It is no longer necessary to spend hours glued to the screen searching for fortunes in the $6 trillion currency marketplace. Technological advancements and highly effective tools have made it possible for people to spend less time creating profitable ventures out of part-time forex trading.

The forex market is a 24-hour marketplace that presents unique opportunities to make money as long as the markets are up and running.

Automated systems that reduce human intervention in the trading business are also making it possible to spend less time analyzing financial instruments in search of profitable opportunities.

To trade the forex market successfully as a part-time job, one must master a couple of things.

Market selection

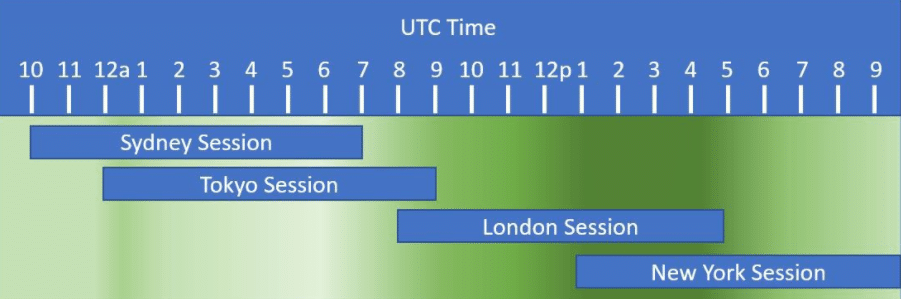

While the forex market runs 24 hours a day, it is further divided into three key sessions, which give rise to unique opportunities. Any person looking to launch a successful part-time forex career can settle on a session that rhymes with their schedule.

The first forex session to see action is usually the Asian session when liquidity is restored after the weekend. The session comes online at 11 p.m. GMT and runs until 8 a.m. GMT every day of the week. The session runs whenever markets in Japan, Australia, and New Zealand are open.

The European session sees action as activity in the Asian markets comes to a close. London defines activities in the European passion with activities starting at 7:30 a.m. until 3:30 p.m. GMT. The North America forex session comes online at 12 p.m. GMT and runs until 8 p.m. GMT as markets in the U.S shut down for the day.

The forex market is most active, giving rise to the most investment opportunities when the European and North American forex sessions overlap. Therefore, anyone looking to profit from heightened volatility can look to pursue opportunities as soon as the North America session starts and the European session is about to close for business.

The Asian session is ideal for people looking to profit from small price swings, given the calmness that depicts this session with reduced liquidity and volatility.

Find the right pairs

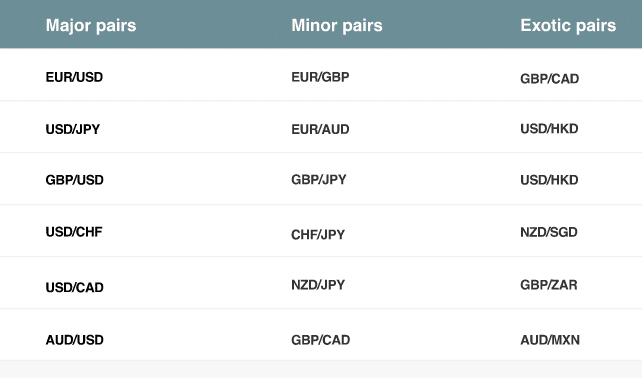

As a part-time trader, it is also important to settle on currency pairs that offer the best opportunities. Liquidity is an important aspect that part-time players should consider as the level of liquidity dictates the opportunities that come into play on any given day.

For part-time investors with small accounts and little experience, currency pairs involving the US dollar would be the best. These pairs come with the highest amount of liquidity and ideal to invest in at any given time.

Part-time players with more experience can look to profit from currency pairs that don’t involve the dollar. The likes of EUR/GBP, EUR/JPY, and GBP/CHF are some of the best. The pairs are especially good for part-time players who can carry out in-depth analysis and research.

Rely on an automated trading system

The availability of automated systems makes it easy for people to pursue currency trading as a part-time venture.

There are a variety of systems that come with programmed instructions on how to open and close positions. The systems can carry out research, open and close trades on behalf of people.

The system’s ability to monitor the forex market in real-time, searching for investment opportunities, makes it ideal for people who don’t have time to stay glued to the screen. Therefore, a part-time investor can choose an automated system to trade on their behalf, only making adjustments on positions from time to time.

Stop loss order is a must

While the focus is usually on the number of profits that one can make, it is also important for part-time traders to focus on risk management. Given the time constraints that can mean a limited amount of time to monitor positions, leveraging a stop loss order would have to come into play.

If suddenly price moves against an open position, a stop loss order will ensure invested capital is protected from net loss accumulation. The order would be able to close a position as soon as losses hit a predetermined level.

Price action analysis

Part-time investors who cannot keep up with news feeds that might cause price fluctuations must also master the art of price action analysis. Price action analysis entails analyzing currency pair charts and techniques to try and predict the direction price is likely to move.

It becomes pretty easy to identify long-term trends that can generate profitable investing opportunities by analyzing candlestick bars and patterns. With this strategy, it is important to focus on a chart time frame that meets one’s schedule. If you’re the kind of person that can pop in and out of sessions after every hour, then carrying out price analysis on hourly charts would be ideal. Persons that can take days to analyze financial instruments can focus on daily charts and analysis.

Part-time trading strategies

For part-time investors, active trading won’t be necessary. In this case, one can look to open a few positions and hold for days. A take profit order should be in place to lock in profit on all opened positions. Similarly, a stop loss order should be in place to protect from the market going too far against the position.

Part-time investors who don’t have much time to spend analyzing and opening positions should also focus on long-term trends. With long-term trends, it becomes pretty much easy to analyze the market, open positions, and let them run for days.

Additionally, people can set up orders to not miss out on opportunities that crop up while away. In this case, one can set up the entry price to open a position and stop loss order to protect against losses and profit order to lock in profits.

Bottom line

Becoming a part-time forex trader is viable as long as one has the patience and commitment to carry out in-depth analysis. Time restrictions can be a good thing as it forces one to use spare time more productively to analyze currency pairs and play the long term game.