Black Monday existed before October 19, 1987, but this particular event is more significant because it precipitated reforms that guide the stock market till today. The 1987 Black Monday happened because of unfettered risk-taking and structural flaws that were yet to be identified.

For starters, the US stock market lost 12.82% in value on Monday, October 28, 1929. Hence, this is the first Black Monday recorded. Since then, the global stock market has experienced three more Black Mondays – in 1987, 2015, and 2020. The focus of this article is the October 19, 1987 market correction.

What is the 1987 Black Monday?

The US Federal Reserve describes October 19, 1987, as the “first contemporary global financial crisis.” Media reports did not mince their words when announcing the crisis to the world. On the following day, the Los Angeles Times ran a headline that read, “BEDLAM ON WALL STREET: Across Nation, a Feeling of Shock, Fear.”

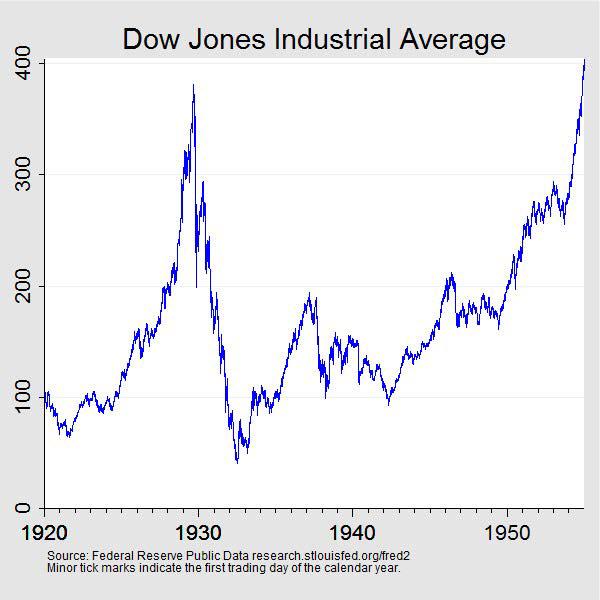

Indeed, the events in the stock market were nothing short of bedlam. The market distress spread from the Hong Kong session and terminated in the New York session. All US markets reported losses; the Dow Jones Industrial Average (DJIA) lost 22.6% and the S&P 500 sunk 20.4%.

For context, stocks across the US declined 12.82% during the Black Monday of 1929. The previous Thursday, the market had lost 11%. The numbers were huge, and they were to headline countless discussions among finance experts for close to 60 years.

Figure 1: Performance of the DJIA before and after the 1929 Black Monday

Like any other financial crisis, crowds of people developed an interest in what was happening. According to the LA Times report cited earlier, NYPD personnel was busy battling crowds by 5:30 p.m. on Monday. Some of the reasons people were jamming the Wall Street district are plain hilarious. For example, some people wanted to see Wall Street at its worst. Another couple of visitors were queued up at the New York Stock Exchange’s visitors’ entrance on Broad Street. Reason? They were waiting for people in suits to jump onto the street in apparent suicide!

Why did Black Monday happen in 1987?

The Federal Reserve’s official report cites structural flaws and novel problems arising from new technology and new products as the crisis causes.

Structural flaws

Technology became a huge phenomenon in the global financial industry in the late 80s. The increased use of technology introduced and propagated the concept of derivatives trading. While the market was good for liquidity and the depth of the market, it exposed specific structural flaws in the US stock market.

For example, the exchanges cleared and settled different trades in different timelines. Exchanges settled transactions for stock trades after three days, while the derivatives market (futures and options market) settled after 24 hours. The result was a cash settlement mismatch that created a virtual liquidity crunch in the market. Without a liquidity injection by outside forces such as the Fed, trading could not go on.

Another structural flaw that emerged in the build-up to Black Monday was the powerlessness of security exchanges to intervene when trading got too hot. Before the Black Monday of 1987, exchanges could not halt trading to control a rapidly declining market, especially when the selling entailed large-volume orders.

New products

Derivatives trading was still a new concept by the late 80s. Options and futures expanded the product scope in which investors and traders could commit funds hoping for a profit. The derivatives market had evolved so much that, leading to the crisis, investment firms were packaging these products as a hedge against stock trading risk – also called portfolio insurance.

Portfolio insurance entailed using derivatives to short the stock market to counterbalance the decline in the value of a stock portfolio. Given that portfolio insurance was a popular hedging strategy, almost every trader was in on it. Therefore, the strategy fed the downward spiral of the market as sell orders flooded securities exchanges.

Computer trading

1980s America was wild. A former Hollywood actor was in the White House. The US had just persuaded its major economic rivals to help in manipulating the dollar exchange rate, and investors and traders were experimenting with computer trading. Other names for computer trading were automated trading and program trading.

Traders had discovered that a computer program could automate cumbersome tasks such as technical analysis. Also, the program could execute trades automatically without human input. By the mid-80s, investment firms and individual moneyed traders were using computers to execute large-volume trades.

However, the programs had one crucial flaw; they are not reasoning beings but rather take instructions and act accordingly. Upon reports from the London and Hong Kong sessions reaching New York, the market sentiment turned negative. For this reason, the computer programs went into a liquidating frenzy.

Regulatory response

The crisis was a wake-up call for regulators, especially because investors needed a reason to regain confidence in the market. The US Fed under Alan Greenspan took various steps to plug the holes the crash exposed in response. Some of the steps taken were short-term, and others (such as structural reforms) were long-term.

To correct the problem of liquidity arising from cash settlement mismatch, the Fed encourages banks to turn the liquidity spigot all the way up. Commentators such as Ben Bernanke argued that the strategy was good “for the preservation of the system as a whole,” but it was losing money for the banks.

On the issue of structural flaws, the aftermath of the 1987 Black Monday ushered in reforms that guide the market. For example, trade-clearing protocols were harmonized to avoid cash settlement mismatches. Also, regulators allowed securities exchanges to halt trading in the face of sudden surges – either upsurges or down-surges.

Conclusion

The Black Monday pandemonium aroused investors and traders to risk. Risk management became an integral part of investing, and the usage of computer programs was more cautious. But whether the market took the lessons of the 1987 Black Monday to the heart is a matter of conjecture because similar events have happened since then, more than once.