Two phrases come to mind when speaking about the foreign exchange market; safe-haven assets and currency pairs. If you are wondering, these phrases have no particular relevance to our discussion. Only that safe-haven currencies are a vital refuge when the forex sky falls.

The Swiss franc (CHF) is among the few currencies that provide shelter in high-risk environments. Other members of this club include the US dollar and the Japanese yen. While the US dollar dominates forex by being the most preferred currency in global trade, the Swiss franc obtains its strength from various factors. Come with us to learn why and how the Swiss franc is so strong.

Welcome to the Safe Haven Club

The top plan on an investor’s mind is to put money in assets with competitive returns. However, returns do take the back seat sometimes. The economy in which the investors put money ebbs and flows from time to time. During a downturn, many assets tend to reduce in value by substantial margins. Since no investor wishes to see his/her money reduced to zero, they will move their funds to assets whose value does not correlate with the global economy.

Such an asset is the roughest outline of a safe-haven investment. JPMorgan’s list of safe-haven assets – assets that fit in its “broader definition of safe havens” – include government bonds, gold, the US dollar, real estate, and infrastructure. A more globally oriented list wouldn’t miss the Swiss franc and the Japanese yen.

The idea here is that a safe haven preserves an investor’s value during an economic crisis. This asset could be one that the market rushes towards when things begin to go south. The investment is one that the market believes to have some unique strength other than what the market provides. Gold, for example, derives its value from a litany of valuable qualities outside the financial realm.

How the swiss franc got strong

Being a member of the safe-haven club implies the asset has a great value – but this is not a guarantee. Currencies to which the market runs when risks are too high in the forex market tend to be strong. For example, REMITR ranks the Swiss franc as the seventh most traded currency in 2020. The Japanese yen came third, and the US dollar took the first place.

But how did the currency of a tiny European country become so strong? Three major factors contributed to the Swiss franc’s strengthening:

- European debt crisis

Since its formation, the European Union (EU) has seen various members suffer sovereign debt crises more than once. The first crisis came in the 90s, but the aftermath of the Great Recession was more serious. In 2011, the possibility of five EU-member countries defaulting on their sovereign debt came forward. The crisis had started in 2008 after the Iceland monetary system collapsed.

The immediate impact of the crisis that the market anticipated was the euro’s (EUR) collapse. An unraveling euro would send the bloc’s economies into a severe problem. Here is the crux of the matter. All major economies in Europe – except the UK and a few Scandinavian countries – used the euro as the primary currency. If it were to unravel, the euro would cost millions of investors billions.

Switzerland borders EU member states on all its sides, but it does not use the euro. Also, Switzerland is top five among the EU’s biggest trading partners, and the others are China and the US. As such, investors saw it fit to pack their funds in Swiss assets. The resulting surge in demand for the Swiss franc caused it to strengthen against the EUR.

- Quantitative easing by the ECB

The 2007/08 Great Recession was massive in terms of the shock delivered to the global economy. Europe was among the regions whose economies were on the verge of collapse. In response, the European Central Bank (ECB) resorted to an unconventional monetary policy – quantitative easing (QE).

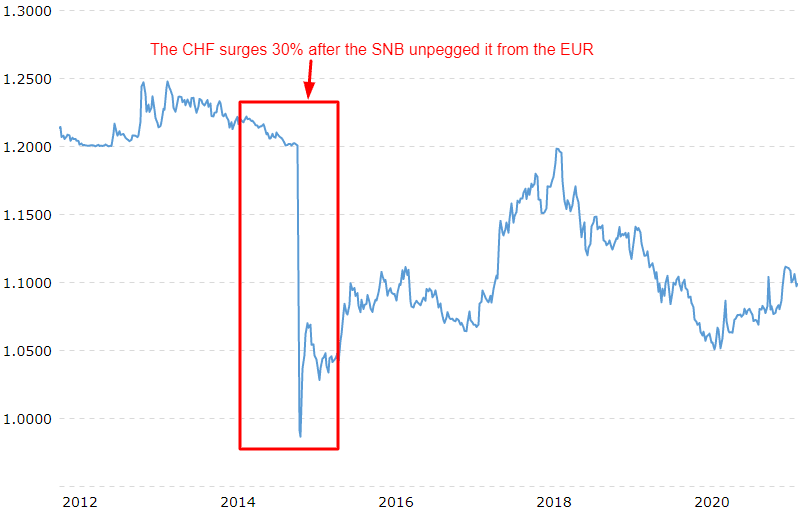

QE is a technical term for the ECB spending billions to buy government debt. The aim is to keep the economy oiled. But here lies a huge problem. The ECB’s efforts flooded the market with EURs. Until 2015, the Swiss National Bank (SNB) maintained a peg to the EUR at around 1.20 francs for one euro. The sudden surge of EURs meant that the SNB had to print more bills to match the euro flood.

However, overusing the printing press could lead to hyperinflation in Switzerland. That is why on January 15, 2015, the SNB had no choice but to unpeg the franc from the euro. The impact of the SNB’s decision was immediate and forceful. Suddenly, the CHF’s exchange rate against the EURO popped 30%.

EUR/CHF exchange rate

The ECB continues to apply QE, more so after the coronavirus pandemic struck. For this reason, the Swiss franc (CHF) remains strong.

- A depreciating US dollar

Like the ECB, the US Federal Reserve also opted for QE to shore up the US economy. In like manner, the flood of the greenbacks undermined the currency’s value in the market. The last five years have seen the CHF strengthen against the USD and peaked in early 2021, as the figure below shows.

USD/CHF five-year price chart

As mentioned earlier, the US dollar and the Swiss franc are two of the very few safe-haven currencies. When the USD becomes weak, the market gravitates to the other safe-haven options. The resulting demand pushes the exchange rate of the CHF up against the USD and other major currencies.

Final word

Switzerland is a small country whose economy is among the world’s most developed. However, the economy is more export-oriented, which means the price movement of its currency has a significant influence on economic activity. A stronger CHF spells difficulty for the Swiss exporters, which directly impacts the country’s balance of payments. That is why the SNB maintains a keen eye on the value of the CHF in the forex markets.