In the crypto market, increased volatility creates unique trading opportunities. Scalping is a strategy in which traders attempt to profit from even the tiniest market volatility. As a result, transactions are opened and closed in a matter of seconds or minutes, allowing traders to lock in tiny profits on each position. When small profits obtained with each investment are compounded, they add up to large gains in the long run. The method stands out partly because it does not necessitate a large sum of money to be profitable. You can automate the process using bots.

What is a scalping bot?

A crypto scalping bot is software that will assist you in automating the process of scalping. While most traders rely on their intuition to choose when to trade and when not to trade, automated trading systems have emerged to make the process considerably easier. Furthermore, the technologies have alleviated the need to spend hours hooked to a computer screen opening and closing trades.

Trading with automated bots decreases the chance of human error. The system is set up to open and close positions according to predetermined guidelines. As a result, even if the trader is not there, it will consistently execute and lock up profits. Developing a crypto scalping bot does not require coding knowledge; some platforms make it simple for traders to build bots.

Types of scalping strategies to automate

Arbitrage trading

This is a strategy in which investors buy crypto on one exchange and then quickly sell it on another exchange for a higher price. Because arbitrage trading chances are typically only available for a short period of time—often just a few seconds—doing arbitrage calculations on their own is too time-consuming for traders. As a result, traders employ a variety of software tools capable of detecting and calculating arbitrage opportunities in real-time.

Arbitrage traders use a variety of software programs, including automated software. This type of software is installed on a trader’s brokerage trading platform, and anytime it detects an arbitrage opportunity, it immediately executes the trades on the trader’s behalf. This type of program is designed to address one of the most difficult aspects of arbitrage trading: executing trades in a fast and accurate manner in order to take advantage of opportunities that may only last a few seconds.

Margin trading

This entails borrowing funds from an exchange and utilizing them to conduct a trade. It’s also known as “leveraged trading” since it involves traders “leveraging up” their trades beyond the capital they already have.

Bots can also perform margin trading on your behalf, automatically and based on the best signals. Bots allow you to earn from the world of crypto without having to have any prior knowledge of trades or signals. The bot connects to your account via API keys and executes trades based on the signals received as well as the personalizations you’ve made. You can set your profit, loss, and leverage limits with most margin trading bots.

Bid-ask spread

This is the difference between the highest ‘bid’ price and the lowest ‘ask’ price for an asset. The spread in crypto markets is determined by the differential between buyers’ and sellers’ limit orders.

The lower the bid-ask spread, the higher the liquidity of an item. A significant volume of orders and a small bid-ask spread characterize more liquid assets. When placing big volume orders on an item with a greater bid-ask spread, there will be significant price changes. When making an instant market price purchase, you must accept the lowest ask price from a seller. It is critical to evaluate the highest bid price from a buyer if you want to make an immediate transaction.

Range trading

A trading range is a section of a chart where the price moves for a long period of time. Range trading takes advantage of the fact that during sideways trends, markets vary within a range defined by resistance and support bands. Crypto traders frequently go long and short at different times depending on where the price is in the range while trading ranges. A trader will attempt to initiate positions by buying at support and selling at resistance after determining the ideal trading range. Bots can automate the process by identifying a trading range and then executing the trade accordingly.

Building a scalping bot using Bitsgap

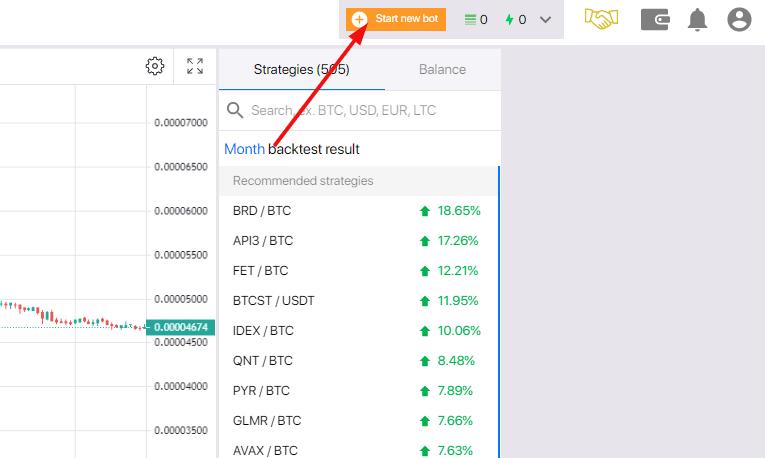

Step 1: On the Bitsgap bots page, go to the top of the page and click on ‘Start new bot.’

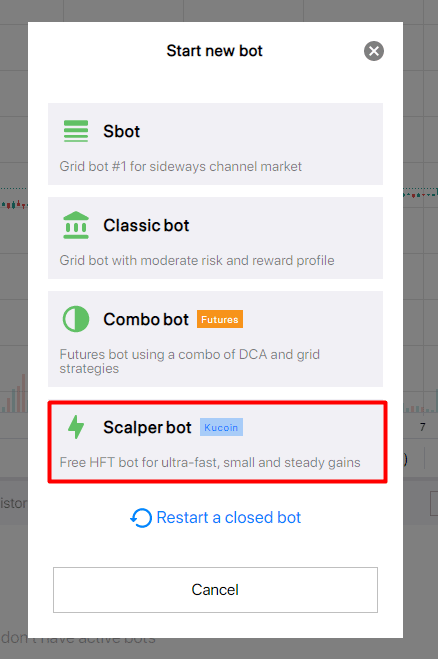

Step 2: When you click the button, a pop-up menu will appear, detailing all of the bot types that are accessible. Select Scalper bot from the drop-down menu. It’s worth noting that your bot will only work with the KuCoin exchange.

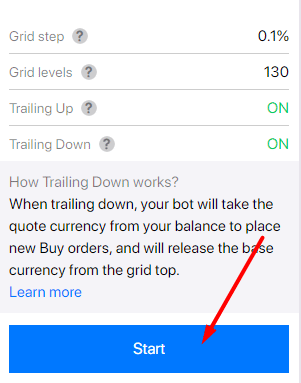

Step 3: Select a crypto pair with which to trade. This will prompt you to enter the amount of money you’d like your bot to trade with from your account balance. Once you’ve selected this, the system will find the best settings for your grid step, trailing features, and high and low pricing for you.

Step 4: To ensure that all of your settings are in order, click the “Start” button. This will open the preview tab, where you can double-check that everything is in order before launching the bot.

Step 5: If everything looks good, click “Confirm.” This will start the bot-building process. The system will indicate any flaws that prohibit the bot from being created. Otherwise, it should just take a few minutes for your bot to be up and running.

Summary

Scalping cryptocurrency trading can be a high-risk, high-reward approach, provided you have the right tools and understanding. Because transactions are created and closed in a matter of seconds or minutes, automating the procedure is the best option in this strategy. Bitsgap is one of the best platforms for creating a scalping bot in a few simple steps without having to code.