EUR/USD is a popular currency instrument that elicits strong volume and unique trading opportunities in the $6 trillion forex market. It is one of the most liquid and most traded as it represents two of the biggest economic blocks. It came into being in 1999 on the introduction of the common currency to European nations.

Conventional naming structure

The conventional naming structure sees the EUR appearing on the left-hand side of the pair as the base and the greenback on the right-hand side. Consequently, any price will always show the total number of U.S. dollars needed to buy the euro.

When EUR/USD is 1.2890, it simply implies 1.2890 dollars are needed to buy one euro. In this case, the common currency is considered much stronger as one needs more dollars to buy it. If its value drops to 1.2000, it means the buck has strengthened, thus lowering it.

Similarly, if the price were to increase to 1.3000, then it means the E.U. money has strengthened against the greenback, consequently requiring people to pay more for one euro.

Direct vs. indirect naming structure

The direct and indirect quote comes into play depending on who is trading a given currency instrument. Likewise, for traders within the European Union, the EUR/USD is a direct quote given that the euro is the domestic legal tender and the base in the instrument.

The buck, on the other hand, is the quote as it appears on the right-hand side. For Traders in the U.S., the instrument is an indirect quote given that their domestic fiat is on the right-hand side of the instrument and not on the left or the base.

The direct and indirect naming structure comes into being depending on the strength of the currency. Therefore, the more dominant legal tender will always be on the left side as the base, while the less dominant will be on the right-hand side.

While the greenback is the most popular, the euro is considered more dominant, thus appearing on the left-hand side. A similar situation is synonymous with greenback instruments involving sterling pound AUD and NZD.

When paired with the Japanese Yen, Swiss Franc, and the Canadian dollar, the greenback turns out to be the base fiat as it is the dominant of the trio. Likewise, it is common to see the buck appearing on the left when paired with the Swiss franc and yen.

Factors that influence EUR/USD

As one of the most traded, the EUR/USD price fluctuates as traders react to various developments across Europe and the U.S. Additionally, its value is influenced by many things.

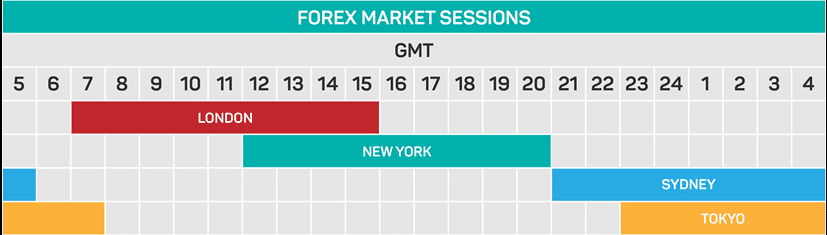

Session

EUR/USD tends to see the most action during specific times of a given trading day. Therefore any person serious about profiting from this fluctuation should have in mind the perfect time to trade it.

While EUR/USD can be traded any time of day as long as the market is open, it is most volatile and generates exciting opportunities when the European and American sessions overlap.

While the European session is open at 3:00 AM ET and closes at 12:00 PM ET, the New York session in the U.S. opens at 8:00 AM and closes at 5:00 PM. The overlap between the two sessions occurs between 8:00 AM ET and 12:00 PM ET.

When the overlap is in play, more players are trading the instrument giving rise to some of the best opportunities. The increased number of market participants often causes the price to fluctuate rapidly. Additionally, when the overlap is in play, the bid and ask spreads for the instrument narrows significantly.

Institutions and personalities

EUR/USD is always susceptible to sentiments choked by some institutions and personalities with a huge say on monetary policy. The European Central Bank and the Federal Reserve are the two big institutions with a huge sway on its price action.

The two central banks initiate various policy measures that go a long way in influencing traders’ sentiment. Likewise, traders are always looking for monetary policy reports from the two institutions to gauge which direction the instrument is likely to move.

Sentiments echoed by governors and chairs of the ECB and FED also have a huge say on the EUR/USD rate. The market is always on the lookout for speeches by the chair of the two banks to try and gauge the direction of monetary policies known to influence traders’ sentiments, consequently the price.

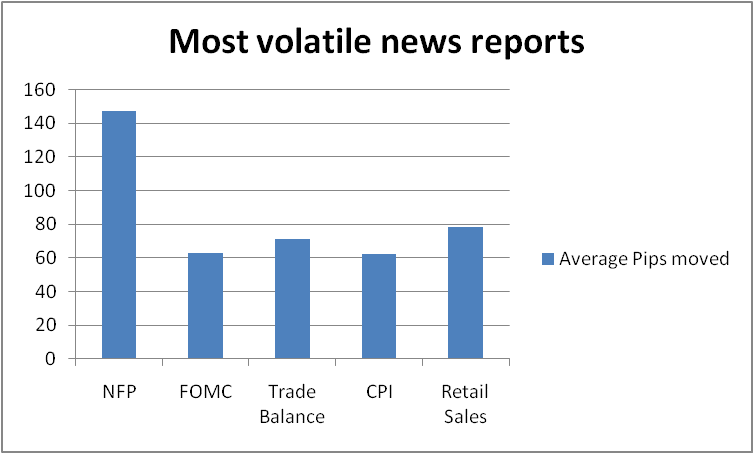

Economic reports

Economic reports issued across the two economies have one of the biggest impacts on the EUR/USD instrument on swaying trader’s sentiments. Traders are always on the lookout for economic reports as they paint a clear picture of the health of the U.S. and European Union economies.

The economic reports also provide insights into the policies that policymakers are likely to implement to steer economic growth and avert economies heating up. Some of the most followed economic accounts touch on employment, such as the Non-Farm Payroll, Consumer Price Index report, GDP reports, and manufacturing data.

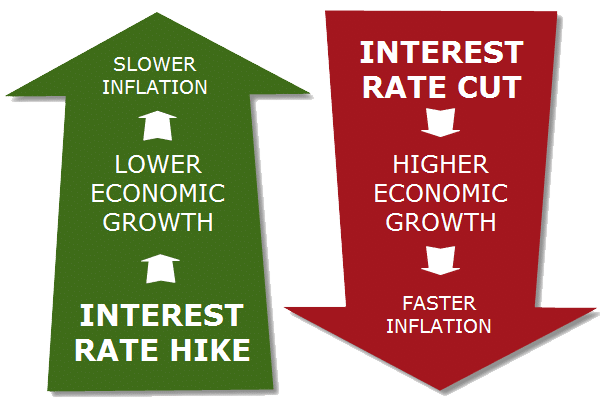

Interest rates

Interest rates are the single most important monetary policies that influence exchange rates a big deal. The pair will always rise and fall depending on the benchmark in the U.S. and the E.U. Whenever the U.S. increases its benchmark rate, the same implies economic strength, consequently leading to dollar strength, sending the instrument lower.

Likewise, whenever the ECB hikes the benchmark, the same implies resiliency in the E.U. economy, leading to EUR strength, thus sending the instrument higher.

Bottom line

The EUR/USD is a major instrument in the forex market as it represents two of the biggest economies in the world. Conventionally it is framed as the EUR/USD, which means it is a direct structure for participants in the European Union and an indirect structure to players in the U.S.

While it can also appear as USD/EUR, the conventional quoting structure entails the euro being the base and greenback the quote.

Interest rates, economic indicators, institutions, personalities, and sessions are factors known to affect the instrument value. How traders react to these factors determines whether the value will appreciate or depreciate.