Ethereum was the first blockchain to launch with smart contract capability. Since then, all the subsequent blockchains have come with this functionality, which enables the development of decentralized blockchain apps (dApps) on them. Most of these dApps have a finance component, and they handle funds to the tune of millions, if not billions of dollars. For that reason, there is a dire need for ensuring the security of the smart contracts on which they run, lest their investors lose their hard-earned capital. This is done by carrying out security audits.

Smart contract security audit

Smart contracts are audited by examining the comments on their underlying code. Most of these contracts are coded in the Solidity language, and their code is usually accessible via Github. These audits are especially necessary for decentralized finance (DeFi) projects that handle millions of dollars in transactions and involve large numbers of players. Investors of such DeFi protocols will typically want to see glowing reports from these audits before investing in the projects.

Typically, auditors follow a four-step procedure when analyzing these projects. Below are the steps involved.

- Obtaining the smart contract from the project’s developers for examination and analysis.

- Auditors present a preliminary report to the developers on any issues .

- The developers make the necessary fixes and adjustments.

- The auditor examines the updated code and releases a final report.

What makes these audits absolutely necessary?

Since the inception of blockchain technology, there have been several malicious attacks on a number of these networks. For instance, there was a DAO hack on Ethereum, which saw the hackers make away with around $60 million in ETH. This even caused a hard fork in the network. These hackers typically take advantage of any errors on the smart contract codes.

What makes such attacks dangerous is the fact that transactions made on a blockchain are irreversible. Therefore, all measures must be taken to ensure the code behind a project has no weak links. If anyone manages to sneak in fraudulent transactions into a verified block, recovering any stolen funds would be next to impossible.

The auditing process

Usually, auditing the smart contracts starts with defining the scope of the audit. This begins by identifying the project’s goals as well as its architecture. This way, the audit team can understand how best to examine the ways in which the project’s code achieves its goals. This helps them provide the project team with a quote depending on the amount of work they’ll need to undertake.

Once this is done, the auditors then run the necessary tests on the code. Depending on their needs and resources, they can test the code manually, automatically, or both. They then write a preliminary report to the project team highlighting all the necessary fixes. Once the fixes are made, the auditors will then draft a final report detailing the performance of the smart contract.

What security audits look out for

- Transaction efficiency

Apart from blockchain security, these audits also check to see how efficient the transaction process is on the project’s network. If smart contracts need to carry out several complex transactions to complete a single function, unnecessarily high gas fees could be introduced. For that reason, these smart contracts have to find the most optimal way of completing their functions. This will ensure that transactions are fast and cheap.

- Security flaws within the code

Usually, auditors will simulate common malicious attacks on a project’s smart contracts to check for any vulnerabilities. For instance, a poorly structured code may provide a prior warning of sales or purchases on the platform. This could allow users to utilize such leaked information to trade for their own benefit.

- Platform security vulnerabilities

Sometimes, hackers will take advantage of flaws in the API that interacts with the dApp, or the website on which it is hosted. For that reason, security audits will often include checks on these platforms to ensure their stability.

Audit reports

This is where the auditors present their findings to the project team. For transparency, the project team is expected to publicize such findings to its users. These reports will list all flaws, and vulnerabilities found, categorizing them as critical, major, or minor. They will also contain recommendations on how to improve the code, examples of repetitive or redundant code, and a detailed breakdown of errors in the code. As aforementioned, the audit team will often give the developers time to correct highlighted issues before releasing a final report.

Industry leaders in the auditing space

- Certik

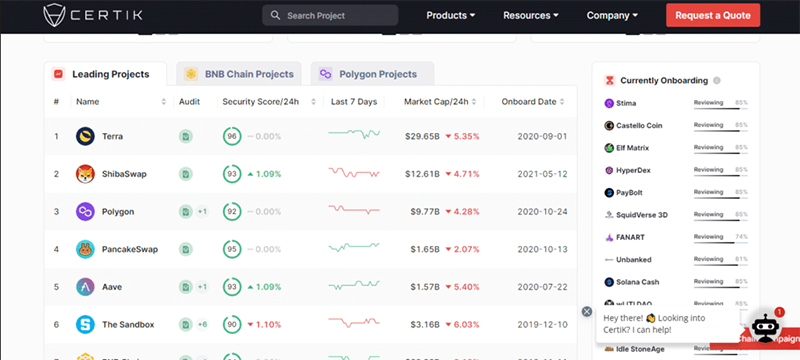

This is a renowned firm that carries out smart contract audits. The projects they’ve audited include PancakeSwap, a popular decentralized exchange on BSC. In fact, most of the projects on Binance Labs have been certified by this market leader. Certik also audits projects on Ethereum and Polygon.

On their website, there is a leaderboard listing their audited projects ranked by their security scores.

ConsenSys Diligence

This is an auditing firm that was founded and is currently headed by Joseph Lubin, who was among the founders of Ethereum. The firm is mainly concerned with auditing Ethereum smart contracts. They also have an algorithm-based service for checking Ethereum Virtual Machine (EVM) compatible smart contracts for common vulnerabilities.

In a nutshell

Blockchain products and decentralized finance are still in their nascent stages. Therefore, as investors buy into these products, there is a need to ensure their security and reliability, lest they fall into rug pull scams. Luckily, there are several renowned auditors of the smart contracts on which these projects run, as well as the networks and websites they are hosted on. Therefore, the onus is on you as an investor to ensure you read a project’s audit report before investing capital in it.