Hippo Trader Pro works on EURUSD at the M1 time frame and uses the relative vigor index to analyze the markets. The robot comes with multiple inputs that traders can tweak according to their liking. Let us see if we can make good profits through the use of the algorithm while keeping the risks on the lower end.

Features

The robot has the following features:

- It has multiple settings that traders can tweak.

- It is FIFO compliant.

- It works on both MT 4 and 5 versions.

- It has backtesting records that date back up to 2003.

Strategy

As mentioned before, the EA works on the M1 chart on EURUSD and employs a relative vigor index to analyze the pair. It looks for the main trend on the market and does not use any indicators. The robot employs the ATR for proper entries. The historical records on Myfxbook show that the algorithm employs grid and martingale strategies to profit in the market. The developer does not declare this openly, which is a poor approach.

How to start trading with Hippo Trader Pro?

The robot can be downloaded directly into your MT 4 or 5 platform from the MQL 5 community after the purchase. Traders will then have to attach it to the EURUSD chart and enable the auto-trading button.

The developer recommends using a minimum deposit of $3000 for backtesting purposes. There is no statement on leverage, however, the records on Myfxbook show the implementation of 1:500.

The asking price is $299, and there is no money-back guarantee. Traders can also rent it for 1 and 3 months at $199 and $269, respectively.

Backtests

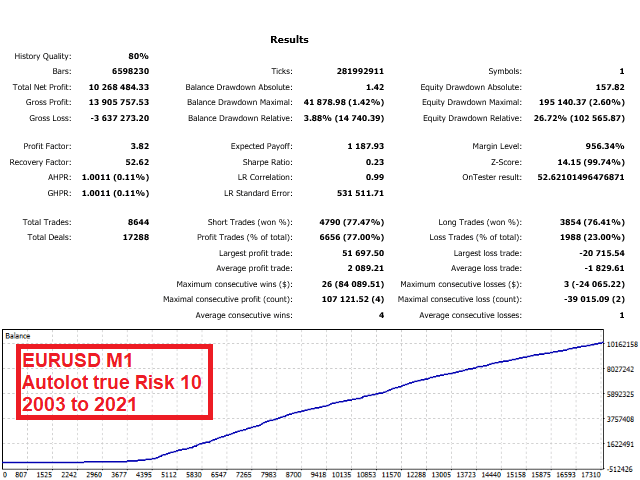

Backtesting results are available for EURUSD. The duration of the test is 2003-2021. For EURUSD, auto lot size enabled the robot to have a maximum drawdown of 26.72 and turned an initial deposit of $1000 into $10268484.33. It had a winning rate of 77%, with a profit factor of 3.82. The average amount of profitable trades was $2089.21, while the average amount of losing deals was -$1829.61. There were a total of 8644 trades executed during this period.

