This is a trading strategy whereby traders identify and set up all their exit and entry orders for a trade. This is done by using predetermined intervals measured from the current price.

The strategy is premised on covering a trade regardless of the direction taken by the price. In essence, the various entry and exit points serve as pending orders that are executed in succession upon the closure of the previous position. These orders are commonly referred to as “legs” and ultimately create grids. The more the stop orders, the bigger the grid.

How it works

In this strategy, traders profit depending on the movement of the price away from the current price. Traders place their buy stop orders at carefully calculated intervals above the current market price to profit from a bullish market.

During a bullish movement, the buy stop orders put you in a long position. Similarly, sell stop orders are placed below the current price at intervals corresponding to the buy stop orders. Effectively, they enter a trader into a short position if the price depreciates.

With the grid strategy, traders will continue making profits for as long as the market moves in a direction that favors them. For instance, the buy orders will continuously grow your assets for as long as the price keeps rising.

However, this downside is that you can easily get distracted by the price rally only to see your gains wiped out by a sudden price reversal. Therefore, you should have a specific profit target and exit the market once you hit it.

The sell orders are purposely set up to minimize your losses in case the market reverses suddenly. However, due to their distance from the profit levels, the triggering of these orders may come in too little too late, when the market has already reversed all gains made during the uptrend.

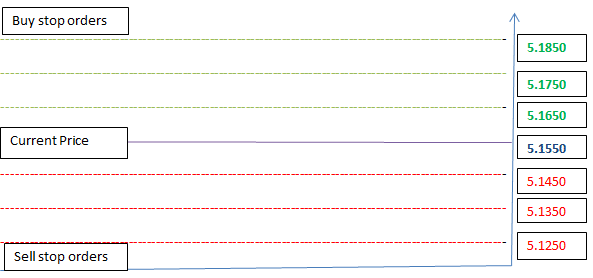

The illustration below depicts how to set up a grid strategy.

From the setup above, the current price is 5.1550. The setup has used buy and sell stop orders at intervals of 0.1000. The intervals are equidistant, meaning that the closure of one trade triggers the opening of another trade.

However, you must not always use similar intervals for your grid. One of the most common ways of setting up the levels is by using the already-established levels of support and resistance. You may set up three levels of resistance (R1, R2, and R3) and three supports (S1, S2, and S3).

A grid strategy is a form of trading the trend. Eventually, if a market rallies strongly for a long time, the price will breach the current support and resistance levels. At some point, the market may enter into a range.

Therefore, it is crucial to understand the potential market movers and the extent to which they can propel price movements in either direction. Below are ways to trade in a trend and a range market.

Grid trading during in a trending market

All traders set up their grid hoping that the price rally will be strong enough to touch all the levels either on top or bottom of the current price. The price movement should be towards one direction without reversing to the levels on the opposite side to make a profit.

Therefore, work with a profit target and close all positions once you reach your profit. Otherwise, you risk losing your profit if a reversal occurs.

Grid trading in a range market

Volatility may trigger unsuitable conditions for either a price rally or a downtrend, resulting in a range. This can create a situation whereby the price oscillates wildly both above and below the current price. This may trigger sell orders and buy orders at a high frequency, ultimately leading to a loss.

Pros of grid trading

This is one of the few strategies that enable traders to profit from a trend regardless of the direction of price movement. As long as you’ve spaced out your buy orders and sell orders at the proper intervals, you stand to benefit, provided that the market is not volatile and a well-defined trend is established.

Cons of grid trading

This strategy uses pending orders to execute trades. Some traders can easily fall into the trap of setting up many pending orders, which can be challenging to manage because it means watching several trades simultaneously.

Secondly, one can easily fall for the temptation of leaving their positions open even after making decent profits. This is common when a market is trending and showing strong momentum. However, a sudden reversal can lead to costly losses.

In summary

Grid trading can be pretty profitable if set up correctly and stick to a predetermined profit target. You should also ensure that you open trades that you can comfortably manage. However, the strategy is limited in its profitability and can lead to losses in a range market.