The EURUSD is the most liquid and most traded in the trillion-dollar currency market. The increased activity on the financial instrument has to do with the plethora of economic releases always available touching on the pair. At heart are employment figures from the Eurozone and the United States that market player’s analyze to make informed decisions while trading.

Understanding the Non-Farm Payroll report

The Non-Farm Payroll report is known to have the biggest impact on the pair compared to other economic releases. Released on the first Friday of every month at 8:30 a.m., the economic metric is one of the most-watched by people looking to profit from EURUSD based on employment figures.

The NFP triggers increased volatility and wild swings in the forex market and mostly affected the EURUSD, given that it is the most traded pair among the majors. The increased volatility has to deal with the fact that the information paints a clear picture of how the US economy is doing, either expanding or contracting.

Consequently, the NFP is known to have the biggest impact on the US dollar than any other economic release. In return, the EURUSD tends to experience wild swings as players jostle for positions depending on how the report influences dollar sentiments in the market.

How to trade EURUSD on NFP

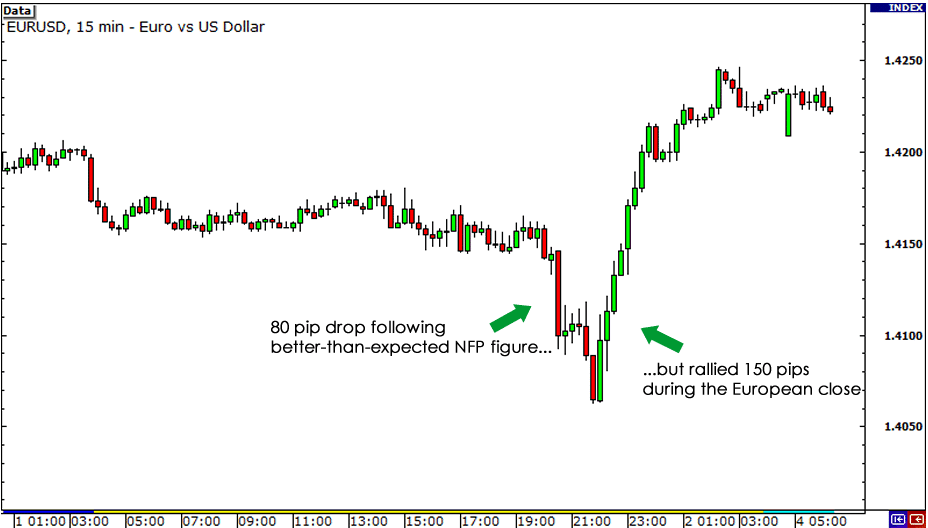

There are three possible outcomes on the NFP print; either it comes above estimates, in line with estimates, or below estimates. A higher-than-expected print tends to be positive for the US dollar as it signals more people in the labor market away from the farms, government offices, or non-government organizations.

An increase in the number of people in the labor market signals expansion of the US economy. With more people in the labor force, consumer spending tends to increase, all but helping accelerate economic growth.

Consequently, market participants’ eye sells or short positions on the EURUSD pair whenever the NFP print beats expectations as the dollar tends to strengthen against the euro.

In contrast, whenever the NFP print misses estimates and declines significantly, it is interpreted as a negative for the US economy. The same signals contraction of the US economy struggling to create more jobs to lower the unemployment rate.

A lower than expected NFP print tends to trigger dollar weakness on increased sell-off in the market. The net effect is the weakening of the greenback against the euro resulting in the EURUSD edging higher. In this case, market participants look to enter long positions on expectations that the EURO will strengthen and consequently push the EURUSD exchange rate higher.

In addition, whenever the print comes in line with estimates, it signals neither contraction nor expansion. In this case, the focus shifts to other components of the NFP report to gauge how the economy is fairing. Traders pay close watch to the unemployment rate to see whether unemployed people are increasing or decreasing.

A declining unemployment rate signals more people are getting jobs, thus good for the economy. In return, it tends to positively impact the dollar, leading to its strengthening against the majors.

Additionally, attention is often paid to manufacturing payroll and average hourly earnings. A higher print on this front signals more people are getting an income to spend on the economy. This is usually positive for the dollar, which traders can leverage to eye long positions on the EURUSD pair.