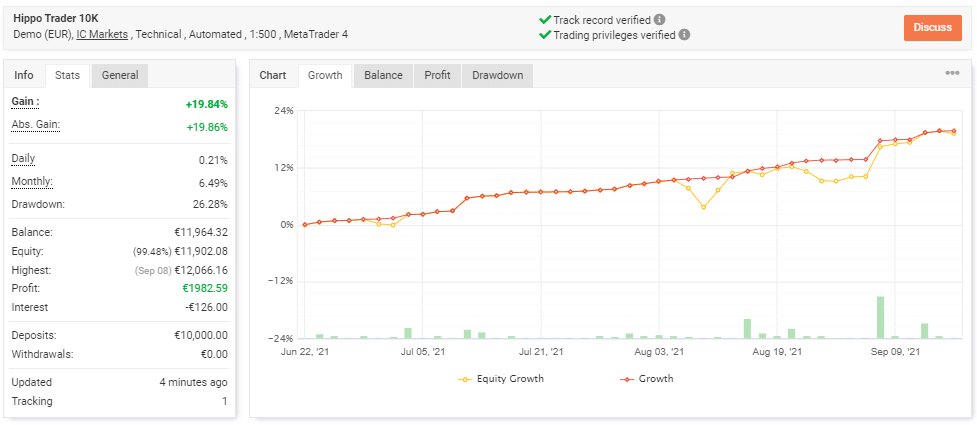

Verified trading results of Hippo Trader Pro

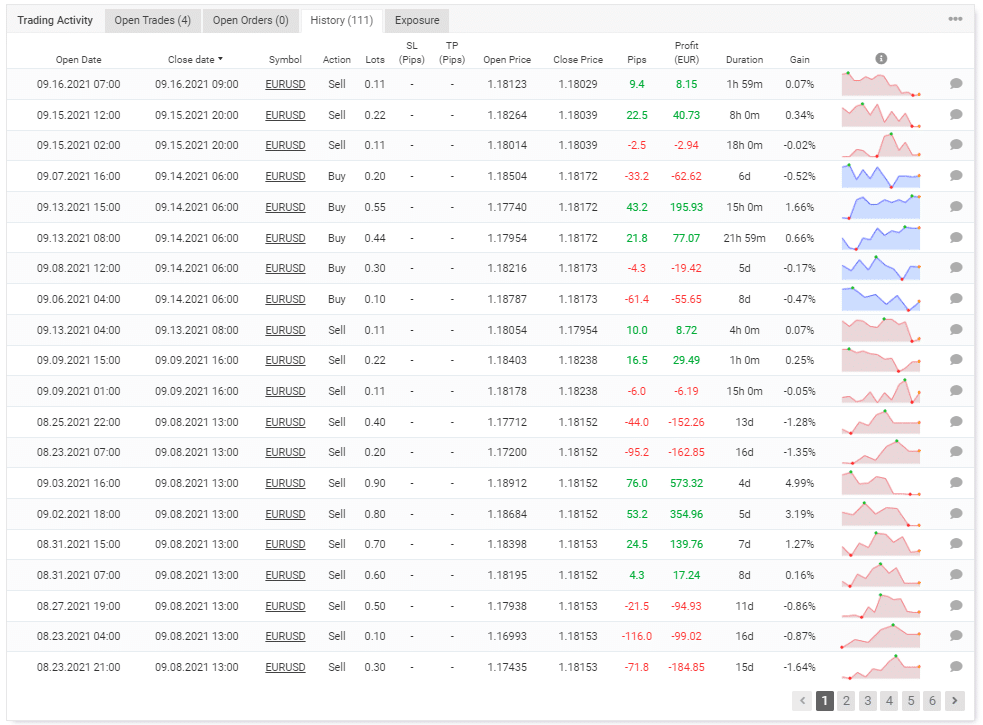

Live trading results are available on Myfxbook from June 22, 2021 till the current date for a 10k account. Since then, the robot has had an average monthly gain of 6.29%, with a drawdown of 26.28%. There were 112 trades in total, with an average holding time of 2 days. The expert advisor traded with a winning rate of 69% with a profit factor of 2.47. The best trade was 573.32 Euros, while the worst one was -184.85 Euros.

The developer tests the system of a demo account. They might be afraid of putting real money on the line as the algorithm uses risky grid and martingale.

Vendor transparency

Michela Russo is the author of the EA who resided in Italy. He has a total rating of 4.7 for 201 reviews. The developer has six products published on the MQL 5 marketplace and has a total of 91 subscribers for his services. He has experience of two years. There are no certificates to highlight the knowledge of the trader.

Is Hippo Trader Pro a viable option?

Hippo Trader Pro uses risky grid and martingale strategies that do not work when the market is trending. This can lead to a high drawdown or even complete liquidation of your portfolio, which makes the algorithm unreliable.

Advantages

- Provides backtesting for an extensive period

Disadvantage

- It uses grid and martingale

- There is no stop loss attached to trades

- Live records are on a demo account

Conclusion

Hippo Trader Pro is not an efficient algorithm due to the implementation of a risky approach. The developer tries to hide this on the MQL 5 marketplace. Through live records, we were able to know that the EA is not fit for use.