EAs on the platform.

Strategies of Grid Trading Bot

The Pionex Grid Trading Bot works on the averaging strategy based on the uptrend or downtrend in the market. It will buy low and sell high within the specified range set by the trader. As mentioned before the two main strategies of Grid Trading Bot are “Use AI” or “set myself.”

Pricing, fees, and commissions

There is no monthly or annual subscription fee for using this bot. The Pionex exchange charges 0.05% commissions as trading fees.

Deposit requirements

The platform accepts deposits only in cryptocurrency, including Ethereum and Bitcoin. Pionex does not have a minimum deposit requirement or funding fee.

What exchanges does the Grid Trading Bot support?

Grid Trading Bot is a built-in algorithm within Pionex. It is one of the 16 bots on the platform and can only be used on this exchange.

What languages does Grid Trading Bot support in their product?

The website interface is available in multiple languages including English, Turkish, Chinese, Spanish, Portuguese, etc. For coding your algorithm there is no need for programming skills. The company does not mention which coding language they are using to develop their bots.

Can you really make money with this bot?

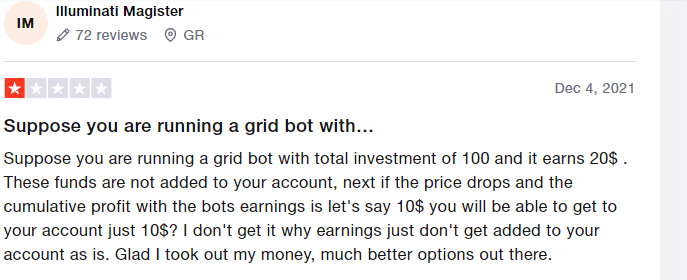

The profitability of the system depends on the market volatility. The developers give no guarantee to benefit from this bot. The use of averaging strategy can cause a high drawdown if the market trends significantly in one direction.

Advantage of Grid Trading Bot

- No programming required to use the service

- The trader can customize this bot

Disadvantages of Grid Trading Bot

- The platform does not offer a demo account

- The bot uses only uses 7 days backtest for determining the best set file

- It does not support multiple exchanges

Customer support

Customer service can be reached via email, live chat, or telegram. There is no phone number available.

Who is the Grid Trading Bot suitable for?

Beginners can use the bot easily as no programming skills are necessary, and the set file is made available. There is no need to open accounts on multiple exchanges.

Grid Trading Bot summary: is it worth using?

Grid Trading Bot is only useful when the market is ranging. As soon as the instrument shows momentum in one direction, the drawdown exceeds the threshold. Currently, the Pionex averaging algorithm is not compatible with multiple exchanges.