Volatility is an important aspect in the forex market that traders and investors pay close watch to while selecting financial instruments to trade. How volatile a financial instrument is, dictates the amount of capital one can deploy as well as the trading strategy.

Understanding volatility

Volatility is simply the rate at which the price of a given asset changes. In the forex market, it is the rate of exchange rate fluctuation. While some pairs are known to be extremely volatile, fluctuating between highs and lows over a short period, some are known for their relative stability.

While volatile pairs make it easy to fill positions over a short period, the heightened risk exposure always in play is worth paying close attention to. Additionally, volatility is a double-edged sword that allows one to accumulate significant profit over a short period and lead to an exponential increase in losses.

How to trade volatile instruments

A trading plan is essential for anyone looking to have an edge while trading volatile currency pairs. Following a rule-based system is a sure way of shrugging off the downside risks of wild swings and still stand a fair chance to generate profit.

Trading breakouts

The heightened price swings that come into play due to increased volatility are best addressed by strategies that keep track of large price movements. Some of the best plays entail focusing on breakouts and trend-following strategies.

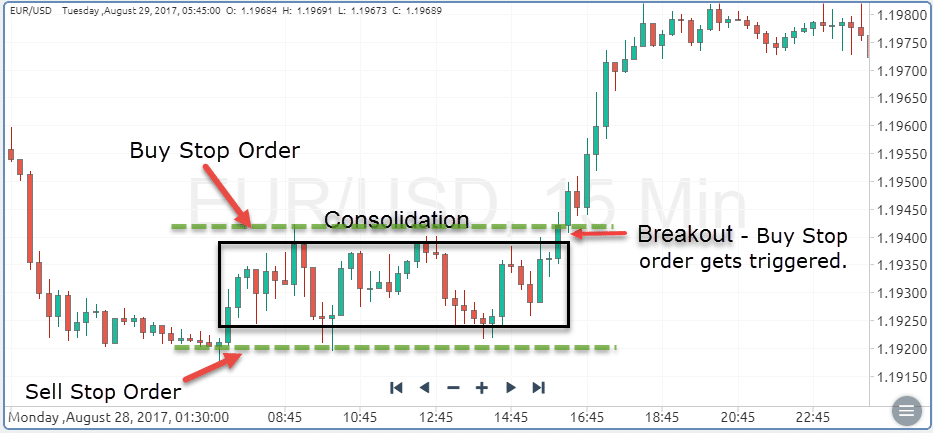

Breakout strategies entail waiting for consolidation from which strong breakouts occur. The chart below shows the EURUSD, which was in consolidation mode before breaking out.

Looking to take advantage of a sudden spike in price due to increased volatility, a trader could have entered a buy stop order slightly above the range to take advantage of the price breaking out to the upside.

As it can be seen, price broke out of the range and moved up with force, allowing traders who had placed long positions to generate significant profit.

Trading volatility with options

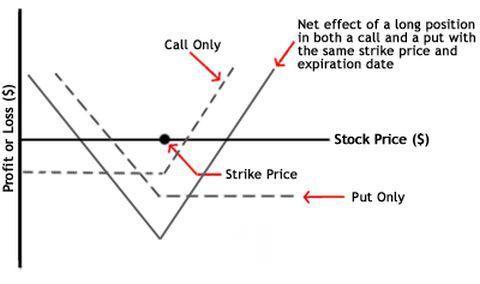

Another way to profit from heightened volatility and keep risks low is to leverage options. With options, one can buy, call, and put options at the same strike price and expiration date. In case of a large price move, one can profit from one of the options being in the money.

For instance, a spike in price would mean making money on the call option while only losing the premium on the put option. Similarly, a fall in price will translate to making money on the put option.

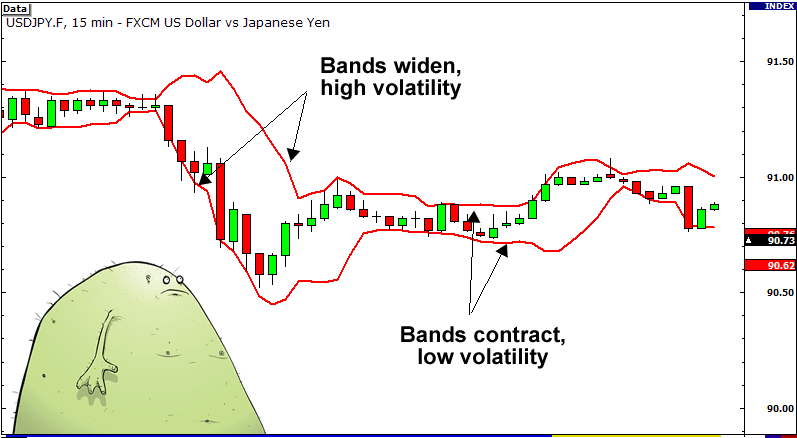

In a volatile market, it is best to focus on long-term plays rather than short-term price moves. This is the only way one can avoid jumping into trades just because the price is moving. A good number of technical indicators make it easy to spot volatility and to prepare adequately.

Bollinger bands, the Average True Range, or the Average Directional Index are just a few indicators that can be used to spot volatility. Once it’s clear there is a prospect of volatility edging higher, it is important to ensure that any open trade is in the direction of the long-term trend.

Opening a trade in the direction of a trend and not against the trend increases the prospects of generating profits by shunning the short-term price swings. Additionally, it is important to master conventional patterns, making it easy to identify trends during a volatile session.

In addition, if a trading strategy is based on fundamental analysis, it is important to ensure that the news being traded is with the trend.

Risk and money management

Profiting from volatile currency pairs often comes down to how well one can manage risks by deploying risk management strategies. While trading volatile pairs, the first goal is to protect capital rather than chasing profits.

The use of stop loss and take profit orders is ideal for anyone looking to make a fortune during periods of rapid price oscillation in the market. Additionally, it is important to ensure the size of positions is not one that will put pressure on the underlying capital in case something goes wrong.

Stop-loss orders should be placed at a safe distance so that they are not triggered too soon on prices moving up and down rapidly. For instance, placing such risk management orders 10 to 20 pips below or above a breakeven price on a volatile pair increases the risk of being closed out too soon.

While dealing with volatile financial instruments, the best practice is to place the stop loss orders at least 40 pips from the entry point. At this level, it is highly unlikely that they would be triggered, especially on opening a position in the direction of the prevailing trend.

Position sizing and pairs selection

Trading volatile pairs are all about managing risk. Given the increased prospects pr prices fluctuating dramatically, it is important to ensure the size of the position is one that does not put a trading account under pressure.

When dealing with small trading counts, the sides of the positions should also be small to ensure that the free margin is sufficient to reduce the prospects of a margin call in case something goes wrong.

Diversification can enhance the prospects of generating significant profits. However, trading a few volatile currency pairs at a go is the best practice. Increasing the number of pairs one is trading increases the risk exposure even if there is a chance of generating significant returns on everything panning out as expected.

When choosing pairs to trade, it is also important to consider the correlation that exists to mitigate the overall risk. In most cases, it is essential to refrain from trading many pairs countered by the same currency as they would often react the same way.

Bottom line

Volatility is the measure of the rate at which prices fluctuate in the market. Relatively high price changes make it easy to generate profits as orders get filled with ease. However, it is important to remember that losses can also accumulate if one is on the wrong side of the trade. The use of options or breakout strategies makes it easy to profit from explosive moves.