The Metaverse is rapidly approaching reality, and many investors are preparing for it. Although it is still in its infancy, it has the potential to transform everything from e-commerce to social media to real estate. Many multimillion-dollar real-estate transactions have put the term metaverse on their lips this year.

As the popularity of these virtual settings grows, so does corporate interest in capitalizing on the trend. For example, Facebook has rebranded itself as “Meta” (FB) and expects to invest billions in its metaverse ambition.

Definition

The metaverse’s basic concept is simple: take the exciting activities we do as individuals or in groups and put them on the internet. In some senses, this has been around for quite some time. For example, virtual reality (VR) gaming has been around for a while, allowing players to be in the game rather than just watching or playing it.

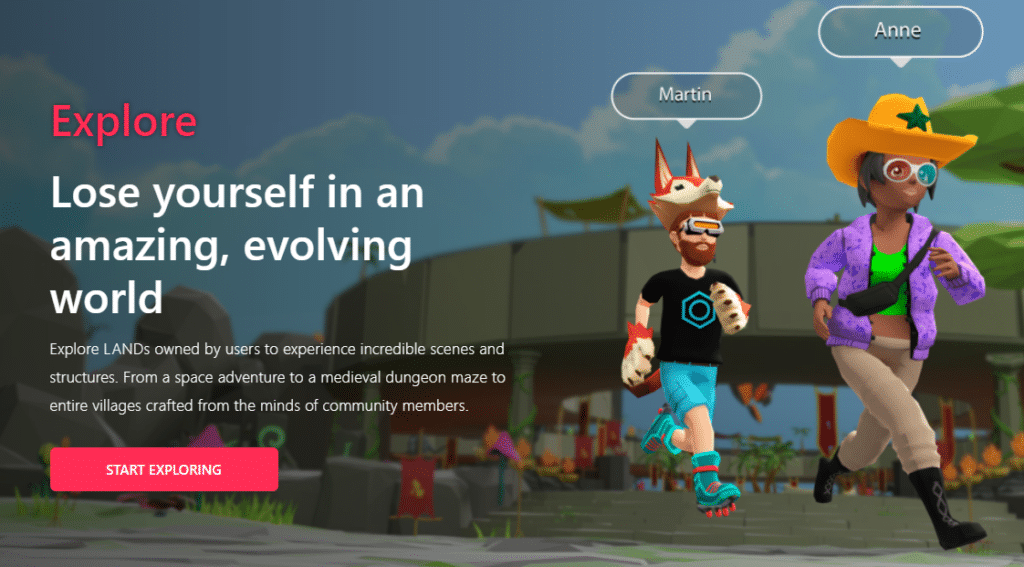

This concept has been carried to the next level in the metaverse. You may use your smartphone, PC, or VR headset to engage with people in this new environment. Inside this new virtual reality, you can go on a run, drive a car, shop, and more.

In the future, people will be able to transfer themselves as avatars into virtual settings to work, play, shop, exercise, learn, and experience most aspects of life digitally. Users can also use complex graphics to recreate real-life aspects such as their home or business décor, such as a beach in Hawaii.

Which are the ways one can join?

Purchase metaverse tokens

Interestingly, there are no complicated steps involved in purchasing. You must first decide which platform you wish to invest in and then purchase their native tokens. MANA – Decentralnds’s native token, SAND – The Sandbox native token, and AXS – Axie Infinity’s native token are now the most popular ones.

Buy in-game NFTs or virtual land

Virtual real estate has quickly become one of the most popular investment options in the metaverse. Open an account on the metaverse site, where you’ll be buying NFTs and virtual land.

However, investing through NFTs and virtual land has some serious implications. For example, NFTs have no set price and can fluctuate depending on several criteria, such as scarcity.

Many businesses are pouring millions of dollars into securing a piece of virtual real estate. For instance, Pavia, an NFT initiative, reportedly sold out over 60% of the total 100,000 virtual land parcels available.

ETFs (Exchange-Traded Funds)

You can invest in the ETF with your brokerage account. The ETF fund is the largest at the moment, and it focuses on computer hardware, gaming, and IaaS solutions. The advantage of ETFs is diversified assets provide a simple approach for limiting volatility and thus risk exposure.

Metaverse stocks

You may not want to participate directly in the metaverse, thus, you can invest indirectly in the stocks of companies that work on its initiatives. Stocks in gaming and 3D technology companies might provide lucrative investment opportunities. Investors can seek investments in companies like Roblox that are involved in metaverse gaming. On the other hand, you can search for investments in metaverse 3D technology companies like NVIDIA.

Metaverse index

It is similar to stock market indexes in that it tracks the performance trends of a country’s top enterprises. For example, include the gaming and entertainment industries. One of the best aspects of it is the reduced volatility.

Sell or rent metaverse experiences

You can create your own virtual land lots and rent them out to businesses or offices. Additionally, as a viable financial option in the metaverse, you can rent out billboards on metaverse land for advertisements.

State of the metaverse market?

Virtual reality venues have been running for years at companies like Nintendo and The Sandbox. These businesses collectively draw millions of users. The stakes are enormous for huge tech companies who want to integrate these various groups together into a united metaverse.

Our social life and games are merging, resulting in a sizable and rapidly expanding virtual goods consumer sector. Content creators and other players utilize crypto to sell virtual goods in this environment. It also allows users to own their digital assets NFTs, exchange them with other players in the game, and carry them with them to other digital experiences, resulting in a complete new free-market internet-native economy that can be monetized in the real world.

Many large corporations are beginning to participate. For example, in December 2021, Nike announced the acquisition of RTFKT, a virtual sneaker firm, to expand its digital footprint. Also, Gucci and Adidas, for example, have hosted virtual fashion displays in the metaverse.

Pop stars have also held virtual concerts in the metaverse, attracting millions of followers from all over the world. Real estate investments are also becoming more accessible as a result. Some investors have paid millions of dollars for digital land in the hopes of living next to celebrities.

Risks of investing in the metaverse

- There will be arguments about intellectual property and ownership, data protection, content licensing, and the hazards associated with crypto assets in the metaverse. To set the regulations, several lawsuits will be filed.

- For investors, the most significant risk is determining which firms truly understand how to create a fascinating metaverse that people will want to join and return to.

- People can’t take their virtual identities across platforms because the metaverse is still too fragmented.

Summary

Metaverse goes beyond games, and it allows visitors to interact online and participate in real-time events. Metaverse can be joined by purchasing metaverse tokens, NFTs, ETFs, and indices and selling or renting out metaverse experiences. The market has already been penetrated, but there is still so much potential. Investing in the metaverse comes with some risks.