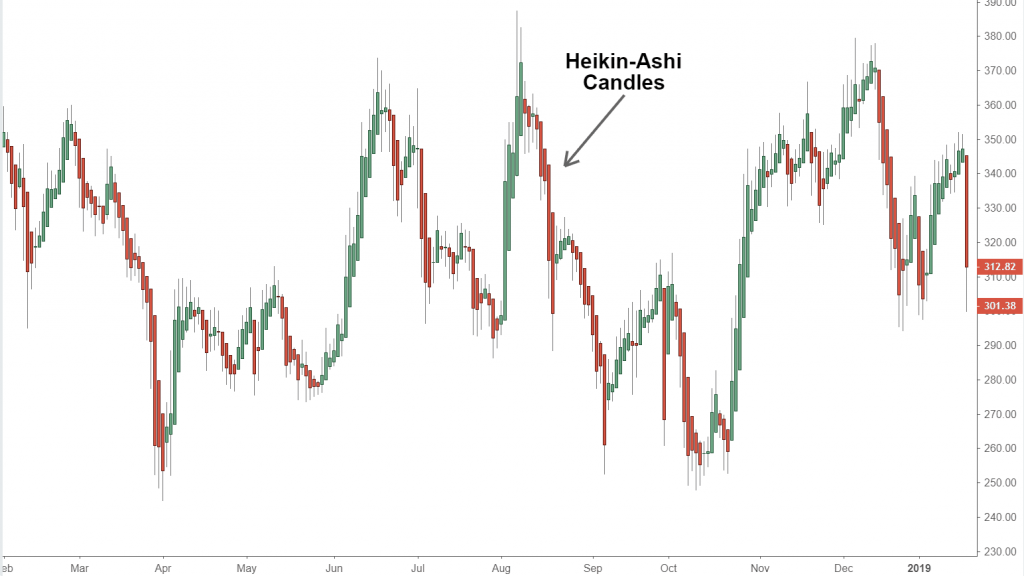

Swing trading tends to capture short-term and medium-term gains in a stock or any financial asset over a specific period of time. It can be a few days to several weeks. Swing traders primarily use technical analysis to find trading opportunities. Heiken Ashi candles and stochastics are among the most popular ways of swing trading. Keep on reading to find more.

When to Trade

It is essential to watch out for any major news announcements concerning the pair you are considering trading on a particular day. It is a good practice to execute trades in the morning by Greenwich time because then you can have the rest of the day to direct the trade movements in your favor. One can trade the AUD and JPY currency pairs in the evening because these two have more liquidity in the Asian sessions and Sydney.

If you see the news of any crucial events within a few hours, you enter a trade. However, even if the news is most likely to cause a large spike, you can try to get to break. It is best to avoid NFP morning altogether. Once the noise calms down, you can trade in the NFP day afternoon.

First Trade

The first trade should be executed when the first valid system signal appears on the hourly chart. Keep in mind that a valid signal is a smooth pullback, Heiken Ashi and stock cross change away from the 100 SMA. After a cross of the 100 SMA, you can see the price come back and bounce from the 100 SMA. This is generally a brilliant trade opportunity.

Trade Management

Once you enter a trade, you can put the stop loss 20 pips behind the 100 SMA. You can have a trailing stop EA for it with the option to ‘Close by MA’ set to true. It means, if the price closes the other side of the MA but does not hit the stop loss, it will be closed even after the trade or trend becomes invalidated. It stops you from being stopped out by spikes going 5 to 10 pips beyond the MA, but the price closes the right side of the MA. A lot of traders watch the 100 SMA. The battle between sellers and buyers can be intense around the level that can cause spikes before the continuation of the trade.

Now, when you have a trade and a stop loss in place, the only thing you need to do is wait. If the trade resumes, your trade will be at break-even gradually. In the meantime, if you get a pullback towards the 100 SMA and a smooth stock cross and Heiken Ashi change, you can add on only if the combined stop losses on the two trades do not sum up to more than 50 pips.

You will receive a second signal frequently just below the first. It is fine to take the second signal if the two combined stop losses are not over 50 pips. If the price is too close to your first entry, do not go for it. Instead, wait some more and give your first trade more time to work out.

You need to continue adding trades whenever the price remains on the right side of the 100 SMA. However, do not forget the 50 pip max risk rule. You should be able to add 3, 4, 5, or even more trades per position on a long trend.

When the 100 SMA is breached, it is the exit signal for all trades. There can be two results:

- The price can go a long way past the breached SMA and hit your stop losses.

- The price can close the wrong side of the MA, and the EA closes out the trades.

It means that every trader will lose at least one of their trades, even if it is for a small loss. However, when you catch a good trend, you can bank between 400 and 1000 pips combined from all trades. So, a small loss will not matter.

With a system like this that follows the trend, you will notice that you receive a huge number of break-evens and small losses before catching a good trend by using the higher timeframe trend to start looking for trades for increasing your probability immensely.

Money and Risk Management

We would strongly suggest risking no more than 3%, not only on your first trade but also on each subsequent trade. The indicator on the thread would calculate the lot size you must use to risk X% over X pips. It is convenient to set to 50 pips at 3% for both beginners and professionals. At the time when your bank grows, you have to lower your risk on every first trade, ideally down to 0.5%. You may notice that you only get one or a couple of good trades per month. However, they are enough to pay for all of your losses.

Daily Routine You Can Follow

This is an example of how you can take care of trading days. You can follow this routine at the beginning:

- Review current trades to consider if there is a chance of an add on that day.

- Review the daily charts to see if any new pairs are setting up.

- Set up charts for any possible new trades.

- Check the news for the day.

- Check the rules that concern correlated pairs and the ‘two trades per currency’ rule.

- Monitor the charts for possible trades. The stock crossing indicator is useful for this.

- Take any valid trade and make sure that you have set up EA properly and stop loss is also in place.

Keep in mind that trading is full of risks, and not being cautious can cost you a lot of money. So, make sure to learn about swing trading well and practice the use of Heiken Ashi before you start trading.