How to trade EURUSD on NFP

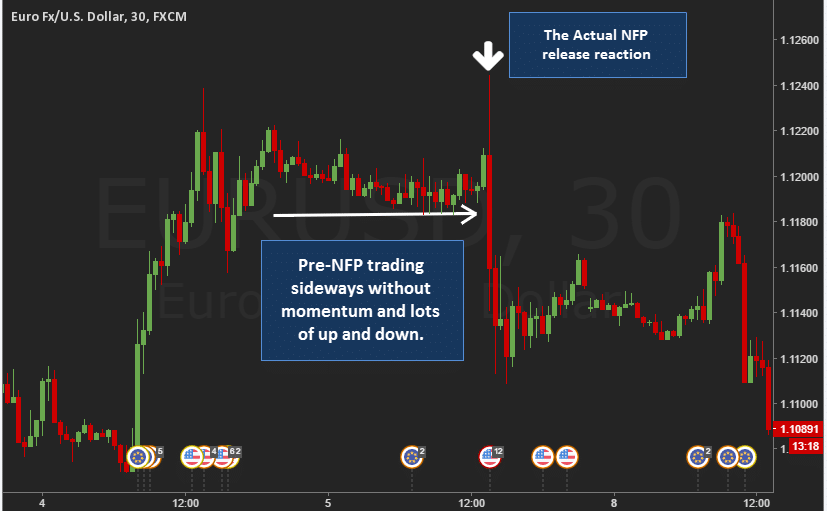

Given the increased volatility that comes about with the economic release, caution is important for anyone looking to profit while trading the EURUSD. It is best practice to refrain from placing positions minutes into the report or immediately after the report is made available.

The best way to trade the EURUSD is to wait for the market to interpret the NFP data and the dust to settle. After about 15 minutes, everything should be clear, and a dominant trend on the pair should emerge, making it much easier to place the trade in the prevailing trend. The idea is to wait for market movers to dictate the pace of dollar weakness or strength to open positions.

Eurozone employment figures

In addition to the NFP, it is important to pay close attention to employment and unemployment data out of some of the big economies within the Eurozone. Labor data from the German statistics office or France paint a clear picture of how the Eurozone economy is doing.

The Unemployment Change released by the Bundesagentur für Arbeit is one of the most followed metrics while trading the euro. The metric shows the number of unemployed people in Germany. A higher print signals contraction of the German economy, thus unable to create more jobs. More unemployed people have a negative implication on consumer spending, which often leads to an economic slowdown known to trigger euro weakness against the dollar.

A reading above what is expected often triggers an increased sell-off of the euro resulting in the EURUSD price edging lower as traders short the pair.

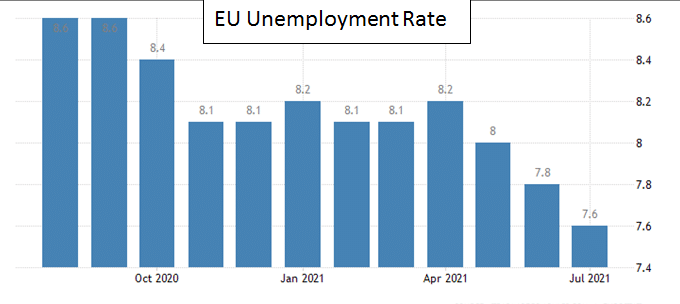

The Eurozone unemployment rate, as released by Eurostat, is another commonly tracked metric while trading the pair based on employment figures. The metric measures the total number of people unemployed and actively seeking employment within the economic block

A higher-than-expected reading is taken as a negative as it indicates the broader economies within the Eurozone are struggling to generate much-needed jobs. In contrast, a lower than expected print is positive and bullish for the euro as it indicates the Eurozone economy is growing and creating more jobs that go a long way in triggering an uptick in consumer spending.

Eurostat also releases employment data that indicates the rate of job additions in the EU block. A healthy increase in employment level is positive and bullish for the euro against the dollar as it affirms economic growth. Similarly, a print signaling a decline triggers concerns about the broader EU economy known to cause weakness on the euro against the greenback.

Bottom line

The EURUSD, just like any other major currency, is susceptible to the outcome of various economic releases. Employment figures in the EU and the US are known to sway trader’s sentiments, consequently affecting dollar and euro strength.

Employment figures signaling labor market growth are known to trigger strength on the dollar and the euro. Figures that raise concerns about the two economies’ health often trigger weakness on the euro and dollar, consequently affecting EURUSD price action.